Good morning.

The Fast Five → Powell heads for ‘hyper-charged’ hearings, Gold punches through historic high toward $3k, steel and aluminum tariffs are official, Grayscale files for a Cardano ETF, and US Treasury will stop minting pennies…

The DOGE Agenda (nine stocks to buy)

Every investor in America is trying to figure out what Musk will do in Washington, D.C. in the coming weeks. Here’s our take…

-from Altimetry

Calendar: (all times ET) - Full Calendar

Today:

Fed Chair Powell testifies to Congress, 10:00A

Tomorrow:

Consumer Price Index (CPI), 8:30A

Your 5-minute briefing for Tuesday, February 11:

US Investor % Bullish Sentiment:

↓ 33.33% for Week of February 06 2025

Previous week: 40.96%. Updates every Friday.

THE ELON SHOCK: All of Elon Musk’s strange behavior may soon make sense… and impact the markets in a way no one’s expect. Full story here »

- from Altimetry

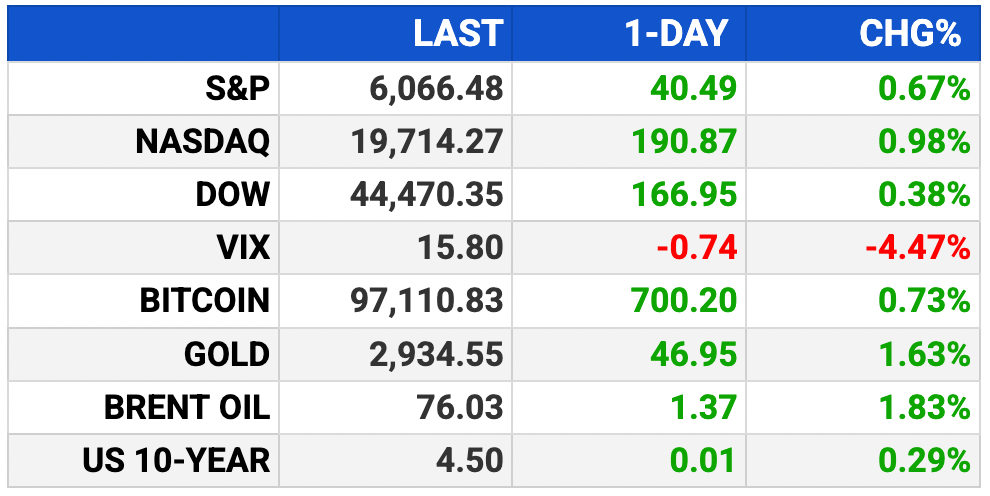

Market Wrap:

Futures flat Monday night ahead of key inflation data.

Dow -26 pts, S&P/Nasdaq -0.1%.

Nasdaq +1% Monday, led by Nvidia (+2.9%) and Micron (+3.9%).

Trump signed 25% steel tariff, lifting Cleveland Cliffs (+18%) and Nucor (+5%).

Today: Powell testifies before Congress; CPI, PPI data ahead;

EARNINGS

Here’s what we’re watching this week:

HEADLINES

Tech lifts Wall Street, steelmakers climb on Trump tariff threat (more)

Trump officially imposes global 25% steel, aluminum tariffs (more)

Copper price premium soars to record after Trump tariff moves (more)

Bond traders waver as Trump questions US government debt figures (more)

Credit quants target bulk trades to conquer $8T market (more)

Oil prices climb despite trade war concerns (more)

China frees possible $27 billion from insurers to buy gold (more)

Meta starts eliminating jobs in a shift to find AI talent (more)

McDonald’s revenue disappoints as sales see worst drop since pandemic (more)

OpenAI is set to finalize its first custom chip design this year (more)

US eased enforcement of law banning US firms from bribing foreigners (more)

Treasury to halt minting pennies to cut waste (more)

IN PARTNERSHIP WITH AI CAPITAL NEWS

Smart Investors Are Betting On A.I. Stocks—Are You?

Experts say Trump’s $500B A.I. investment plan could transform the industry.

Meanwhile, a small but ambitious A.I. healthcare company just went public after eight years of innovation, securing $18M in funding and partnering with industry giants.

With a $120M market cap and shares still under $2, this stock may not stay cheap for long.

DEALFLOW

M+A | Investments

Plaid is said to tap Goldman Sachs for share sale (sale)

Hyatt to buy Caribbean resort owner Playa for $2.6B (more)

Merck in advanced talks to acquire biotech firm Springworks (more)

Cotiviti, a company specializing in data-driven healthcare solutions, acquired Edifecs, a healthcare data interoperability company (more)

Validus Risk Management, a services platform for financial risk management, received a $45M Growth equity investment from FTV Capital (more)

VC

75F, a company specializing in IoT and AI-driven commercial HVAC automation, raised add’l $45M in Series B funding (more)

Lynx, a fintech platform for healthcare payments and administration, raised $27M in Series A funding (more)

Epicore Biosystems, a digital health solutions company developing advanced sweat-sensing wearables, raised $26M in Series B funding (more)

Boostly, a provider of automated SMS marketing and feedback solutions for restaurants, raised $22M in Series A funding (more)

Greyson Clothiers, a performance apparel brand for sport, raised $20M in Series A funding (more)

Clean Core Thorium Energy, a nuclear fuel company, raised $15.5M in Seed funding (more)

Reservoir, a crypto startup, raised $14M in Series A funding (more)

Nirmata, a cloud-native security policy automation and governance solutions company, raised $9.6M in funding (more)

Fifteenth, a tax solution company, raised $8.25M in Seed funding (more)

Edacious, a multi-disciplinary tech company specializing in the relationship between agriculture and human health, raised $8.1M in Seed funding (more)

Crowded, a fintech platform specializing in financial management for nonprofit organizations, raised $7.5M in Series A funding (more)

&AI, an AI agent for patent attorneys, raised $6.5M seed funding (more)

DevAI, a company building agentic AI solutions for enterprise IT teams, raised $6M in Seed funding (more)

Questal, an owner and operator of financial wellness service provider Questis, raised $3.2M in Seed funding (more)

Self Inspection, an AI-powered platform for the automotive inspections market, closed a $3M seed funding round (more)

Centerseat, a physical security compliance company, raised $2.7M in Seed funding (more)

InvestNext, a real estate investment management platform, raised an undisclosed amount in Series B funding (more)

CRYPTO

BULLISH BITES

🚨 Elon Musk may not be as unpredictable as you think. See what one investing expert claims is his next move *

😎 Trump’s tariffs make currency trading cool again after years of decline.

💰 The investor betting on people in their 50s and 60s—because older is better.

🦄 VCs don’t start unicorns: The No.1 lesson from Andreessen Horowitz.

🎉 Memecoin pumps are just for fun.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.