Good morning.

The Fast Five → OpenAI unites with Jony Ive in $6.5 Billion deal, tariff math leaves retailers very little choice, 30-year Treasury yield spikes to 5.09%, Boeing increases 737 production pace as safety improves, David Sacks says stablecoin bill will unlock ‘trillions’ for US Treasury

📌 Elon Musk says Optimus will be worth more than Tesla's entire car business. This is more than just another AI trend—it could be the biggest wealth creation event of the decade. (ad)

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

Existing home sales, 10:00A

Tomorrow:

New home sales, 10:00A

Your 5-minute briefing for Thursday, May 22:

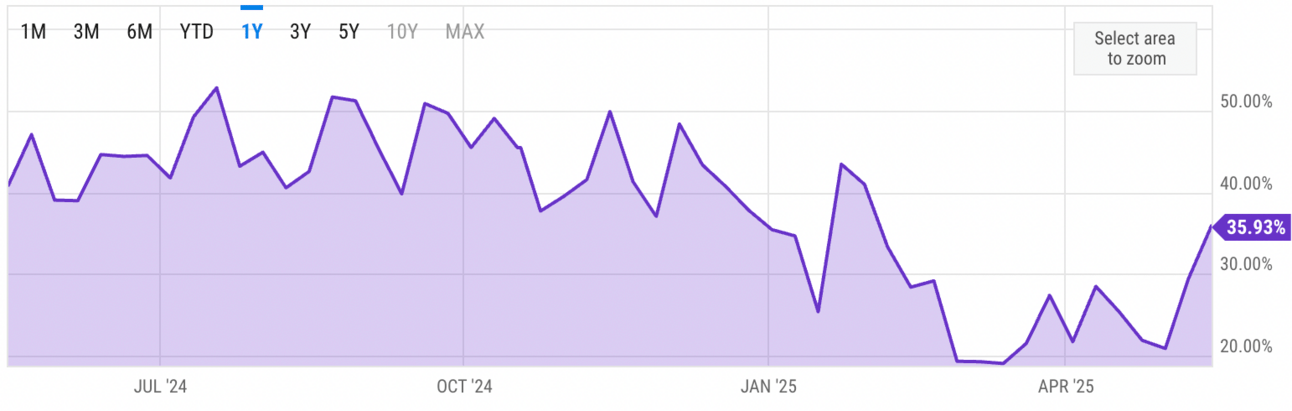

US Investor % Bullish Sentiment:

↑ 35.93% for Week of MAY 15 2025

Previous week: 29.45%. Updates Friday.

Market Wrap:

Futures flat after Wall Street sell-off; Dow futures -60 pts

Dow dropped 800+ pts, S&P 500 fell 1.6% on deficit concerns

Budget bill stalls in House over SALT deduction fight

Bill could raise deficit amid rising tariff-driven inflation

Treasury yields spike: 30-yr hits 5.09%, 10-yr at 4.59%

EARNINGS

Here’s what we’re watching this week:

Today: Ross Stores $ROST ( ▲ 0.53% ), Workday $WDAY ( ▼ 1.58% )

A message from Stansberry Research

Elon Musk's upcoming Optimus robot could turn him into the world's first trillionaire…

While simultaneously turning everyday investors into millionaires.

Morgan Stanley has already gone on record to say that Optimus could be part of a $30 trillion opportunity…

And one Silicon Valley insider found a way for Americans to potentially profit from Optimus before it gets rolled out.

HEADLINES

Treasury yields rise, stocks decline on US fiscal outlook worries (more)

30-year Treasury yield spikes to 5.09%, 10-year yield hits 4.61% as GOP bill raises deficit concerns (more)

Crypto czar David Sacks: stablecoin bill will unlock ‘trillions’ for US Treasury (more)

House GOP muscles through bank merger reforms (more)

Gold Buoyed by Weaker Dollar, Global Uncertainties (more)

Asian shares slip as worries about US debt send Wall St tumbling (more)

Phillips 66 narrowly survives Elliott proxy fight (more)

UnitedHealth falls after report it secretly paid nursing homes to reduce transfers (more)

Target to "offset" majority of tariff impacts, focus on value (more)

Boeing increases 737 production pace as quality, safety culture improves (more)

US Accepts Qatar Luxury Jet as Trump’s New Air Force One (more)

Nike to resume selling directly on Amazon for first time since 2019 (more)

DEALFLOW

M+A | Investments

OpenAI to acquire AI device startup co-founded by Jony Ive for $6.5B

AT&T to acquire Lumen's Consumer Fiber Business for $5.75B

Motorola Solutions nears $4.5B acquisition of Silvus Technologies

Stora Enso to sell 12.4% of Swedish Forests for about $1 Billion

China Mobile nears acquisition of Hong Kong Broadband Network

Revolution Beauty explores sale following takeover approach

VC

DataHub, an open-source metadata platform, raised $35M in Series B funding

SparkCharge, an off-grid electric vehicle fleet charging network and mobile charging solutions, raised $30.5M in Series A-1 funding

Clair, a fintech company offering EWA originated by National Bank, Pathward, raised over $23M in Series B funding

Greenlite AI, an AI agent platform for financial services, raised $15M in Series A funding

Reperio Health, a provider of at-home and onsite comprehensive health screenings, raised $14M in funding

Sangha Renewables, a company supporting renewable energy generation through Bitcoin mining, raised $14M in equity funding

Zoca, an AI-first growth platform supporting local service businesses, raised $6M in funding

Pay-i, a value-intelligence platform for GenAI, raised $4.9M in Seed funding

DataHub, an open-source metadata platform, raised $35M in Series B funding

Flo Recruit, a company offering a connected suite of legal talent software, raised an undisclosed amount in Series A funding

CRYPTO

BULLISH BITES

🤖 A First: Klarna used an AI avatar of its CEO to deliver earnings.

🤫 Microsoft’s AI security chief accidentally reveals Walmart’s AI plans after protest.

🔥 AI videos from Google’s Veo 3 are here, and they’re both impressive and terrifying.

⌚︎ Is wearable tech making us paranoid about our health?

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.