A quick favor? Hit ‘reply’ and tell us your current top stock pick!

Why? we are changing our send domain which may cause some bumps in delivery. When you ‘reply’ it “tells” your email provider to keep briefings in your primary inbox (plus we’ll share the stock picks!) - thank you.

Good morning.

The Fast Five → Dow closes at new record high, Fed likely to cut rates by quarter point, Apple announces iPhone event, OpenAI supports California AI bill requiring 'watermarking', and SpaceX to launch billionaire on first-ever private spacewalk. Today’s briefing ahead, but first…

📈 Some of Nvidia’s partners have already surged as much as 4,744%. These 3 are next »

A message from Weiss Research

Calendar: (all times ET) - Full calendar here

Today: Consumer confidence, 10:00A

Tomorrow: [none]

Your 5-minute briefing for Tuesday, August 27:

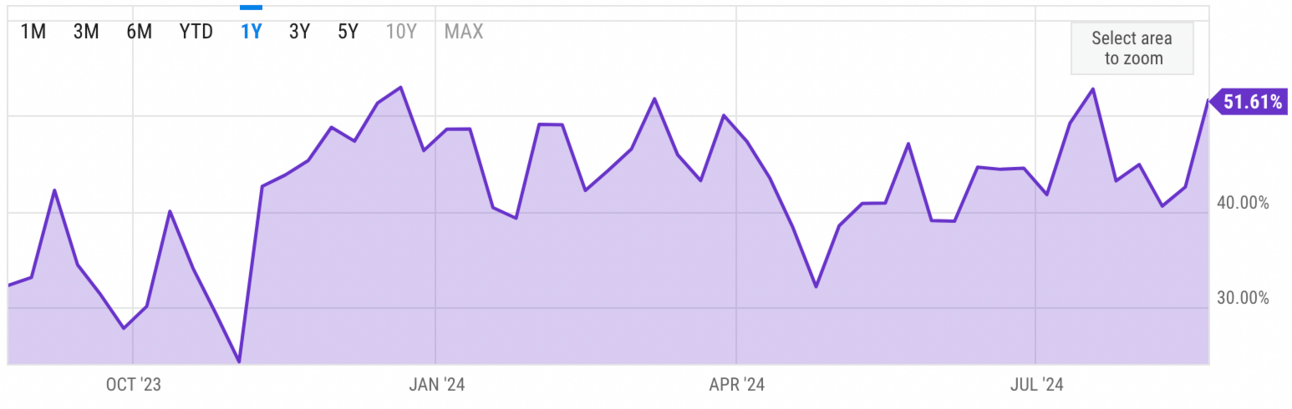

US Investor % Bullish Sentiment:

↑51.61% for Wk of August 22 2024

Last week: 42.54%. Updates every Friday.

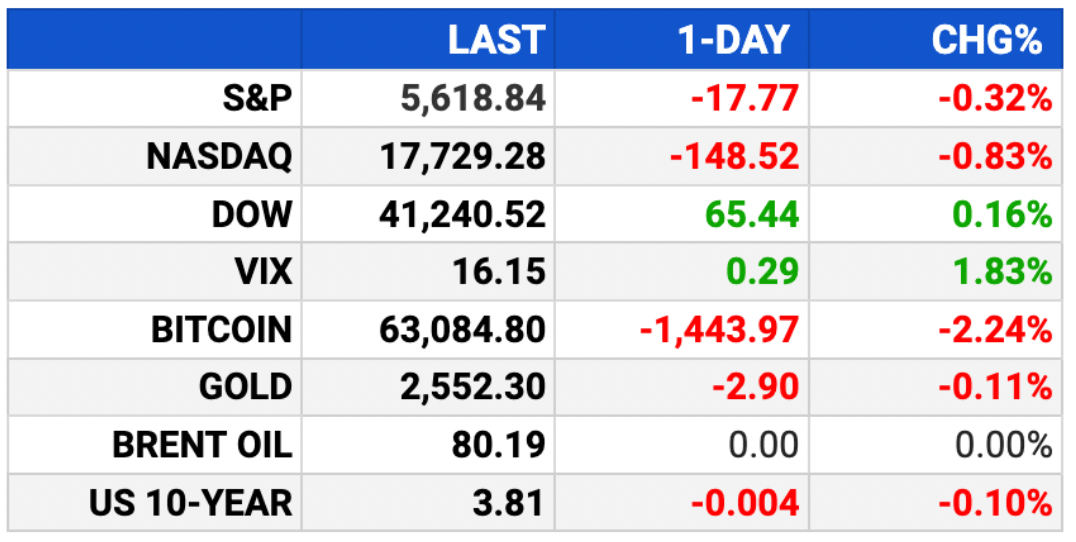

Market Wrap:

Dow closed at a record, up 65 points; S&P -0.32%, Nasdaq -0.85%.

Tech fell; Nvidia dropped 2.3% ahead of key earnings.

Energy sector up 1% as traders rotated out of tech.

August began with a sell-off, but stocks have rebounded.

Powell hinted at rate cuts; traders expect Sept cut.

EARNINGS

Here’s what we’re watching this week:

Today: Nordstrom (JWN)

Nvidia (NVDA) - earnings of $.57 per share (lower than Q1 due to the 10-for-1 stock split) on $25.6B revenue, nearly double the $13.5B it reported in the year-ago period.

Salesforce (CRM) - earnings of $2.36 per share (+11.5% YoY) on $9.2B revenue (-3.8% YoY)

Ulta Beauty (ULTA) - earnings of $5.52 per share (-8.3% YoY) on $2.6B revenue (+4% YoY)

Full earnings calendar here.

HEADLINES

Fed likely to cut rates by quarter point next month, Daly says (more)

US business' equipment spending shows loss of momentum (more)

Oil jumps more than 3% on Libya production halt (more)

Goldman’s Rubner sees S&P new high this week, spurring FOMO (more)

Banks likely ‘end game’ for repo market as Treasury supply grows (more)

Nvidia mints millionaires too busy to bask in new wealth (more)

Apple announces iPhone event for Monday, Sept. 9 (more)

Apple’s Maestri to hand off CFO job (more)

JPMorgan sued over low rates on cash sweeps (more)

SpaceX to launch billionaire on first-ever private spacewalk (more)

OpenAI supports CA AI bill requiring 'watermarking' of synthetic content (more)

Meta platforms strikes geothermal energy deal to power data centers (more)

A MESSAGE FROM OUR PARTNER

Nvidia Ex-Partners Soared up to 4,744%: $1T AI Pivot Lures New Names

Nvidia's past collaborations have often benefitted both parties, with one rising as much as 4,744%.

As Nvidia pivots to capitalize on a new $1 trillion opportunity in AI, fresh alliances are forming. Dr. Martin Weiss has pinpointed three silent partners that could play a crucial role in this phase of the AI boom.

- sponsored message -

DEALFLOW

M+A | Investments

Bronfman drops Paramount bid, clearing path for Skydance deal (more)

McKesson to buy stake in Florida cancer chain for $2.49B (more)

Trintech's owners explore $2 bln sale of financial software maker (more)

Avionté, a provider of enterprise staffing platforms acquired AkkenCloud, a staffing software company (more)

Dysrupt, a marketing agency, acquired Armscye, a performance marketing and brand strategy firm (more)

Enigma, a cybersecurity platform focusing exclusively on Zero Trust, acquired Onclave Networks, a cybersecurity company focused on diverse environments (more)

VC

Butlr, a physical AI startup, raised $38M in Series B funding (more)

Slingshot AI, an AI mental health startup, reportedly raised approximately $30M in seed funding (more)

Home Run Dugout, an entertainment provider featuring indoor soft-toss baseball, raised $22.5M in Series A funding (more)

HomeLight, a real estate tech platform empowering innovative transactions, raised $20M in Series D extension funding (more)

PrivacyHawk, a company specializing in consumer data protection, raised additional $3M in funding (more)

Revenew, a provider of a payment operations and optimization platform, raised $4.6M in seed funding (more)

CancerIQ, a health platform that personalizes cancer prevention and early detection, received financing from Decathlon Capital Partners (more)

CRYPTO

BULLISH BITES

📈 AI’s Big Pivot: A massive $1 Trillion AI superproject is underway *

🏦 Pursuits: Will TXSE make Dallas America's next financial titan?

👀 Inside Look: What to know about Telegram CEO Pavel Durov.

🎸 Spun Out: Martin Shkreli is ordered to give up a one-of-a-kind Wu-Tang Clan album.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.