Good morning.

The Fast Five → ‘Ugly’ technicals put the rally at risk of correction, Bitcoin’s drop flashes warning sign for stocks, Trump's tariffs hit the global economy, Amazon raises $15B in first US bond sale in 3 years, and Apple intensifies succession planning for Tim Cook…

📌 Wall Street Legend: ”Trump Tariffs Will Accelerate the Greatest Wealth Transfer in History”— A financial insider with decades on Wall St. has released a controversial video from his oceanfront estate. He reveals the unseen connection between Trump's economic vision and a tech revolution silently reshaping America. This hidden synergy is creating both unprecedented wealth and poverty. What can you do about it? Click here to see » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

none watched

Tomorrow:

FOMC Meeting Minutes, 2:00P

Your 5-minute briefing for Tuesday, Nov 18:

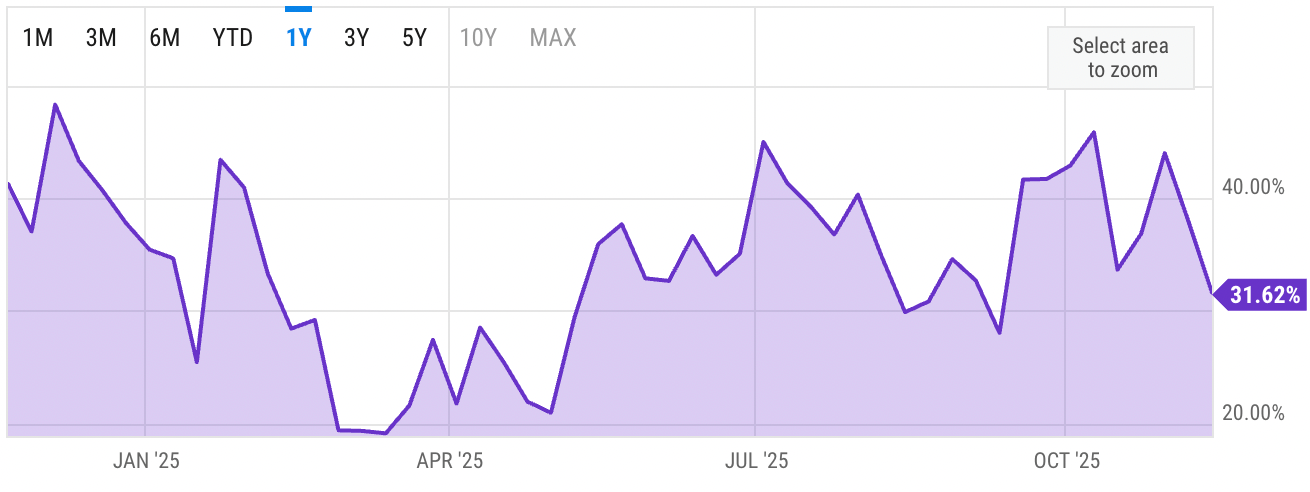

US Investor % Bullish Sentiment:

↓31.62% for Week of NOV 13 2025

Previous week: 37.97%

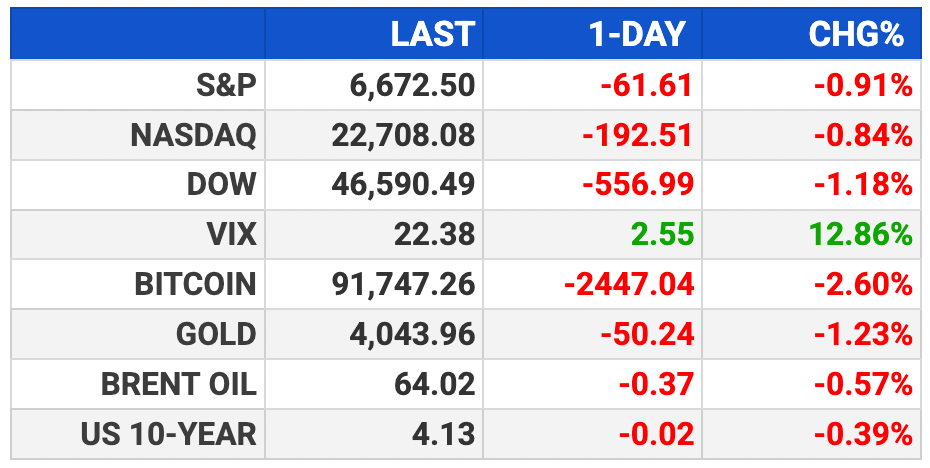

Market Wrap:

Futures flat: Dow +52 (0.1%), S&P +0.1%, Nasdaq +0.2%.

Stocks fell Monday: Dow -550 (-1.2%), S&P -0.9%, Nasdaq -0.9%.

Nvidia -2% ahead of Wed. earnings; AI trade under scrutiny.

Tech weakness: valuation, debt, and chip-cycle fears.

Nasdaq tracking to end 7-mo win streak; S&P -2.5% in Nov.

Fed cut odds drop to 40%; minutes and delayed jobs data due midweek.

Walmart, Home Depot, Target to report — key read on consumer health.

EARNINGS

Here’s what we’re watching this week:

Today: *Baidu $BIDU ( ▼ 0.91% ), *Home Depot $HD ( ▲ 0.97% )

WED: *Lowe’s $LOW ( ▲ 0.78% ), Target $TGT ( ▲ 0.89% )

Nvidia $NVDA ( ▲ 1.02% ) - earnings of $.98 per share (+7.7%) on $14.8B revenue (+7.2%)

THU: Gap $GAP ( ▲ 1.95% ), Ross Stores $ROST ( ▲ 0.53% ), Webull $BULL ( ▼ 0.84% )

*Walmart $WMT ( ▼ 1.51% ) - EPS of $.60 (+3.4% YoY) on $175.14B revenue (+4.3% YoY)

The window for preparation isn't just closing —

It's slamming shut.

What I've uncovered about the true impact of President Trump's tariffs and DOGE initiative has left me deeply troubled.

As someone who worked inside the Federal Reserve system and managed billions for America's wealthiest families, I recognize the warning signs others miss. I urge you to see my urgent message immediately. The window for preparation isn't just closing — it's slamming shut.

- a message from InvestorPlace Digest -

HEADLINES

Market rout intensifies, sweeping up everything from tech to crypto to gold (more)

Stock market sell-offs seem less enticing to retail investors (more)

Trump's tariffs hit the global economy (more)

Trump promises $2,000 tariff checks by mid-2026 (more)

Gold declines for fourth day as rate-cut expectations weaken (more)

Goldman sees oil prices falling through 2026 on supply surge (more)

Huang’s ‘half a trillion’ Nvidia forecast will come up at Q3 earnings (more)

Arm custom chips get a boost with Nvidia partnership (more)

Peter Thiel’s hedge fund dumps Nvidia stake, cuts back Tesla position (more)

Apple intensifies succession planning for CEO Tim Cook (more)

Amazon raises $15B in first US bond sale in three years (more)

Ford taps Amazon to let shoppers buy its used cars online (more)

Strategy makes $835M Bitcoin bet, largest since July (more)

DEALFLOW

M+A | Investments

SoftBank’s $6.5B Ampere deal receives final FTC approval

CD&R to acquire Sealed Air in $6.2B take-private deal

Sinclair Broadcast Group took an 8.2% stake in E.W. Scripps Company

Cantor Fitzgerald to acquire UBS O’Connor hedge fund unit

VC

Alembic Technologies raises $145M in Series B funding

Solve Therapeutics raises $120M in upsized funding

Gridware, a grid-technology company, raised $55M in Growth funding

PowerLattice, a company improving power delivery for AI accelerators, raised $25M in Series A funding

Span, an AI-native developer intelligence platform, raised $25M in Seed and Series A funding

Skeletalis, a drug development company focused on therapies for treating musculoskeletal diseases, raised $8M in funding

Shipday, a global delivery and logistics tech platform provider serving SMBs, raised $7M in Series A funding

AlertD, an agentic AI SRE and DevOps platform for cloud operations, raised US $3M in pre-Seed funding

No Barrier, a company specializing in AI-powered medical translation, raised $2.7M in Seed funding

TearOptix, a contact lens company developing solutions for patients with presbyopia, received strategic funding

Trump's Neighbor Reveals Truth Behind America's New Transformation

A mysterious financial figure — called "one of the most important money managers of our time" by national media — has issued a scathing economic warning. His controversial video exposes how an invisible force is rewriting the rules of wealth creation.

The question everyone's asking: Who dared to break ranks with the financial elite?

- a message from InvestorPlace Digest -

CRYPTO

BULLISH BITES

🤖 Meta is about to start grading workers on their AI skills.

🛠 How a first-year legal associate built one of Silicon Valley’s hottest startups.

⚾️ Dune of Dreams: Baseball league in Dubai begins with novel rules and camels.

😍 Bentley brings back the Supersports name.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.