Good morning.

The Fast Five → Powell says Fed has time to assess data before cut decisions, Apple explores home robotics as ‘next big thing’, US economy continues to shine, Gold plows to another record high, and Spotify is raising prices again…

Calendar: (all times ET)

Today: | Jobless claims, 8:30am |

FRI 4/5: | Unemployment rate, 8:30am |

Your 5-minute briefing for Thursday, April 4:

US Investor % Bullish Sentiment:

50.00% for Wk of Mar 28 2024 (Last week: 43.20%)

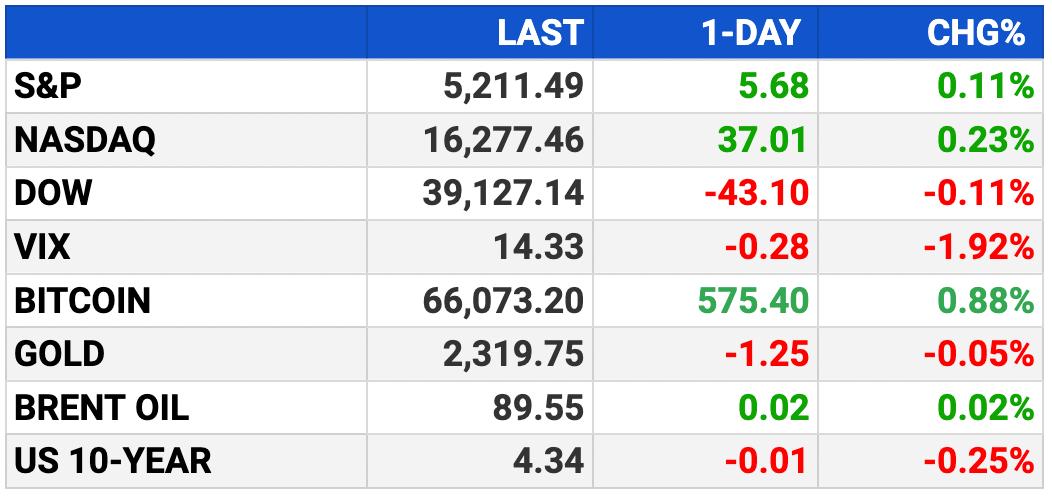

Market Recap:

U.S. stock futures flat Wednesday night

Dow slightly up, S&P 500, Nasdaq barely budged

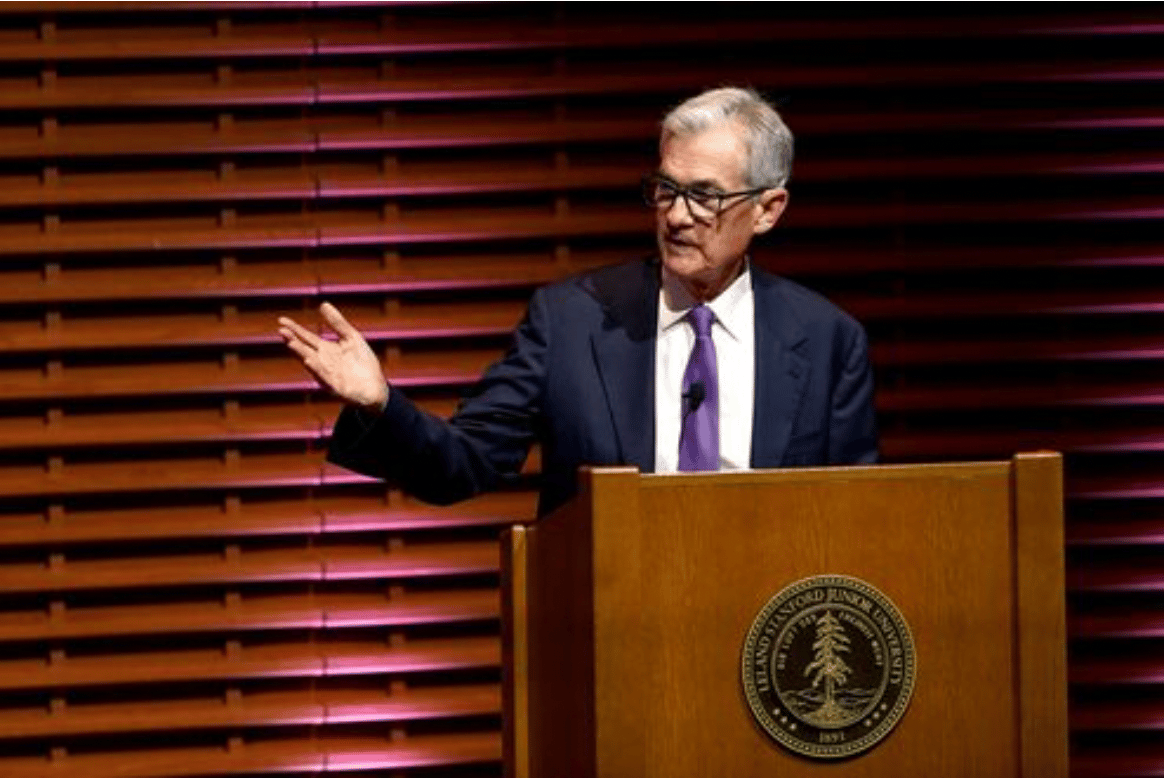

Powell's cautious stance on rates damps market

Fed cuts expectations drop to 62.3% for June

ADP's strong job data spooks investors

10-year Treasury note briefly tops 4.4%

Market shows signs of "bullish rotation."

Today: Jobless claims, trade deficit data

EARNINGS

What we’re watching this week:

Lamb Weston (LW) - earnings of $1.46 per share for fiscal Q3. Revenue expected to rise 31% to $1.7 billion.

Full earnings calendar here

HEADLINES

US economy continues to shine with help from consumers, labor market (more)

Bonds get some relief from Powell’s deja-vu tone (more)

Gold plows to record high after Powell's remarks (more)

US Oil is stealing market share from OPEC (more)

Asian stocks to rise as Powell reaffirms rate cuts (more)

Citigroup sees ‘exciting market’ for Japan bonds after BOJ move (more)

EU launches competition probes into Chinese solar panel firms (more)

Tesla’s shrinking China market share compounds global woes (more)

Multiple Apple services down for users (more)

Google plans to charge for AI-powered search engine (more)

Spotify is raising prices again (more)

Musk says he’s boosting Tesla pay to stop OpenAI from poaching (more)

VC’s are still largely on the sidelines despite gen AI hype (more)

A MESSAGE FROM OUR PARTNER

FDA Approval Could Send This Stock Up 46,751%

Whenever the FDA approves a new drug...

Timely investors could see 300-400% returns overnight...

CCXI returned 281% to investors in one day...

Relmada shot up 971% in 9 months...

Agile soared 305% in 5 months...

- please support our sponsors -

DEALFLOW

M+A | Investments

Paramount, Skydance said to enter exclusive merger talks (more)

Endeavor Group agrees to $13B buyout from Silver Lake (more)

BlackRock, KKR sell Adnoc Oil Pipeline stake back to Abu Dhabi (more)

Blue Owl to buy Kuvare Asset Management for insurance push (more)

Clariant acquires Lucas Meyer Cosmetics for $810M (more)

PE firm CD&R to buy IT company Presidio from BC Partners (more)

PE firm EQT agrees to buy software maker Avetta from Welsh Carson (more)

Italy's Azimut to sell full stake in investment group Kennedy Lewis for $225M (more)

Broad Sky Partners buys Punctual Pros (more)

Creative Planning acquires ML&R Wealth Management (more)

ServiceTitan, a software platform built to empower trades, acquired Convex, a provider of a sales and marketing platform purpose-built for the commercial services industry (more)

Colohouse, a player in the cloud, hosting, and network services sector, acquires Hivelocity, a provider of bare metal hosting (more)

NFL helmet maker Riddell gets $400M from BC Partners (more)

Yellow Pages owner seeks $350M of private credit (more)

Accel-KKR invests in Aico (more)

Summit Partners invests in Netgain (more)

VC

Obsidian Therapeutics, a clinical-stage biotechnology company, raised $160.5M in Series C funding (more)

Alsym Energy, a developer of non-flammable rechargeable batteries for stationary storage, raised $78M in funding (more)

Homebase, a company providing an HR and team management app, raised $60M in Series D funding (more)

HawkEye 360, a provider of space-based RF data and analytics, received $40M in debt financing from Silicon Valley Bank (more)

Netgain, a provider of software for finance and accounting teams, raised $35M in funding (more)

actnano, a company specializing in surface protection technologies for automotive, consumer, and industrial electronics, raised $30M in funding (more)

Biofidelity, a genomic technology company, raised $24M in funding (more)

Medcura, a developer of hemostatic products for use in surgery, closed a $22.4M in convertible debt (more)

Oros Labs, a thermal solutions company, raised $22M in Series B funding (more)

Datavolo, a company which specializes in multimodal data pipelines for AI, raised over $21M in funding (more)

Miach Orthopaedics, a company transforming the treatment of ACL tears from reconstruction to restoration with the BEAR® Implant, raised $20M in Series B funding (more)

Permiso, a threat detection company, raised $18M in Series A funding (more)

dappOS, an intent execution network operator, raised $15.3M in Series A funding, at a $300M valuation (more)

Raven SR, a renewable fuels company, raised $15M in funding (more)

Nucleai, a spatial AI biomarker company, raised $14M in funding (more)

Agora, a provider of a digital dollar (aka stablecoin), raised $12M in Seed funding (more)

Allure Security, an online brand protection-as-a-service company, raised $10M in Series A funding (more)

NobleAI, a company specializing in science-based AI solutions, raised over $10M in Series A extension funding (more)

Higgsfield AI, a startup focused on democratizing social media video creation, raised $8M in seed funding (more)

TrojAI, a provider of enterprise AI security solutions, raised $5.75M in Seed funding (more)

Home From College, a provider of a career platform, raised $5.4M in funding (more)

Delivery Collective, provider of a merchant-first delivery infrastructure, raised $3.8M in funding (more)

Conformation-X Therapeutics, an immune-oncology focused drug development company, raised a further tranche of $3.65M (more)

Gesture, a gifting and delivery platform, received a growth funding package from Decathlon Capital Partners (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

🤖 Rundown: YC’s Winter 2024 Demo Day confirms that we are indeed in an AI bubble.

🫡 Tech pledge wanted: Billie Eilish, Nicki Minaj, Stevie Wonder and more musicians demand protection against AI.

🚗🚙 Decisions, decisions: Understanding the slow and messy switch to electric cars.

📟 Next-level: Welcome to the AI gadget era.

🔥 In case you missed it… Experience MarketSurge for FREE thru Sunday - No Credit Card Required. Don’t miss this chance to explore premium market insights and tools — try it now » (grab your chance before it expires!)

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.