Good morning.

The Fast Five → Buffett market indicators send warning to bulls, Tesla shareholders approve Musk's $1 trillion pay package, ‘Jenga Tower’ economy teeters, October job cuts hit highest level in 22 years, and Trump official says NO to AI bailout…

📌 Jeff Bezos quietly backing world-changing tech (not AI) — The Amazon founder is quietly advancing a radical technology that could change society forever and make early investors rich. Take these three steps to prepare » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Prelim Consumer Sentiment, 10A

Monday:

Nothing watched

Your 5-minute briefing for Friday, Nov 7:

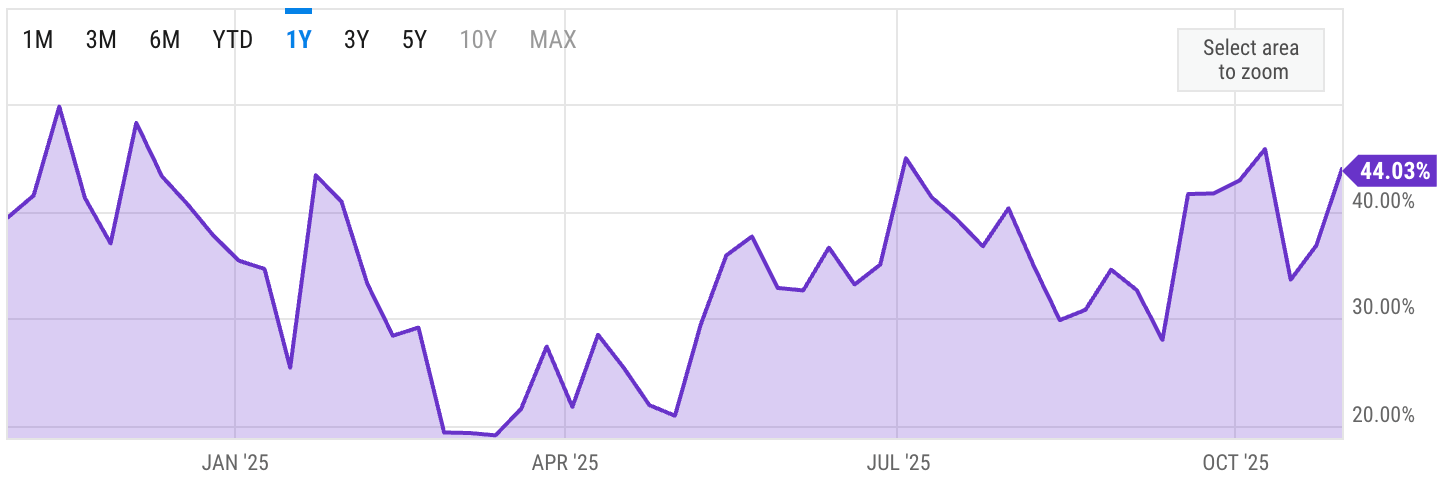

US Investor % Bullish Sentiment:

↑44.03% for Week of OCT 30 2025

Previous week: 36.86%

Market Wrap:

Futures up: Dow +95, S&P +0.3%, Nasdaq +0.3%.

AI leaders slid Thurs (NVDA, AMD, TSLA, MSFT), dragging indexes lower.

Layoffs hit highest Oct. level since early 2000s; 2025 worst year since 2009.

Indexes all red WTD: S&P -1.8%, Dow -1.4%, Nasdaq -2.8%.

Hopes pinned on shutdown ending, Dec Fed cut, and Nvidia earnings catalyst.

Payrolls delayed again by shutdown; economists saw -60K jobs, 4.5% unemployment.

EARNINGS

None watched today. See full calendar here »

A.I. Bombshell

The AI arms race could be a massive boom to ONE company that's doing something truly unprecedented.

This company counts Nvidia, Google, Bill Gates, and Stanley Druckenmiller as investors...

It holds 57 patents...

And it produces a CRUCIAL piece of AI technology.

But few investors have ever heard its name.

That's about to change - fast.

Its new device could become the cornerstone of the next wave of the AI revolution...

And early investors could make a substantial sum of money as this story hits the mainstream.

A Wall Street legend - dubbed "The Prophet" by CNBC - just predicted that this could be bigger than the internet.

-Sam Latter

Senior Researcher, Stansberry Research

HEADLINES

Wall Street ends lower on tech valuations, economic jitters (more)

‘Jenga Tower’ US economy teeters as middle class pulls back spending (more)

Nvidia leads tech lower as Trump official says no to AI bailout (more)

Trump announces deals with Eli Lilly, Novo Nordisk to lower drug prices (more)

US firms announce most October job cuts in over 20 years (more)

Homebuilders bet on 1% mortgage rates to wake up US buyers (more)

Datadog’s soars 20% on revenue beat, strong forecast (more)

Doordash drops 15%, heads for worst day ever on spending concerns (more)

Duolingo stock plunges 27% on light guidance (more)

Microsoft forms superintelligence team 'to serve humanity' (more)

Schwab to allow investments in private companies, joining a Wall St craze (more)

Disney signs DraftKings as ESPN’s new sports-betting partner (more)

Bernstein sees prediction markets propelling Robinhood, Coinbase (more)

DEALFLOW

M+A | Investments

Nvidia-backed Vast Data inks $1.17B AI deal with CoreWeave

Aquarian Capital to buy insurer Brighthouse in $4.1B deal

KKR, Singtel seek to fully own Singapore data centre firm in $3.9B deal

Schwab to buy Forge Global for $660M as demand for pre-IPO shares grows

Exxon enters Greece with gas deal that expands US footprint in eastern Med

Metropolis Technologies receives $1.6 billion in financing

VC

Ripple, a fintech company offering crypto solutions for businesses, received a $500M strategic investment at a $40B valuation

Synchron, a company specializing in non-surgical BCI, raised $200M in Series D funding

Reevo, a creator of an AI-native technology that turns fragmented GTM stacks into one platform, raised $80M in funding

Inception, a company developing dLLMs, raised $50M in funding

Kaizen Labs, a provider of e-government solutions, raised $21M in Series A funding

DealMaker, a retail capital-raising platform, raised $20 M in equity and debt funding

Fintary, an AI-powered revenue growth platform for insurance companies, raised $10M in Series A funding

Arx Research, a provider of Burner Terminal, a handheld stablecoin + card payment device for merchants, raised $6.1M Seed funding

Avallon, a company building AI agents that automate repetitive insurance claims tasks, raised $4.6M in Seed funding

MiSalud Health, a bilingual AI-powered health platform, raised an undisclosed amount in funding

BUY ALERT

This rapidly developing story involves President Trump, trillions of dollars, practically every member of the Silicon Valley elite... Not to mention a potentially MAJOR upgrade to America's power grid. See why one former $200 billion hedge fund manager says, "If you make one investment in 2025, I recommend making it this one."

- A message from InvestorPlace Digest -

CRYPTO

BULLISH BITES

🤬 Why the AI executives are mad at their investors.

🗽 Zohran Mamdani and the Wall Street vibe shift.

🤖 Apple could make $133B a year on humanoid robots by 2040.

🦃 Thanksgiving turkey prices might give shoppers a shock this season.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.