Good morning.

The Fast Five → Bessent, Trump focus on 10-year yields, traders see tariffs and inflation as 2025's market movers, MicroStrategy rebrands to: Strategy, Trump to help spark a nuclear energy ‘renaissance’, and US Crypto Czar, David Sacks, calls Bitcoin an ‘excellent store of value’…

These Six “Picks and Shovels” Companies Are the Real Secret to Profiting From the AI Boom —

These six companies are so essential to AI that the industry cannot survive without them.

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

Tomorrow:

Unemployment report, 8:30A

Wholesale inventories, 10:00A

Your 5-minute briefing for Thursday, February 6:

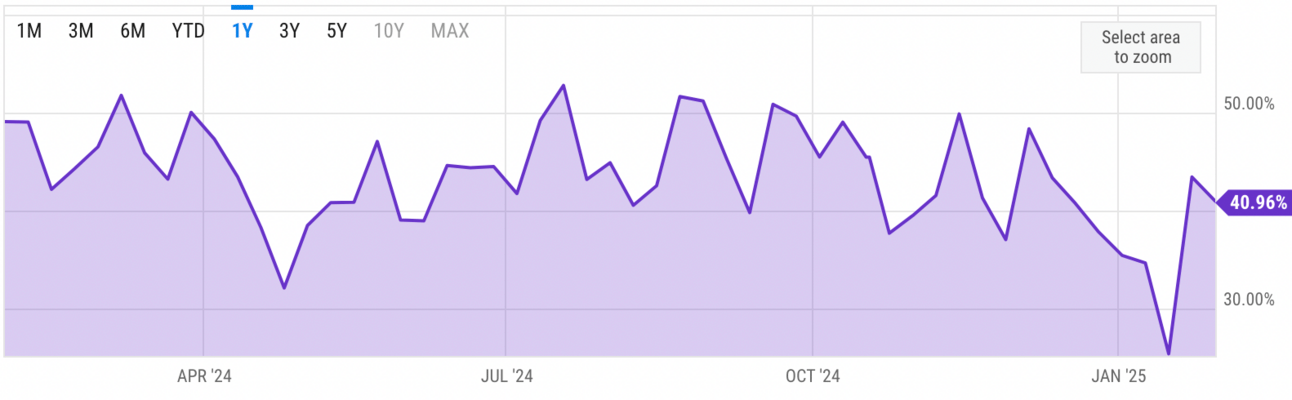

US Investor % Bullish Sentiment:

↓ 40.96% for Week of January 30 2025

Previous week: 43.43%. Updates every Friday.

📉 The Real Reason Nvidia Shares Are Experiencing Worst Days in Months »

- From Porter & Co

Market Wrap:

Stock futures were flat after back-to-back gains for major indexes..

Chip stocks slid post-earnings, with Qualcomm, Arm, and Skyworks dropping.

Dow gained 317 points Wednesday, boosted by Nvidia's rally.

Tariff fears eased after Trump paused duties on Canada and Mexico.

Weekly jobless claims data due today.

EARNINGS

Here’s what we’re watching this week:

Amazon.com (AMZN) - earnings of $1.49 per share (+49% YoY) on $187.3B revenue (+10.2% YoY)

HEADLINES

Wall St ends higher as investors digest earnings (more)

Record high imports pressure US trade deficit (more)

Gold dealers sell BOE bullion at big discounts in tariff turmoil (more)

Oil down as US crude inventories swell (more)

Crypto Czar David Sacks calls Bitcoin an ‘excellent store of value’ (more)

Trump to help spark a nuclear energy ‘renaissance,’ investor says (more)

Musk’s DOGE team mines for fraud at medicare, medicaid (more)

Ford CEO calls for ‘comprehensive’ tariff analysis for all countries (more)

Google opens its most powerful AI models to everyone,in virtual agent push (more)

Bitcoin treasury pioneer MicroStrategy rebrands with a new name: Strategy (more)

Morgan Stanley selling $5.5 billion of X debt on demand surge (more)

Apollo plans to build the first marketplace for private credit (more)

DEALFLOW

M+A | Investments

Teladoc Health to acquire Catapult Health in $65 million deal (more)

SoftBank nears deal to acquire chip designer Ampere (more)

Horizon Infusions, a network of ambulatory infusion centers, received an investment from Rubicon Founders (more)

Prescient Logistics, LLC, d/b/a RepScrubs, a healthcare compliance company, received an investment from Pittco (more)

Appfire, a software provider that enhances and connects platforms, acquired Flow, enterprise software for software engineering intelligence (more)

Smarsh, a comms data and intelligence company, acquired CallCabinet, a cloud-native compliance call recording and analytics tech company (more)

VC

Semgrep, an application security platform, raised $100M in Series B funding (more)

Nextworld, a provider of enterprise platforms, raised $65M in Series F funding (more)

Fay, a digital nutritional therapy company, raised $50M in Series B funding, at a $500M valuation (more)

Ivo, an AI-powered contract review solution, raised $16M in Series A Funding (more)

GenLogs, a freight Intelligence platform raised $14.6M in Series A funding (more)

INFI USA, an AI-driven self-service software platform, raised $12M in Series A funding (more)

Little Otter, a company specializing in digital whole-family mental health care, raised $9.5M in funding (more)

Miist Therapeutics, a physics-based developer of inhaled medicines, raised $7M in funding (more)

GetWhys, an AI-powered customer insights platform, raised $2.75M in Seed funding (more)

Pickleheads, a platform for pickleball players to connect and organize games, raised $2.5M in Seed funding (more)

Comma, an integrated period care company, raised $2M in Seed funding (more)

Astra Security, a security platform with continuous vulnerability scanning and pentests, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🚫 The SEC is making moves to squash the size of its crypto enforcement unit.

🤔 UnitedHealth raises concerns over Bill Ackman's post on X with SEC.

👎 'Big Short' and 'Moneyball' author says sports betting Is a disaster.

🏈 The Super Bowl has never seen anything like these five gigantic humans.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.