Good morning.

The Fast Five → Nvidia (NVDA) shares jump on upbeat forecast, Biden touts $1.2B in student loan relief, Apple releases free new sports app for iPhone, Boeing replaces head of troubled 737 Max program, and Bezos sells more shares bringing total to $8.5 Billion…

Poll Results:

71.4% of you voted ‘YES’ to yesterday’s question: “Will Q4 beat drive Nvidia stock higher?”

Presented by WiserAdvisor.com: Let us connect you with the best financial advisor in your area. A free, independent and unbiased matching service that finds you a personalized match with 2-3 vetted advisors to compare. Try it »

Your 5-minute briefing for Thursday, February 22:

BEFORE THE OPEN

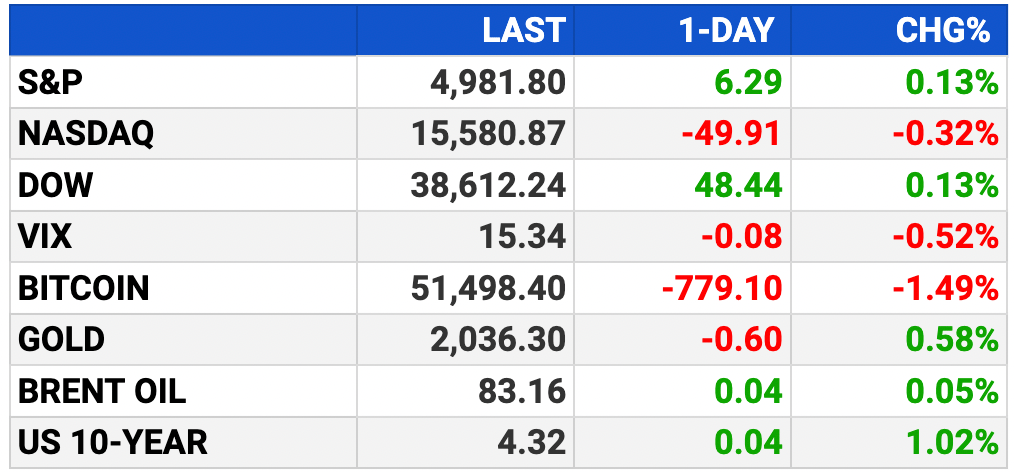

As of market close 2/21/2024.

Pre-Market:

Market Recap:

S&P 500 futures up 0.7%, Nasdaq 100 up 1%; Dow adds 0.1%.

Nvidia soars 9% after record revenue, AI-driven growth.

Nasdaq eyes rebound after 3-day slump; down 1% this week.

Fed minutes caution on rate cuts; focus on inflation data.

Thursday: jobless claims, home sales; earnings: Moderna, Booking, Intuit.

EARNINGS

What we’re watching this week:

Today: Intuit (INTU), Live Nation (LYV), Moderna (MRNA), Wayfair (W)

Friday: Warner Bros. Discovery (WBD)

Full earnings calendar here

HEADLINES

Biden touts $1.2B in student loan relief with eye to 2024 (more)

Minutes show Fed officials remained worried that inflation could stop cooling (more)

Banks should be managing risks from fintech partnerships, regulator says (more)

IRS to begin ‘dozens of new audits’ of corporate jets in crackdown of corporations, higher earners (more)

Mortgage demand takes a massive hit as interest rates cross back over 7% (more)

Japan’s Nikkei surpasses 1989 all-time high on robust corporate earnings (more)

AI and semiconductor stocks surge after Nvidia’s earnings beat (more)

Palo Alto Networks plunges by most ever after cutting outlook (more)

Private equity payouts at major firms plummet 49% in two years (more)

The $8 Trln ETF market is ready for Its next move after crypto (more)

Google launches two new open LLMs (more)

Boeing replaces head of troubled 737 Max program (more)

JetBlue joins other airlines and raises checked luggage fees (more)

Bezos sells more shares, bringing total To $8.5B (more)

Rivian lays off 10% of workforce as EV pricing pressure mounts (more)

TOGETHER WITH WISERADVISOR

Compare top advisors in your area—

Connect with the best financial advisor for your needs from WiserAdvisor - a free, independent and unbiased matching service…

Trusted by over 100,00+ consumers since 1998

FREE initial 1 on 1 consultation

Get a personalized match with 2-3 vetted Advisors to compare

— NO match fee

Start now. Simply answer a few questions and WiserAdvisor will find and connect you with 2-3 financial advisors in your area today…

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Propelr, a payment acceptance provider, acquired Ireland Pay, a merchant services company (more)

Archer, a company providing an integrated risk management solution, acquired Compliance.ai, a provider of AI-driven regulatory change management solutions (more)

SVP acquires majority ownership of Hornblower (more)

Podium Education, an experiential education company for universities, acquired Untapped, a provider of an early career talent platform (more)

Highstreet IT Solutions, a cloud-focused Oracle implementation and managed services provider, received an investment from CIVC Partners (more)

MidOcean-backed Cloyes acquires Automotive Tensioners (more)

Harwood Private Equity buys Crest Foods (more)

Resurgens-backed Wellspring acquires Sopheon (more)

LPL Financial Purchases Atria Wealth Solutions (more)

Havenly buys The Citizenry (more)

Heartwood-backed Amlon buys EcoWerks (more)

Divcon Controls, a provider of systems integrator delivering automation and monitoring solutions, received an investment from Goldman Sachs Alternatives (more)

CLARA Analytics has received an investment from Nationwide Ventures (more)

VC

Kairos Aerospace, a company specializing in high-frequency aerial methane detection for the energy industry, raised $52M in Series D in funding (more)

Cagent Vascular, a commercial stage medical device company, raised $30M in Series C funding (more)

Oula, a maternity care company, raised $28M in Series B funding (more)

HealthSnap, a provider of a remote patient monitoring and chronic care management solution for healthcare providers, raised $25M in Series B funding (more)

Qloo, a cultural AI company, raised $25M in Series C funding (more)

AtmosZero, a company focused on decarbonizing steam, raised $21M in Series A funding (more)

Orkes, a provider of a platform for distributed systems, raised $20M in funding (more)

Blackbird Health, a neuroscience-led and technology-backed youth mental health provider, raised $17M in Series A funding (more)

Empowerly, a data-driven education technology company, raised $15M in funding (more)

Insamo, a biotechnology company advancing membrane-permeable and orally available cyclic-peptides, raised $12M in Seed funding (more)

BridgeCare, a provider of a data and technology infrastructure platform for early care and education, raised $10M in funding (more)

Ventiva, a company specializing in active cooling solutions for electronic devices, raised $10M in Series C funding (more)

Novity, a provider of predictive maintenance AI for process industry clients, raised $7.8M in funding (more)

Conservation Labs, an artificial intelligence (AI) company, has raised a $7.5-million Series A funding round led by RET Ventures (more)

ZipLines Education, an education tech company, raised $6.4M in Series A funding (more)

FUNDRAISING

CVC adds to fundraising spree with $6.8B Asia Fund (more)

Keystone Capital, a lower middle market alternative investment manager, closed Fund III, at $630M (more)

Hack VC, a web3 venture capital firm, closed its Venture Fund I, at $150M (more)

Ibex Investors, LLC, a multi-stage and multi-strategy investment firm, closed its fourth Israel-focused fund, Ibex Israel VC II LP, with $106M in capital commitments (more)

CRYPTO

BULLISH BITES

🏛 Breaking custom: Pursuing ‘American dynamism,’ Andreessen Horowitz ups its game in DC.

⚖️ Courtside: Trader fired over off-color joke challenges hedge fund secrecy.

❤️ Still in love: The people keeping old tech en vogue.

😔 Can we solve loneliness? These startups are betting on it.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.