☕️ Good Morning.

The Justice Dept charges $2.5 billion in health-care fraud, Tesla starts running ads, Musk accepts UFC champion’s offer for Zuck fight training, Brookfield on a $50 billion deal spree, and Starbucks to offer ‘cleaner’ store decor guidelines after pride clash…

Here’s today’s briefing:

BEFORE THE OPEN

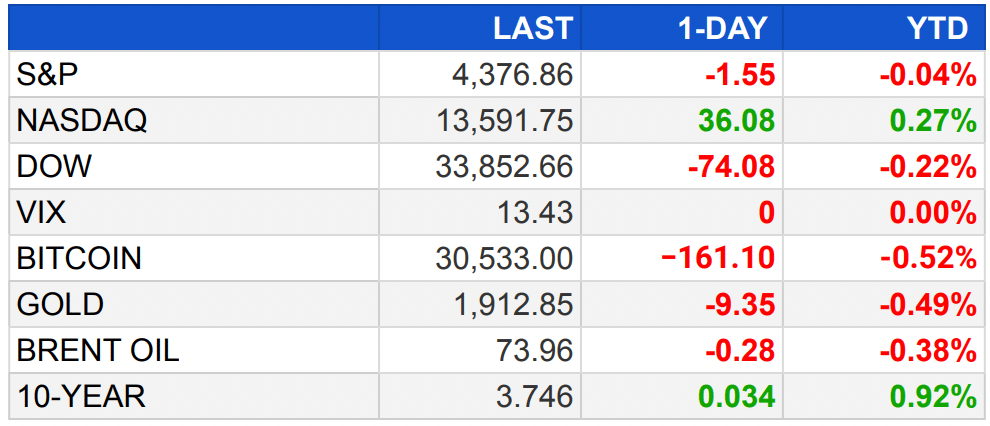

As of market close 6/28/2023.

Markets:

Overnight stock futures see slight rise as Q2 and H1 2023 draw to a close with promising gains.

Dow Jones futures up by 70 points, S&P 500 futures rise 0.2%, and Nasdaq 100 futures climb 0.3%.

Micron Technology stocks up 2% after strong Q2 earnings, driven by high industry demand.

JPMorgan and BoA stocks rise over 1% after passing the Fed’s stress test.

S&P 500 shows 14% YTD gain; tech-heavy Nasdaq skyrockets nearly 30%, marking best first half since 1983. The Dow sees more modest 2% YTD gain.

S&P 500 closed steady amid investor digestion of Fed Chair Powell's comments on a continuing tightening cycle and potential consecutive interest rate hikes.

Attention shifts to Powell's upcoming speech at Madrid conference, followed by discussion with Bank of Spain Governor Pablo Hernández de Cos.

Weekly jobless claims data release awaited to assess labor market health.

S&P 500 sees 4.7% rise in June, its best monthly performance since January, and 6.5% gain in Q2, marking its third consecutive positive quarter.

EARNINGS

What we’re watching this week:

Today: Acuity Brands (AYI), McCormick (MKC), Nike (NKE), Rite Aid (RAD)

Friday: Constellation Brands (STZ)

Full calendar here

DEALFLOW

Bed Bath & Beyond splits auction, doubt grows over Buy Buy Baby sale process (more)

Brookfield trumps buyout titans with $50 billion deal spree (more)

Savers Value, Kodiak, Fidelis near $1 billion IPO day in US (more)

Arcline makes bid for Circor, upending $1.7 billion KKR deal (more)

TSG Is Exploring Sale of Outdoor, Ski Gear Retailer Backcountry (more)

France's Orange enters exclusive talks with BNP Paribas to exit retail banking (more)

CRYPTO

CFTC issues $54M default judgment against trader in crypto fraud scheme (more)

Wood’s Ark adds possible ‘silver bullet’ to Bitcoin filing (more)

Sony Network Communications invests $3.5M in Singapore Web3 company Startale Labs (more)

EU publishes digital Euro bill featuring privacy controls, offline guarantee (more)

EU finalizes controversial smart contract kill switch rules under Data Act (more)

SHARES

Know someone who would enjoy this?

What did you think about today's briefing?

Hope you enjoyed today’s briefing (…it’s almost the wknd!) -mb