Good morning.

The Fast Five → Inflation data feeding fears of higher rates, US deficit for first three months of fiscal 2025 is 40% higher than it was last year, Cleveland-Cliffs eyeing all-cash bid for U.S. Steel, SEC sues Elon Musk, and Trump says he’ll create ‘External Revenue Service’ to collect tariffs, foreign revenue…

These Six “Picks and Shovels” Companies Are the

Real Secret to Profiting From the AI Boom 💥

These six companies are so essential to AI that the industry cannot survive without them.

Click here to find out their names.

- a message from Porter Stansberry

Calendar: (all times ET) - Full calendar

Today:

Consumer price index, 8:30A

Business inventories, 10:00A

Tomorrow:

Initial jobless claims, 8:30A

US retail sales, 8:30A

Your 5-minute briefing for Wednesday, January 15:

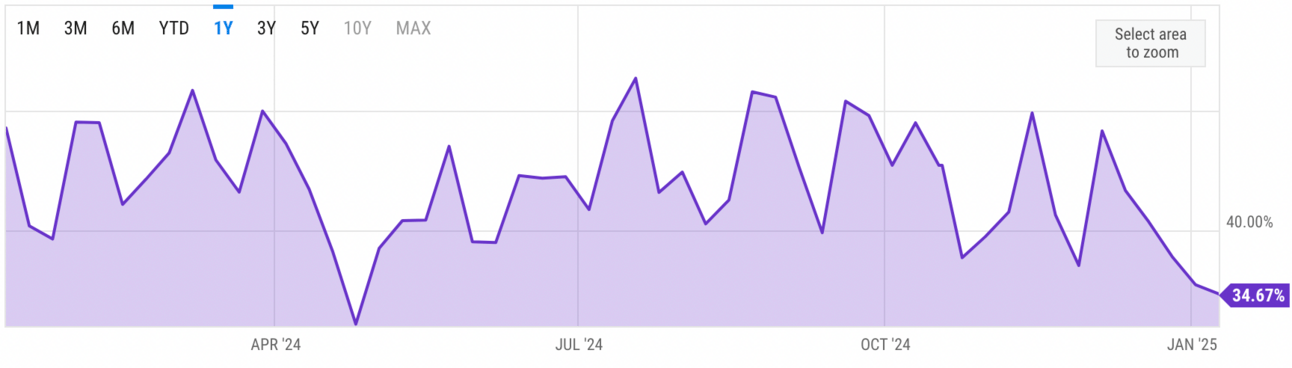

US Investor % Bullish Sentiment:

↓ 34.67% for Week of January 09 2025

Previous week: 35.44%. Updates every Friday.

Market Wrap:

Futures flat; Dow +37 pts, S&P steady, Nasdaq +0.1%.

Dow +0.52%, S&P +0.11%, Nasdaq -0.23% on tech pullback.

Dec PPI +0.2%, below 0.4% forecast, boosting sentiment.

CPI: Expected +0.3% MoM, +2.9% YoY.

Big banks (JPM, Citi, GS) report premarket today.

EARNINGS

Here’s what we’re watching:

JP Morgan Chase (JPM) - earnings of $4.04 per share (-7.6% vs Q3 and up 32.9% from Q4 2023) on $41.5B revenue

UnitedHealth (UNH) - earnings of $6.75 per share (+9.6% YoY) on $101.8B revenue (+7.7% YoY)

Friday:

SLB (SLB) - earnings of $.90 per share (+4.7% YoY) on $9.2B revenue (+2.2% YoY)

HEADLINES

Tech rout in markets continues (more)

Dollar rally pauses ahead of US inflation test (more)

Trump says he’ll create ‘External Revenue Service’ to collect tariffs, etc (more)

Cleveland-Cliffs eyeing all-cash bid for U.S. Steel (more)

SEC sues Elon Musk over late disclosure of Twitter stake (more)

US to ban smart cars with Russian, Chinese tech (more)

Meta announces 5% cuts in prep for ‘intense year’ — read the internal memo

Wiedman, a top BlackRock exec thought to be Fink’s successor, to resign (more)

JPMorgan's Piepszak exits CEO race for now, making contest murkier (more)

Intel Capital is spinning off from Intel (more)

Ex-Wells Fargo execs face millions in fines for misconduct (more)

Fund manager reveals what needs to change to invest in luxury stocks (more)

IN PARTNERSHIP WITH THE RUNDOWN AI

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

DEALFLOW

M+A | Investments

eBay, a global commerce leader, acquired Caramel, an end-to-end online automotive transaction solution provider (more)

Snappy, a global gifting company, announced its acquisition of Covver, a platform specializing in swag and points-based recognition solutions (more)

Vagaro, software for businesses in beauty, wellness, and fitness, acquired Schedulicity, scheduling software for the beauty/wellness industry (more)

Chainalysis, an AI-powered fraud detection solution, acquired Alterya, an AI fraud detection solution identifying scammers before they meet their victims (more)

Cengage Group, an edtech company, acquired Visible Body, a company specializing in interactive, 3D models and software for the sciences (more)

Valeo Networks, a managed security service provider, acquired Verus Technologies Solutions, an MSP (more)

Caidya, a global mid-sized CRO, received a $165M growth investment from Rubicon Founders (more)

VisitorReach, a US personalized communication tools company, received a strategic investment from Gloo (more)

VC

Harbinger, a medium-duty EV company, raised $100M in Series B funding (more)

LemFi, a platform for immigrant communities to access financial services, raised $53M in Series B funding (more)

Solera Health, a tech platform for connecting people to health solutions that work, raised $40M in funding (more)

Orchid Security, a company specializing in identity-first security orchestration, raised $36M in Seed funding (more)

Aerin Medical, a medical device company, raised $32.5M in funding (more)

Overland AI, a tech company developing advanced autonomy for UGVs, raised $32M in Series A funding (more)

Clear Labs, a provider of next-gen sequencing platforms for diagnostics, raised $30M in Series D funding (more)

Labviva, an AI procurement platform for life sciences, raised $25M in Series B funding (more)

Raspberry AI, a gen AI platform for fashion creatives, raised $24M in Series A funding (more)

The Snow League, a professional winter sports league exclusively dedicated to snowboarding and freeskiing, raised $15M in funding (more)

XtremeX Mining Technology, a company providing drilling solutions, raised $11M in Series A funding (more)

Sydecar, a provider of a deal execution platform, raised $11M in Series A funding (more)

BforeAI, a predictive attack intelligence and digital risk protection solution, raised $10M in Series B funding (more)

Lady Technologies, a women healthtech company, raised $6.5M in Series A funding (more)

First Ascent Biomedical, a company specializing in personalized cancer treatments, raised $6M in funding (more)

Daash Intelligence, an AI-powered predictive commerce intelligence platform for retail brands, raised $5.5M in Second Seed funding (more)

Thoras.ai, an adaptive reliability platform for enterprises, raised $5M in Seed funding (more)

Red Sky Health, an AI-driven platform designed to optimize healthcare claims management, raised $3M in Seed funding (more)

Proper Good, a ready-to-eat meal solutions company, raised an undisclosed amount in funding (more)

Kerna Laboratories, an AI biotech startup, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🚨 CEO Jensen Huang does not want you knowing this dirty little secret about Nvidia *

🏚 LA rentals hit $40,000 a month as fires worsen the city's affordability crisis.

📆 At Charles Schwab, a fresh start after a close call.

👋 ‘Goodbye to my Chinese spy’ might be the last great TikTok trend.

🤖 ChatGPT can remind you to do stuff now.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.