Good morning.

The Fast Five → Trump: No more dividends and buybacks for defense companies, Trump to ban Wall Street from buying houses, US to control Venezuela oil exports indefinitely, job openings slide to 'anemic' rate, and Warner Bros. rejects latest Paramount bid, favoring Netflix…

📌 TradeSmith has unleashed a mathematical monster that should terrify hedge fund managers. This Baltimore-based team's breakthrough technology reveals each stock's unique "volatility fingerprint," helping regular people decide when to buy and sell. Go here to see how » (ad)

Calendar: Full Calendar »

Today:

Non-Farm Employment, 8:15A

ISM Services PMI, 10:00A

JOLTS Job Openings, 10:00A

Tomorrow:

Unemployment Claims, 8:30A Consumer Sentiment, 10:00A Inflation Expectations, 10:00A

Your 5-minute briefing for Thursday, Jan 8:

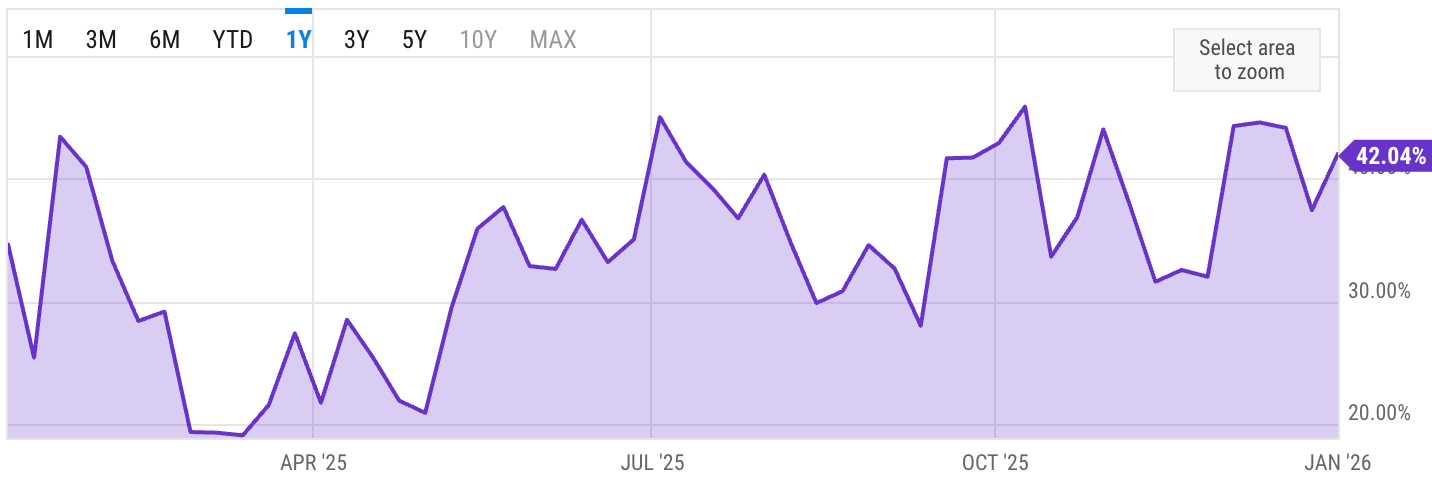

US Investor % Bullish Sentiment:

↓ 42.04% for Week of JAN 01 2026

Previous week: 42.14%

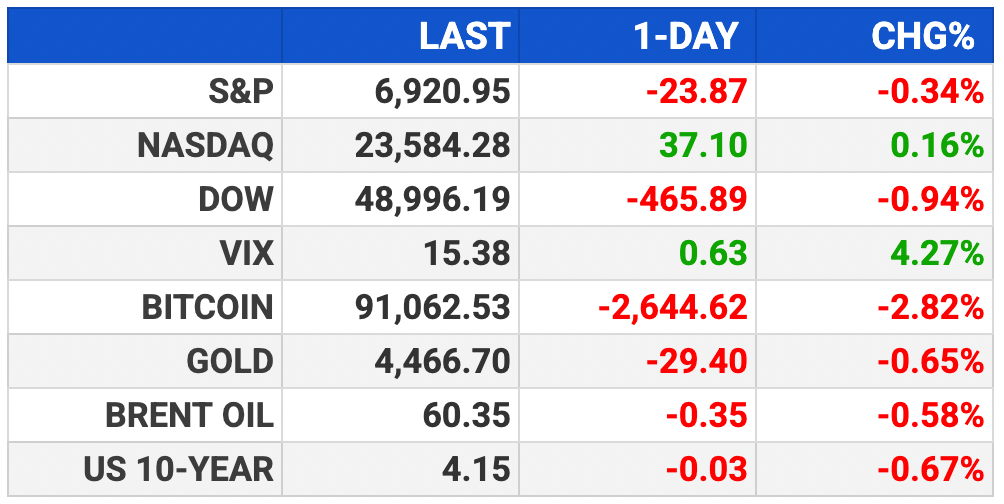

Market Wrap:

Futures near flat after S&P & Dow snapped 3-day streak

Wednesday S&P -0.3%, Dow -466, Nasdaq +0.2%

Alphabet +2.4% as market cap passed Apple (first since 2019)

Oil slid after Trump said Venezuela may send up to 50M barrels to US

Valero, Marathon rose on reports of ongoing Venezuela shipments

Supreme Court tariff opinions Friday could spark volatility

EARNINGS

No noteworthy earnings scheduled this week.

Today:

Greenbriar $GBX ( ▲ 0.12% ) - EPS of 79 cents (-54.1% YoY) on $655.5M revenue (-25.2% YoY)

Maryland’s “Robin Hood”:

CEO’s Company Creates Device that ‘Steals’

Wall Street’s Edge

TradeSmith's Keith Kaplan is Wall Street's worst nightmare.

His Baltimore-based company has engineered a device that helps regular folks decide when to buy and sell based on mathematics, not emotion. "We're leveling the playing field," says the disruptive CEO.

- a sponsored message from TradeSmith Daily -

HEADLINES

S&P 500 ends lower, AI stocks buoy Nasdaq (more)

US says it will control Venezuela oil exports indefinitely (more)

Traders bet on the US’s next airstrike target (more)

Carney to visit China to talk trade with Xi as US tariffs hit growth (more)

Job openings slide as hiring slows to 'anemic' rate (more)

US online holiday spending hits record levels despite slower growth (more)

World's worst bond market faces another big supply shock (more)

Alphabet’s market cap surpasses Apple’s for first time since 2019 (more)

Warner Bros. rejects latest Paramount bid, favoring Netflix (more)

US bank profits to surge on investment banking jump in fourth quarter (more)

Exxon signals fall in fourth-quarter upstream profit (more)

JPMorgan Chase reaches deal to become Apple credit card issuer (more)

Blue Owl BDC allows 17% redemptions as investors storm exit (more)

DEALFLOW

M+A | Investments

Anthropic signs term sheet for $10B funding round at $350B valuation

Proven Optics acquires Brightfin

UserTesting Technologies acquires User Interviews

CoreX acquires InSource’s ServiceNow business unit

Citylogix receives investment from CRH Ventures

Enable Injections receives $30M investment from Sanofi

VC

LMArena, a community-driven platform for AI benchmarking, raised $150M in Series A funding

Rakuten Medical, a biotech company developing its proprietary Alluminox platform-based photoimmunotherapy, raised $100M in Series F funding

Swap, a commerce operating system, raised $100M in Series C funding

Corsera Health, Inc., a clinical-stage company leading future cardiovascular health through prediction and prevention, raised $80M in Series A financing

Mediar Therapeutics, Inc., a clinical-stage biotech company advancing first-in-class therapies designed to halt fibrosis, raised $76M in Series B financing

Spiro Medical, a medtech company developing a pulmonary neuromodulation system for the treatment of asthma, raised $67M in Series A funding

Prudentia Sciences, a company specializing in AI-native due diligence for life sciences dealmaking, raised $20M in Series A funding

xAI, Elon Musk's AI company, completed its upsized Series E funding round, raising $20B

Autonomous Technologies Group, an AI research lab focused on solving complex financial problems, launched with $15M in pre-Seed funding

Sibros, Software-Defined Vehicle (SDV) platforms, raised $9M in growth funding. Niterra Co., Ltd.

STRM.BIO, a biotech company advancing non-viral delivery technologies for in vivo cell and gene therapy, raised $8M in Series Seed 2 financing

Oasys Health, an AI-native operating system for behavioral health, raised $4.6M in funding

CRYPTO

BULLISH BITES

🐻 Where are all the stock-market bears?

🤖 Why a humanoid robot isn't ready to take your job.

🏎 Tour the Alps in a supercar.

🍷 The 10 wines you should be drinking in 2026.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.