☕️ Good morning.

The Fast Five → Investors see 2024 as transition year to new economic order, Barclays downgrades Apple, Harvard’s president Claudine Gay resigns - read resignation letter, JP Morgan shares hit record high, and Congress heads into funding fight as US debt tops $34 trillion…

Here’s your 5-minute briefing for Wednesday:

BEFORE THE OPEN

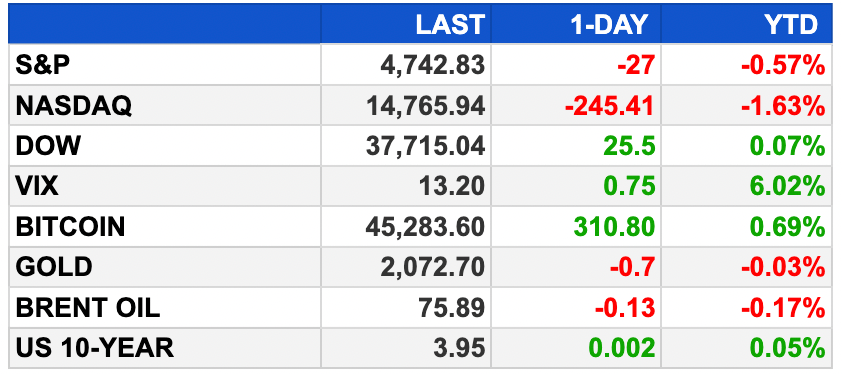

As of market close 1/2/2024.

MARKETS:

Stock futures stable after Nasdaq's weak session.

Bloomin' Brands gains over 5% in after-hours trading.

S&P 500 starts the year down 0.6%.

Nasdaq drops 1.6% with Apple's decline and tech stocks' slump.

AI beneficiaries Nvidia and AMD down, VanEck Semiconductor ETF drops.

Short-term correction expected, but long-term outlook positive.

Markets rebounded in 2023 with easing inflation and rate cut hopes.

Fed's December meeting minutes and economic data to watch for further insights.

EARNINGS

What we’re watching this week:

Thursday: Conagra (CAG), Lindsay Corp (LNN)

Walgreens Boots Alliance (WBA) - expected: $.63 per share (-45.7% YoY) on $34.9 billion revenue (+4.5% YoY)

Friday:

Constellation Brands (STZ) - expected: $3.00 per share (+6.0% YoY) on $2.5 billion revenue (+4.2% YoY)

Full earnings calendar here

HEADLINES

Dollar kicks off 2024 with best day since March on Fed doubt (more)

2024 will be 'Year of AI' as tech stocks surge up to 33%, Wedbush says (more)

US public debt tops $34 trillion as Congress heads into funding fight (more)

Harvard’s President Claudine Gay to resign after controversy (more)

Read Gay’s resignation letter (more)

Global shipping firms continue to pause Red Sea shipments (more)

US pressured Netherlands to block China-bound chip machinery (more)

Tesla reports record 485K deliveries for Q4; hits 1.8 million annual delivery goal (more)

China’s BYD overtakes Tesla as world’s biggest electric vehicle seller (more)

ASML blocked from shipping some of its critical chipmaking tools to China (more)

Fidelity marks down X valuation by 71.5% (more)

Michael Saylor commences plan to sell $216M worth of MicroStrategy stock options (more)

Moderna stock pops after Oppenheimer says company could launch more products over next two years (more)

JPMorgan shares climb to record high (more)

More customers cancel their streaming services as companies like Netflix, Amazon, and Disney hike prices (more)

Dealmakers go half steam ahead to M&A recovery (more)

TOGETHER WITH BEHIND THE MARKETS

Biden’s biggest mistake

On February 27, 2023, Joe Biden made a decision that could cost the U.S. government $9 trillion dollars...and cut the living standards of American citizens by 25%.

How you handle this situation will be one of the most important financial decisions you ever make.

~ please support our sponsors ~

DEALFLOW

M & A | INVESTMENTS

Carlyle’s Gabon asset sale at risk as Junta decides to take over (more)

Gemspring-backed Amplix acquires Go2 (more)

Fourshoe Partners purchases Power Funding (more)

Kimco Realty buys RPT Realty (more)

Platinum Equity purchases Horizon Organic and Wallaby (more)

DayDayCook buys Yai’s Thai (more)

Dish merges with EchoStar, buying time for Ergen’s mobile empire (more)

Ara Partners acquires majority interest in USD clean fuels (more)

VC

IPO

KKR-backed BrightSpring is first to file in 2024 for big IPO (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

Bitcoin spot ETF anticipation boosts BTC price to nearly $46K in strong start to 2024 (more)

Jim Cramer capitulates on Bitcoin: 'Technological marvel … it's here to stay' (more)

BlackRock delays $10 million Bitcoin purchase, new date unveiled (more)

Bankman-Fried won’t face second trial on remaining charges (more)

Puma is sticking to its web3 bets as crypto shakes off a long-held winter (more)

BULLISH BITES

🐭 For grabs? Welcome to the public domain, Mickey Mouse.

🎻 Orchestrated: A plan was hatched to make the football player “as famous as the Rock.” Meet the duo who brought you Travis Kelce.

🏸 Old is new: Grandpacore, groovy weddings, badminton and jazz — get ahead of 2024 trends.

❌ C’est la vie: Will 2024 mark the end of the 'Digital Agency'?

💰 Behind The Markets: Last February Biden made a decision that could cost the U.S. government $9 trillion dollars and cut America's living standards by 25%. Get the full story here…

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.