☕️ Good Morning.

The Fast Five → Watch Apple event live here (10a PT / 1p ET), Arm’s IPO orders already oversubscribed 10x, Huawei releases 5G foldable phone ahead of today’s Apple event, Instacart slashes valuation, and Jamie Dimon slams stricter capital rules…

Here’s your MarketBriefing for Tuesday:

BEFORE THE OPEN

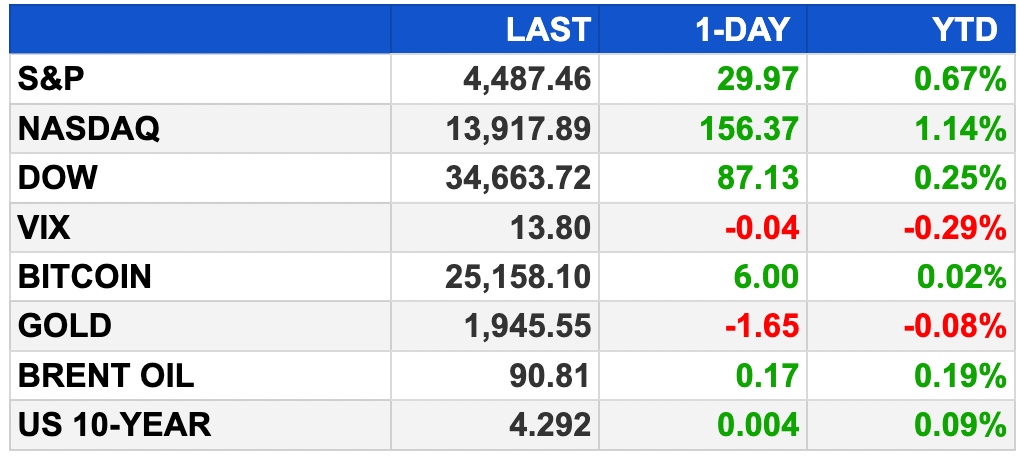

As of market close 9/11/2023.

MARKETS:

Stock futures dip after positive Wall Street day

Dow Jones down 0.1%, shedding 30 points

S&P 500 and Nasdaq 100 futures slip 0.1%

Oracle stock falls 9% in extended trading, missing revenue but beating earnings

Nasdaq leads, up 1.1%; S&P 500 and Dow gain 0.7% and 0.3%

Tesla surges 10% on Morgan Stanley upgrade

Qualcomm rises 4%, securing 5G modem deal with Apple

Investors watch small business data today

Focus on upcoming inflation data: CPI (Wed.) and PPI (Thur.)

Fed's policy meeting next week, 93% consensus on steady rates

Wall Street Journal reports Fed consensus against rate hike this month

NEWS BRIEFING

Arm will close its order book a day early on Tuesday. The IPO could be oversubscribed by up to 15 times by Wednesday.

G20 summit agrees on words but struggles on action (more)

Key takeaways from the 2023 G20 summit in New Delhi (more)

Yellen ‘feeling very good’ about soft landing for US economy (more)

The mighty American consumer is about to hit a wall, investors say (more)

US, Vietnam firms talk business during Biden visit; AI and Boeing deals unveiled (more)

Instacart IPO Slashes Valuation to $9.3 Billion (more)

Instacart clarifies its Snowflake payments in updated IPO prospectus after clash with Databricks (more)

Google’s ties with Apple under spotlight in antitrust trial (more)

Google's rivals get day in court as momentous US antitrust trial begins (more)

JPMorgan CEO Jamie Dimon blasts draft US bank capital rules (more)

Just a 10-day UAW strike risks costing US economy $5.6 billion (more)

Disney, Charter reach distribution deal ahead of 'Monday Night Football' (more)

Tesla jumps as analyst predicts $600 bln value boost from Dojo (more)

Apple renews Qualcomm deal in sign its own modem chip isn’t ready (more)

Nvidia's dominance in AI chips deters funding for startups (more)

Google.org to invest $20M into AI-focused grants for think tanks and academic institutions (more)

JetBlue sheds more Spirit gates to ease antitrust concerns (more)

Popeyes overhauls its kitchens to win the chicken sandwich wars (more)

Tesla and China risk leaving Volkswagen on a road to nowhere (more)

FTX goes after celebrities for millions of dollars in promotional payments (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

Minority stake planned for Berlin in Thyssenkrupp's warship division - Handelsblatt (more)

Diamondback, Five Point Energy form water management joint venture (more)

Kingspan said to make rebuffed proposal for tie-up with Carlisle (more)

KKR to invest more than $1 billion in USI Insurance to become largest shareholder (more)

Ramsay, Sime Darby narrows bidders for $1.5 billion hospital sale (more)

Buffett spurs Sparx CEO to seek $2 Billion for engagement fund (more)

L Catterton nears deal for Japanese vet services firm Withmal (more)

Gryphon’s Aqua Dermatology partners with Sunrise Dermatology (more)

BlueWave, asolar developer, owner, and operator, raised $91M in financing (more)

DetraPel, a materials company that manufactures sustainable coatings, raised $7.6M in Series A funding (more)

Hadrius, a compliance company focused on relationship between firm and client, raised $2M in Seed funding (more)

Land, an electric mobility and battery manufacturer, raised an undisclosed amount in Series A funding (more)

M & A:

J.M. Smucker to buy Twinkies maker Hostess for $5.6 billion (more)

Cetera acquires Avantax (more)

Mill Rock-backed DRT Holdings buys CMC (more)

Anduril Industries, a defense technology company, acquired Blue Force Technologies, a developer of autonomous aircraft with an integrated aerostructures division (more)

Logility, a company specializing in prescriptive supply chain planning solutions, acquired Garvis, a SaaS startup that combines large language models (ChatGPT) with AI-native demand forecasting (more)

Collibra, a data Intelligence company, acquired Husprey, a provider of an integrated SQL data notebook platform (more)

Ripple, a provider of enterprise blockchain and crypto solutions, is to acquire Fortress Trust, a provider of licensed Web3 financial, regulatory and technology infrastructure for blockchain innovators (more)

CRYPTO

BULLISH BITES

☕️ How Luckin Coffee Overtook Starbucks as the Largest Coffee Chain in China

Founded in 2017, Luckin Coffee burst onto the Chinese coffee scene to challenge Starbucks through affordable coffee options and mobile ordering. In June, Luckin Coffee hit 10,000 stores in China surpassing Starbucks as the largest coffee chain brand in the country. → CNBC

🎧 Audio: Instacart, Klaviyo and the Art of the Unicorn Haircut → TechCrunch

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb