Good morning.

The Fast Five → Fed set to deliver third-straight interest rate cut, Dow on longest losing streak since 1978, Nissan shares surge 22% on potential mega-merger with Honda, Nvidia falls deeper into correction territory, and 2024 was the 'year of the bond'…

Wall Street Warns: Stocks Could Be "Dead Money" For Next 10 Years

Today, one of America's most trusted market experts is stepping forward to explain what's really going on behind the scenes of this bull market - and why, even if you're sitting on large gains right now, you could soon face losses of 50% or more if you do nothing.

Calendar: (all times ET) - Full calendar

Today:

FOMC interest rate decision, 2:00P

Fed Chair Powell press conference, 2:30P

Tomorrow:

Initial jobless claims, 8:30A

Existing home sales, 10:00A

Your 5-minute briefing for Wednesday, December 18:

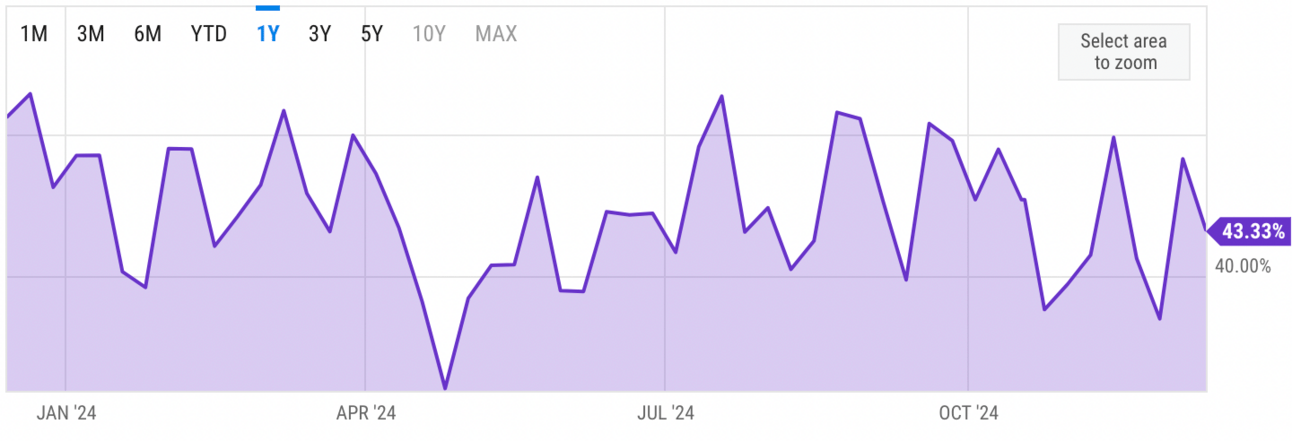

US Investor % Bullish Sentiment:

↓ 43.33% for Week of December 12 2024

Previous week: 48.33%. Updates every Friday.

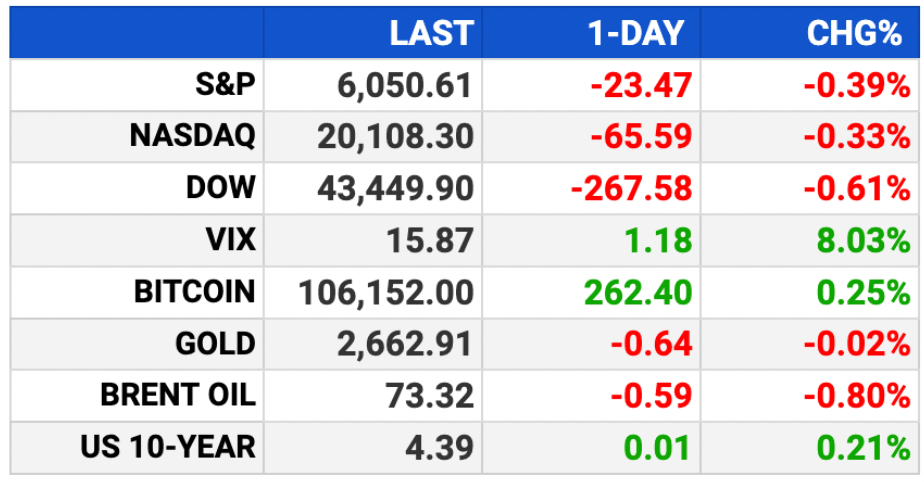

Market Wrap:

Dow slides 267 points for a 9th straight loss, its worst streak since 1978.

S&P 500 (-0.39%) and Nasdaq (-0.32%) hold near record highs.

Rotation out of financials, industrials hits the Dow; Nvidia slips into correction.

Tesla rises; Broadcom drops 3.9%.

Fed rate cut expected today, but strong retail sales fuel overheating concerns.

EARNINGS

Here’s what we’re watching this week: Full Calendar »

Micron Technology (MU) - earnings of $1.77 per share (vs a loss of $.95 per share in the year-ago period) on $8.7B revenue

FedEx (FDX) - earnings of $3.95 per share (-1% YoY) on $22.1B revenue (-0.2% YoY)

Nike (NKE) - earnings of $.64 per share (-37.9% YoY) on $12.2B revenue (-9.1% YoY)

HEADLINES

Stocks drop before Fed’s last decision of the year (more)

US retail sales showcase economy's enduring strength (more)

US manufacturing output rebounds less than expected in November (more)

Dollar rises amid Fed rate cut expectations (more)

2024 the 'year of the bond' as record inflows top $600 billion (more)

Dealmakers await Trump after bouncing back with $3 Trillion haul (more)

Nissan shares surge 22% after reports of potential mega merger with Honda (more)

Nvidia falls deeper into correction territory (more)

Salesforce will hire 2,000 people to sell AI products (more)

Starbucks union votes to authorize strike (more)

GameStop far-off bullish options bets snapped up for second day (more)

CrowdStrike moves to dismiss Delta Air Lines suit (more)

IN PARTNERSHIP WITH KLONDIKE

Discover a generational opportunity to invest in Alaska's energy riches.

Klondike Royalties offers access to an estimated 300 million barrels of recoverable oil reserves in the Cook Inlet. Our royalty structure is designed to provide potential for steady returns.

DEALFLOW

M+A | Investments

Japan’s Honda and Nissan to reportedly begin merger talks (more)

Bain to make $4.2B hostile bid for Fuji Soft against KKR (more)

Bain in talks to buy Little Caesars operator Sizzling Platter (more)

Blackstone buys Ritz-Carlton Okinawa as Japan tourism booms (more)

Alibaba to sell China department store chain in time for $1.3B loss (more)

Compliance Scorecard, a CaaS platform designed by MSPs for MSPs, acquired PrivacyMSP, a specialized consulting firm helping clients ensure compliance to meet privacy regulations (more)

VC

Databriks, a data and AI company, is raising $10B in Series J funding, at $62B valuation (more)

Parafin, an embedded finance infrastructure company, raised $100M in Series C funding, at $750M valuation (more)

Akamis Bio, a clinical-stage oncology company, raised $60M in funding (more)

Stand, a company improving insurance for climate-impacted properties, raised $30M in funding (more)

Slip Robotics, a provider of automated truck-loading robots-as-a-service, raised $28M in Series B funding (more)

Indapta Therapeutics, a clinical stage biotech company, raised $22.5M in funding (more)

BILT, a company specializing in 3D intelligent instructions, raised $21M in Series B funding (more)

Prometheum, a market infrastructure provider for digital asset securities, raised $20M in funding (more)

Anatomy Financial, an AI-powered lockbox to converting paper to an email-like experience for simplified healthcare billing, raised $19M in Series A funding (more)

FastWave Medical, a clinical-stage medical device company, raised $19M in funding (more)

Nuon, a company specializing in SaaS-like experiences directly in customers' cloud account, raised $16.5M in funding (more)

Atlas Invest, a bridge loan company, raised $11M in Funding (more)

NeuroKaire, a biotech company specializing in precision medicine in psychiatry and neurology, raised $10M in funding (more)

Acre Homes, a tech-enabled real estate company, raised over $10M in funding (more)

Vantis Vascular, a medical tech company, raised $10M in Series B-1 Funding (more)

T-robotics, a developer of no-code programming for any robot using natural language and skill models, raised $5.4M in Seed funding (more)

Prequel, a community-driven problem detection and management platform for cloud applications, raised $3.3M in Seed funding (more)

Landbase, an AI-powered go-to-market automation platform, received growth capital from CIBC Innovation Banking (more)

CRYPTO

BULLISH BITES

🚨 Investor Alert: Why are billionaire investors now worried – and selling? *

🚦 Indicator: Flashing yellow light for consumer.

🔥 Hot: Temu was the most downloaded app in Apple's App Store for the second year in a row.

💊 Wired: The drugs young bankers use to get through the day—and night.

🎉 Uninvited: The tradition of bringing a plus-one to the big company bash is fading out.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.