Good morning.

The Fast Five → SoftBank CEO announces a $100 billion investment into the US, Trudeau ‘considering resignation’ after finance minister quits, drone stocks are surging, Broadcom jumps 11%, and Nvidia hits correction territory…

Stocks have soared 25% in 2024...

The S&P has blown through more than 50 all-time highs since the year began...

And a 50-year Wall Street legend has just issued an urgent BUY alert to his 1 million followers:

Calendar: (all times ET) - Full calendar

Today:

US retail sales, 8:30 am

Industrial production, 9:15 am

Home builder confidence, 10:00 am

Tomorrow:

FOMC interest rate decision, 2:00 pm

Fed Chair Powell press conference, 2:30 pm

Your 5-minute briefing for Tuesday, December 17:

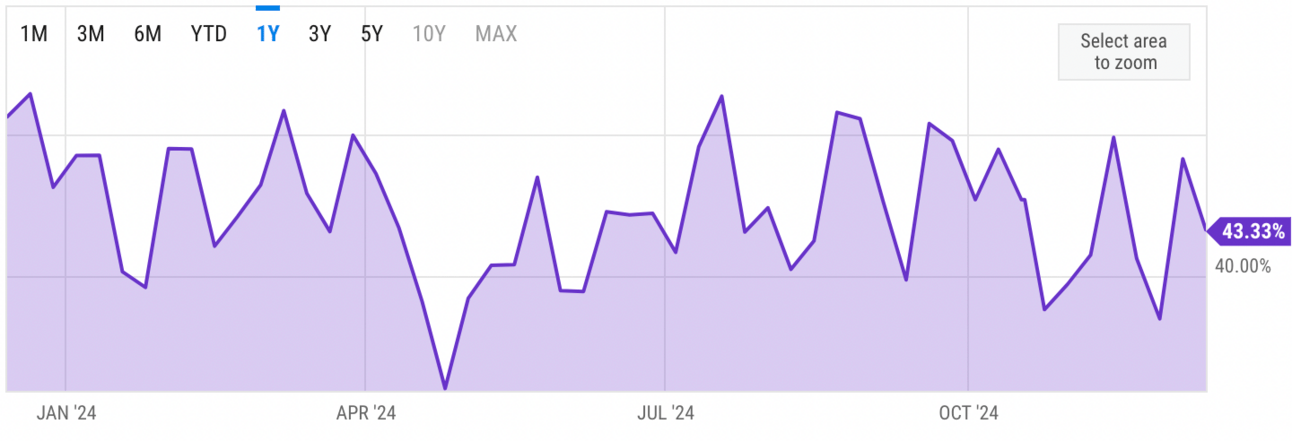

US Investor % Bullish Sentiment:

↓ 43.33% for Week of December 12 2024

Previous week: 48.33%. Updates every Friday.

Market Wrap:

Dow futures dip 68 pts after its 8th straight loss, longest since 2018

S&P 500, Nasdaq hit records; Apple, Tesla, Alphabet notch all-time highs

Nvidia -1.7%, down 4% this month despite semiconductor strength

Tomorrow: Fed begins its final 2024 meeting; markets expect a 0.25% rate cut

Powell’s comments and 2025 rate outlook in focus

EARNINGS

Here’s what we’re watching this week: Full Calendar »

Micron Technology (MU) - earnings of $1.77 per share (vs a loss of $.95 per share in the year-ago period) on $8.7B revenue

FedEx (FDX) - earnings of $3.95 per share (-1% YoY) on $22.1B revenue (-0.2% YoY)

Nike (NKE) - earnings of $.64 per share (-37.9% YoY) on $12.2B revenue (-9.1% YoY)

HEADLINES

Nasdaq hits record as investors await Fed rate decision (more)

Dollar supported as longer-run US rates seen higher (more)

Oil prices nudge down on demand concerns (more)

China plans around 5% growth goal, higher deficit (more)

Trump plans to reverse Biden’s EV policies (more)

TikTok asks Supreme Court to temporarily block government ban (more)

Drone stocks surge on Wall Street led by Red Cat Holdings (more)

Broadcom jumps 11%, extending record run as Goldman expresses ‘higher conviction’ (more)

Nvidia hits correction territory (more)

Waymo to begin testing in Tokyo, its first international destination (more)

Some Chinese AI models are already beating their U.S. rivals (more)

Meta adds live translation, AI video to Ray-Ban smart glasses (more)

TOGETHER WITH THE MOTLEY FOOL

You missed Amazon. You don't have to again.

Amazon, once a small online bookstore, grew into a global behemoth, transforming industries along the way. Now, imagine yourself at the forefront of the next revolution: AI. In The Motley Fool's latest report, uncover the parallels between Amazon's early trajectory and the current AI revolution. Experts predict one of these AI companies could surpass Amazon's success with market caps nine times larger. Yep, you read that right. Don't let history repeat itself without you. Sign up for Motley Fool Stock Advisor to access the exclusive report.

DEALFLOW

M+A | Investments

Universal buys indie music specialist Downtown for $775M (more)

Goldman unit buys €2 bln drugmaker Synthon from BC Partners (more)

Alibaba nears $1 bln intime sale to Youngor Fashion (more)

Greystar buys $1 bln Australian student-housing portfolio (more)

Regional lenders Berkshire Hills Bancorp, Brookline strike $1.1B merger deal (more)

Aprio, an advisory and accounting firm, acquired Securitybricks, Inc., a cybersecurity firm specializing in cloud security (more)

General Inception, a biotech company igniter, acquired Enable Medicine, a company specializing in AI-led data analysis for biological research (more)

ProProfs, a provider of employee development solutions, acquired PeopleGoal, a performance management software company (more)

QuickStart, a company specializing in online IT workforce development, acquired Career Development Solutions, a company offering career training (more)

Pango Group, a holding company that acquires and operates a portfolio of cybersecurity brands, merged with Total Security, a provider of the antivirus protection Total AV (more)

phData, an industry leader in developing and delivering modern data AI solutions, received an investment from Gryphon Investors (more)

VC

Current, a consumer fintech banking platform, raised additional $200M in funding - backers included Andreessen Horowitz (more)

Precision Neuroscience, a brain–computer interface company, raised $102M in Series C funding (more)

CredibleX, a working capital finance platform for SMEs, raised $55M in Seed funding (more)

Jiko, a tech platform and bank that provides access to US Treasury bills, raised $29M in Series C funding (more)

Unrivaled, a professional women's basketball league, raised $28M in Series A funding (more)

Chargezoom, a platform for AI-powered billing and integrated payments, raised $11.5M in Series A funding (more)

Triton Anchor, an offshore anchoring systems company, raised $2.2M in Seed funding and secured a $3.5M grant (more)

CRYPTO

BULLISH BITES

🚨 Investor Alert: 50-year Wall Street legend names #1 stock of 2025 *

🛸 Close Encounters: Mystery drones leave local officials seeking action and answers from Feds.

👀 Watching: The 51 most disruptive startups of 2024.

💙 Smooth: The very personable Claude, Anthropic's AI chatbot, "may be San Francisco’s most eligible bachelor."

🎁 Gift Idea: The Horrible Therapist card game.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.