Good morning.

The Fast Five → Trump signs 'Genesis Mission' order to boost AI innovation, Amazon to invest $50B to power US government, Trump, Xi speak for first time since trade truce, Michael Burry launches newsletter to lay out AI bubble views, and Tesla stock pops as Melius calls it 'must own'…

📌 Former Goldman VP Reveals Mysterious Gold Stock With Huge Upside Potential — He says the gains in this should be far greater than just bullion or mining stocks. Some folks had the chance to see 995% the last time we shared this exact gold stock. Most people know nothing about it (except the elite). See more details about his No. 1 gold stock right here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Producer Price Index, 8:30A

Tomorrow:

Unemployment Claims, 8:30A Durable Goods Orders, 8:30A

Prelim GPD (tentative)

Your 5-minute briefing for Tuesday, Nov 25:

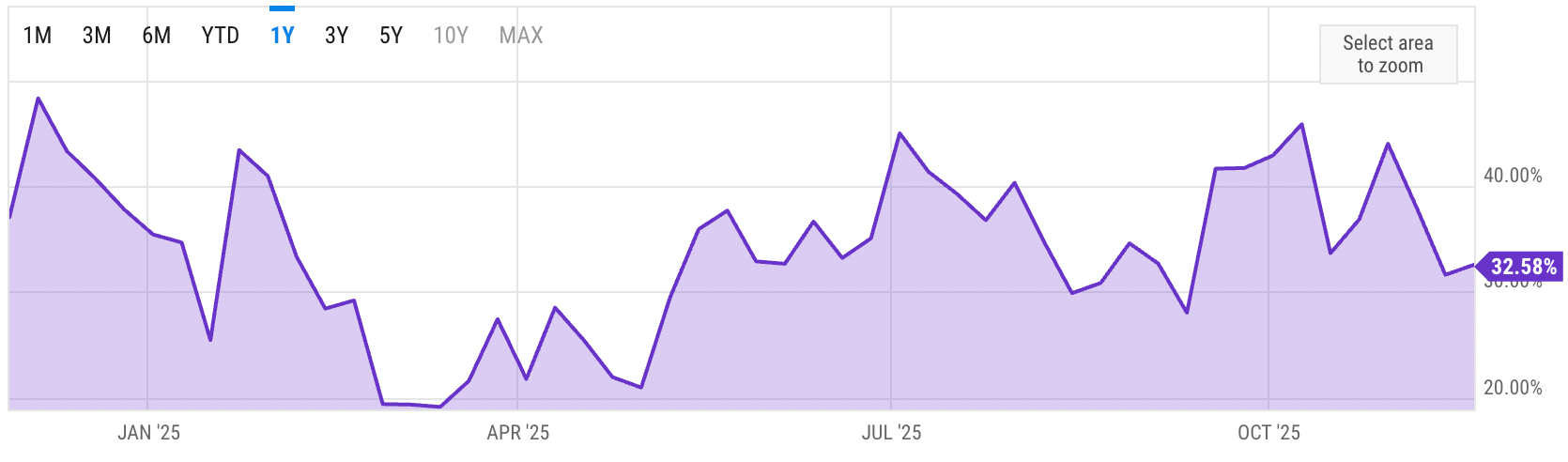

US Investor % Bullish Sentiment:

↑32.58% for Week of NOV 20 2025

Previous week: 31.62%

Market Wrap:

Futures flat: Dow +13 (0.1%), S&P +0.1%, Nasdaq +0.1%.

Monday rally: S&P +1.6%, Nasdaq +2.7%, Dow +0.4%.

Alphabet +6.3% and Broadcom +11% led AI rebound; Nvidia +2%.

November still red: S&P -2%, Nasdaq -3.6%, Dow -2.3%.

AI valuations under scrutiny heading into year-end.

Fed cut odds >80% for December after dovish Williams/Daly.

Short holiday week: markets closed Thu, early close Fri.

EARNINGS

Here’s what we’re watching on this short, holiday week:

Today: *Abercrombie & Fitch $ANF ( ▲ 0.53% ), *Alibaba $BABA ( ▲ 0.12% ), *Kohl's $KSS ( ▼ 2.49% ), Petco $WOOF ( ▼ 0.39% )

*Best Buy $BBY ( ▼ 2.75% ) - $1.31 EPS (+4% YoY) on $9.59B revenue (+1.5% YoY)

Dell Technologies - $2.48 EPS (+15.3% YoY) on $27.3B revenue (+12.9% YoY)

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way.

And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential). He warns if you wait any longer, you could get priced out.

HEADLINES

Alphabet, chip stocks lead tech-fueled market rebound (more)

Trump, Xi speak for first time since trade truce (more)

Morgan Stanley’s Wilson sees US stock pullback coming to an end (more)

Big Tech’s AI debt wave threatening to swamp credit markets (more)

Gold advances as traders bet on December rate cut, await US data (more)

Tech companies tap debt markets to fund AI and cloud expansion (more)

Jony Ive, Sam Altman: OpenAI plans elegantly simple device (more)

Tesla stock pops as Melius calls it 'must own' (more)

Apple cuts jobs across its sales organization in rare layoff (more)

'Big Short' Burry targets AI boom with new blog after hedge fund closure (more)

Anthropic unveils new AI model, Claude Opus 4.5, following $350B valuation (more)

OpenAI announces shopping research tool in latest e-commerce push (more)

Billionaires bankroll San Francisco comeback one party at a time (more)

DEALFLOW

M+A | Investments

Broadcast giant Sinclair makes bid to buy out EW Scripps for $7 per share

Wesco Group to acquire National Coatings & Supplies

Pangea, travel-tech/social-platform company, acquired Overlap

VC

Kalshi, a predictions-market platform, raised $1 billion in funding at an $11B valuation

CookUnity, a chef-to-consumer meal-delivery platform, received $250M from General Catalyst

Dayra Therapeutics, a startup focused on developing oral macrocyclic peptides, received over $70M in committed funding

Sortera, an aluminum-sorting company applying AI analytics to recycling, raised $45M in funding

Tidalwave, an agentic AI-powered mortgage point-of-sale platform, raised $22M in Series A funding

Opti, an AI identity-security platform provider, raised $20M in Seed funding

NetFoundry, a Zero Trust networking-platform provider, received investment from Cisco and raised $15M in Series A funding

Cordance Medical, a med-tech company leveraging ultrasound technology for brain-disease treatment, raised $8M in Seed funding

Maritime Fusion, a fusion-energy company developing reactors for maritime and off-grid applications, raised $4.5M in Seed funding

Interface, an AI-powered industrial safety platform, raised $3.5M in Seed funding

CRYPTO

BULLISH BITES

😬 Why crypto’s slide is rattling Wall Street.

🇺🇸 The ‘S&P 493’ reveals a very different US economy.

🦈 Why college students prefer News Daddy over The New York Times.

🦃 The global struggle to master the Turkey Dinner.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.