Good morning.

The Fast Five → Tech investors turn to Nvidia results for next cues, bonds are heading for the best year since 2020, ‘buy the dip’ investors save stocks, Berkshire added $4 billion Alphabet stake, and hedge funds trim stakes in 'Magnificent Seven…

📌 America’s Final AI Boom? NVIDIA's groundbreaking invention just handed the US the key to winning the AI race against China. It's about to trigger the FINAL wave of America's AI boom. And tech legend Jeff Brown says, investors who own shares of "NVIDIA's Magnificent 7" before Jensen Huang's big reveal as early as Jan 6, 2026...Could see gains of 200%, 300%, 750%, and higher. Click here to find out how before it's too late » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Empire State Manufacturing Index, 8:30A

Tomorrow:

none watched

Your 5-minute briefing for Monday, Nov 17:

US Investor % Bullish Sentiment:

↓37.97% for Week of NOV 06 2025

Previous week: 44.03%

Market Wrap:

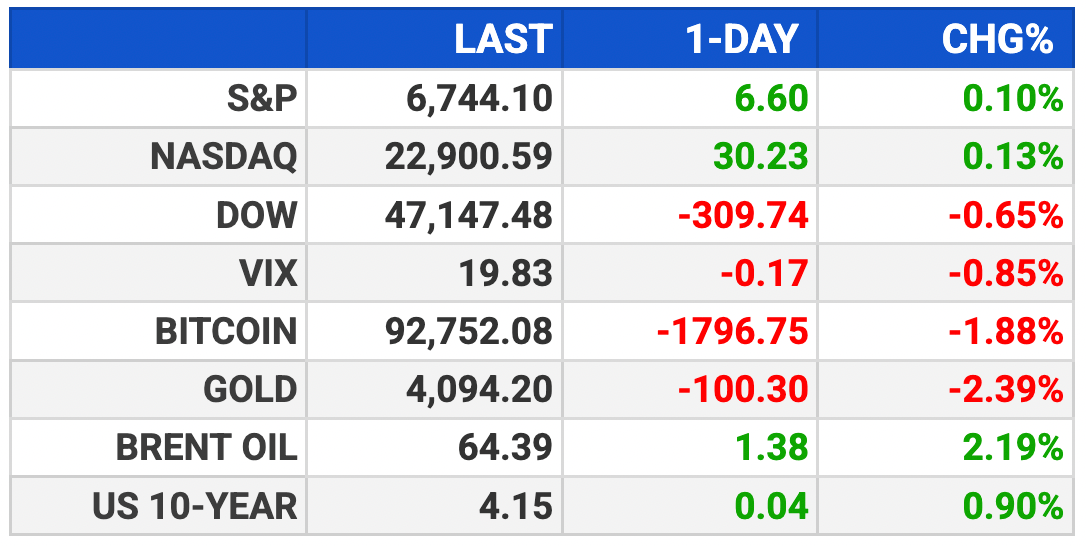

Futures flat: Dow -58 (-0.1%), S&P and Nasdaq near unchanged.

Choppy week left Nasdaq -0.5% as AI leaders slid.

Dow and S&P eked gains despite Thursday’s drop.

Valuation fears and slower Fed cuts pressured tech.

Tom Lee sees a rally ahead, targeting S&P 7,000+.

Nvidia earnings Wednesday to test AI sentiment.

Walmart and Home Depot results to gauge consumers.

EARNINGS

Here’s what we’re watching this week:

TUE: *Baidu $BIDU ( ▼ 0.91% ), *Home Depot $HD ( ▲ 0.97% )

WED: *Lowe’s $LOW ( ▲ 0.78% ), Target $TGT ( ▲ 0.89% )

Nvidia $NVDA ( ▲ 1.02% ) - earnings of $.98 per share (+7.7%) on $14.8B revenue (+7.2%)

THU: Gap $GAP ( ▲ 1.95% ), Ross Stores $ROST ( ▲ 0.53% ), Webull $BULL ( ▼ 0.84% )

*Walmart $WMT ( ▼ 1.51% ) - EPS of $.60 (+3.4% YoY) on $175.14B revenue (+4.3% YoY)

A MESSAGE FROM BROWNSTONE RESEARCH

Tech legend Jeff Brown – the Silicon Valley insider who called NVIDIA in 2016 before it skyrocketed over 30,000...

...has uncovered seven NVIDIA partner stocks set to explode after Jensen Huang's big announcement as early as Jan 6, 2026.

Handing early investors a once-in-a-lifetime chance to pocket generational wealth in America's FINAL AI boom.

- a message from Brownstone Research -

HEADLINES

Wall Street sees tech sell-off as short-term blip (more)

‘Buy the dip’ investors save stocks from a brutal week (more)

As Fed hawks press their case, traders bet against December cut (more)

Trump's $2,000 tariff check requires new law, Bessent says (more)

Trump buys at least $82M in bonds since late August, disclosures show (more)

Bessent says US must trust China's word on trade deal (more)

Hedge funds trim stakes in 'Mag Seven' stocks in third quarter (more)

Dollar steady as investors eye release of US data backlog (more)

Berkshire added $4 bln Alphabet stake and further pared Apple stock (more)

Boeing targets industrial stability before new output rises (more)

AI is making Big Tech weaker (more)

Hyundai Motor announces $86B investment in S. Korea after US trade deal (more)

Popular zero-day options strategies keep a lid on stock rallies (more)

Crowded emerging-market trades draw warnings from money managers (more)

DEALFLOW

M+A | Investments

Merck to buy Cidara in $9.2b deal as sales drop looms

Live Oak acquires Teamshares Inc for $9.2B

VC

Cursor, an AI development platform provider, closed its Series D funding round, raising $2.3B at a post-money valuation of $29.3B

CHAOS Industries, a defense technology company, raised $510M in funding

Gopuff, an instant commerce company, raised $250M in funding

Parallel Web Systems, a web search infrastructure for AI agents, raised $100M in Series A funding

TandemAI, a drug discovery company, raised $22M in Series A extension funding

Self, a provider of zero-knowledge (ZK) identity solutions, raised $9M in Seed funding

Obello, an AI graphic design platform, raised $8.5M in Seed funding

Confidein, an AI and Faith technology company, closed its $6M Seed funding round

Sensetics, a haptics and touch data company, raised $1.75M in Pre-Seed funding

Trash: America’s multi-trillion dollar missed opportunity

TerraCycle turns “unrecyclable” waste—from razors to coffee pods—into profit. Investors in the last round earned between 17-20% back in dividends. Now it’s your turn to invest in innovation for our planet and get 15% bonus stock.

This is a paid advertisement for TerraCycle’s Regulation CF offering. Please read the offering circular at https://invest.terracycle.com/

CRYPTO

BULLISH BITES

🌟 Twilight of the star CEO.

🛒 Americans are addicted to cheap stuff.

🎲 Wanna bet? Online prediction markets wager that you will.

🤠 "Landman" TV show reflects oil industry's renewed swagger.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.