☕️ Good Morning.

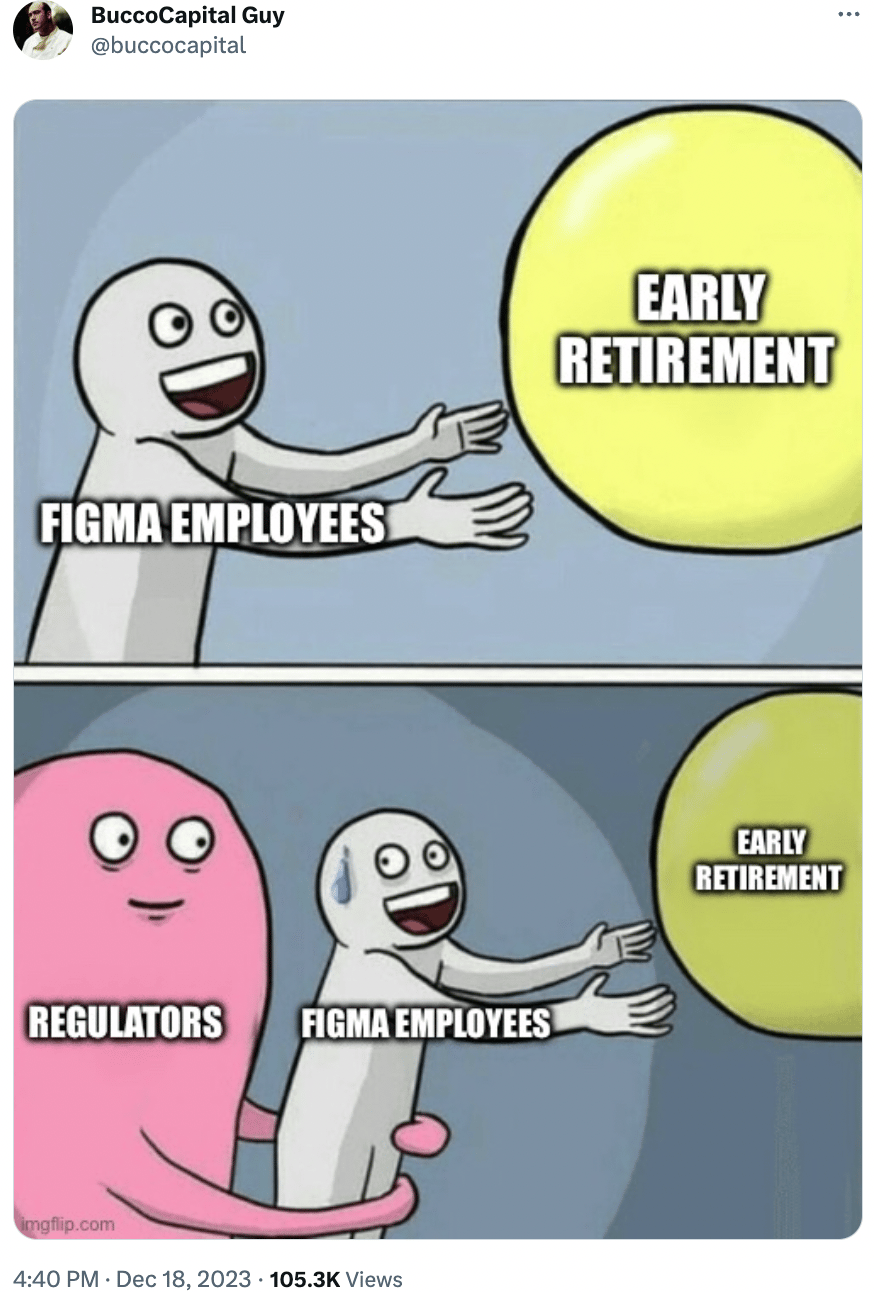

The Fast Five → Apple plans rescue for $17 billion watch business facing ban, Adobe and Figma call off $20 billion acquisition, Fed’s Goolsbee says he was ‘confused’ by last week’s market reaction, antitrust regulators issue new merger rules amid crackdown, and Nikola founder sentenced to four years in prison for fraud…

Here’s your 5-min briefing for Tuesday:

BEFORE THE OPEN

As of market close 12/18/2023.

MARKETS:

Stock futures nearly flat after previous session's gains.

Dow futures dip 22 points (-0.06%), S&P 500 futures and Nasdaq-100 futures slightly lower.

Recent rally fueled by Fed's hint at 2024 rate cuts, cooling inflation, and lower Treasury yields.

S&P 500 just 1.2% away from its all-time closing high.

December on track for gains, with S&P 500 up 3.8%, Nasdaq up 4.8%, and Dow up 3.8%.

Light economic data and earnings week ahead; focus on building permits, housing starts, and FedEx earnings.

Atlanta Fed President Raphael Bostic scheduled to speak.

Fed’s Goolsbee says he was ‘confused’ by last week’s market reaction (more)

Global supply chain under threat after militant attacks in the Red Sea (more)

Antitrust regulators issue new merger rules amid crackdown (more)

Long-dated US Treasury bonds are now in bull market (more)

US Dollar sideways with Fed warning markets they are wrong (more)

Mega-cap tech leads US stocks higher as Dow Jones hits another record high (more)

Homebuilder sentiment rises more than expected as mortgage rates fall (more)

BOJ avoids rate hike signal as it stands pat, driving Yen lower (more)

Dealmakers to miss $3 trillion mark for first time in 10 years (more)

Goldman Sachs faces rocky exit from Apple credit card partnership (more)

Nikola founder Trevor Milton sentenced to four years in prison for fraud (more)

Amazon is spending $10 billion in challenge to Musk's Starlink (more)

Google to pay $700 million to U.S. consumers, states in Play store settlement (more)

Hindenburg’s Adani, Icahn calls mark year of prominent bets (more)

OpenAI is giving its board veto powers over Sam Altman (more)

TOGETHER WITH IBD’s MARKETSMITH

The most powerful platform available

Some call it the ‘affordable’ Bloomberg Terminal.

With IBD’s MarketSmith, you'll have access to the same resources and insights as a professional stock market analyst, but at a fraction of the cost. MarketSmith allows you to streamline your research by consolidating all of the information you need into a single window.

Get smarter trade ideas, analyze them quickly and see when to buy and sell, all in one platform.

🔥 MarketBriefing Exclusive → Get 6-Weeks for just $49.95 (that’s HALF-OFF the regular price!) — so if you’ve ever wanted to test-drive MarketSmith, now is your chance! (limited-time offer)

DEALFLOW

M & A | INVESTMENTS:

Amazon, Diamond Sports discussing potential streaming deal (more)

US Steel agrees to takeover by Japan's Nippon Steel (more)

ERP Logic, an SAP and cloud solutions provider, has been rebranded as Nobl Q and has acquired Jeevan Technologies, an IT services and consulting company with a significant presence in the US (more)

Coupang, Inc. (NYSE: CPNG), a global retailer, announced plans to acquire the business and assets of Farfetch Holdings plc, a UK-based online luxury company (more)

1440 Foods, a portfolio of sports and active nutrition brands, received an investment from Bain Capital Private Equity, in partnership with existing investor and operator 4×4 Capital (more)

Chipotle Mexican Grill (NYSE: CMG) is investing in Greenfield Robotics, a regenerative farming company leveraging the latest advances in AI, robotics, and sensing technologies (more)

Chipotle Mexican Grill is investing in Nitricity, a company seeking to tackle greenhouse gas emissions by creating fertilizer products that are better for fields, farmers, and the environment (more)

Xcellerant Ventures invested in Lenoss Medical, a provider of an innovative system for the treatment of spinal fractures (more)

Samyang buys Verdant Specialty Solutions from OpenGate Capital (more)

TPG buys stake in Canadian Warehouses from Oxford for $750M (more)

Clearlake, Insight buy Alteryx for $4.4B (more)

Masonite acquires PGT Innovations (more)

Kinzie Capital Partners’ GT Golf purchases ProActive Sports (more)

Audax invests in Dobbs Tire & Auto Centers (more)

IBM buys two software AG data platforms for $2.3B (more)

OceanSound-backed RMA Companies buys Rone Engineering (more)

Yellow Wood Partners acquires Elida Beauty from Unilever (more)

VC

Lingrove, a composite materials company, raised $10M in funding (more)

Strike Graph, a Trust Operations platform for operating and measuring security & compliance, raised $8.5M in funding (more)

Biorithm, a women’s health medtech company, raised $3.5M in Series A funding (more)

Aether Fuels, an advanced climate technology company, raised $8.5M in pre-Series A financing via convertible notes (more)

/Reach, a social-fi innovation company to ‘fix Crypto Twitter’, raised $1M in seed funding on chain in less than 24 hours (more)

KAID Health, a maker of the artificial intelligence-enabled Whole Chart Analysis platform, raised an undisclosed amount in funding (more)

FUNDRAISING:

Pivotal Life Sciences, a global investment firm dedicated to investing in companies involved in healthcare innovation seeking to improve patient outcomes, closed Pivotal bioVenture Partners Fund II, at $389M (more)

Turnspire Capital Partners closed Turnspire Value Fund II, L.P. , at $275M in capital commitments (more)

Argonaut Private Equity closes Fifth Fund at $500M (more)

Turnspire closes Fund II at $275M (more)

DEBT | RESTRUCTURING:

Equinox seeks $1.3 billion from private credit for refinancing (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🕺 Watch: Dancing Iranian taxi driver becomes unlikely symbol of resistance.

🎁 Last minute: Gifts you can get at... the grocery store.

🎅🏻 Pitch deck: Some kids are getting more sophisticated with their Christmas lists, creating a vibe that’s more sales pitch than Santa.

🍺 Beer to Bitcoin: The 'most interesting man in the world' of Dos Equis fame is now the face of a Bitcoin ETF provider.

💎 Man-made: That diamond in your Christmas stocking might have been grown in a lab.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team