Good morning.

The Fast Five → Powell says Fed not ‘in a hurry’ to reduce interest rates, stocks show signs of ‘getting tired’, Berkshire buys shares of Domino's -dumps more Apple, Capri and Tapestry abandon merger, and Amazon's telehealth push knocks Hims & Hers…

⚠️ New post-election stock warning from Wall Street

From Chaikin Analytics

Calendar: (all times ET) - Full calendar here

Today:

US retail sales, 8:30 am

Monday:

Home builder confidence index, 10:00 am

Your 5-minute briefing for Friday, November 15:

US Investor % Bullish Sentiment:

↑ 49.84% for Week of November 14 2024

Last week: 41.54%. Updates every Friday.

Market Wrap:

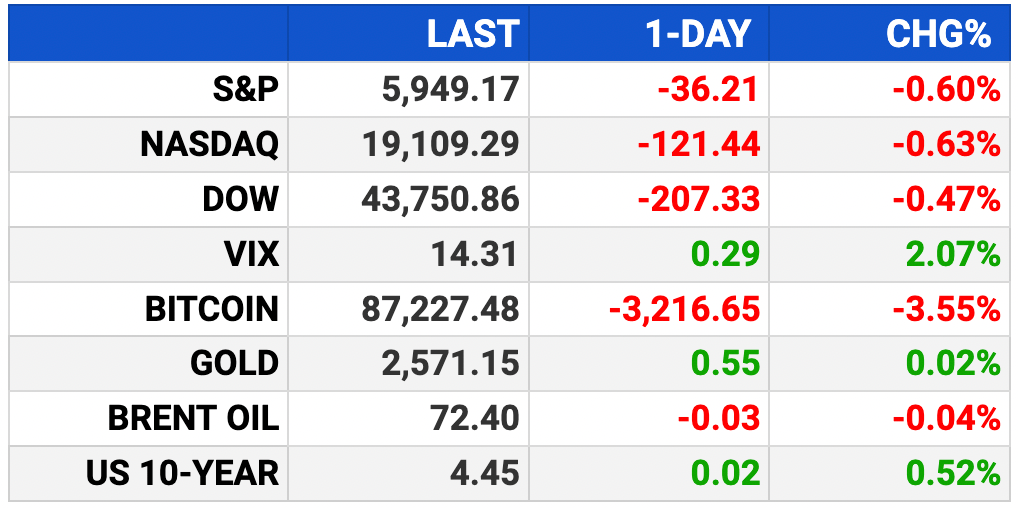

Futures: S&P dips 0.3%; Dow down 91 points, Nasdaq off 0.4%.

Major indexes fall: Dow -200+, S&P and Nasdaq -0.6%.

Applied Materials slides 5% on weak guidance; Domino’s jumps 7% on Berkshire stake.

Powell: no rush on rate cuts, markets react.

Friday's focus: retail sales, import prices, industrial production.

Alibaba reports earnings Friday.

EARNINGS

HEADLINES

Stocks Show Signs of ‘Getting Tired’ After Rally (more)

US weekly jobless claims fall; unemployment rolls shrink (more)

Rising US producer prices add to signs of waning disinflation (more)

Treasury yields slip from three-month high (more)

Oil dips on oversupply concerns, heads for weekly loss (more)

Dollar sits atop one-year peak as Powell sends yields up (more)

US money-market fund assets surpass $7 Trillion for first time (more)

Greenlight’s Einhorn says the markets are broken and getting worse (more)

Sen. Graham lobbying for investor Scott Bessent as US Treasury secretary (more)

Amazon's push into telehealth knocks shares of Hims & Hers (more)

Capri and Tapestry abandon plans to merge, citing regulatory hurdles (more)

Diamond Sports reaches key milestone toward exiting bankruptcy (more)

A MESSAGE FROM CHAIKIN ANALYTICS

New Post-Election Stock Warning from Wall Street

If you’re holding U.S. stocks, it may be time to brace for impact.

The S&P 500 crossed 6,000 for the first time in history...

Stocks are up 25% YTD... making 2024 the best presidential election year since 1936.

But according to 50-year Wall Street veteran Marc Chaikin... who's grown over 1 million followers around the world after working alongside George Soros, Steve Cohen, and Paul Tudor Jones...

And the consequences could hit investors long before Inauguration Day... perhaps even before the end of the year.

He told me,

"If you've underperformed this raging bull market, if you've lost money or missed out... this is it. Your final chance to move your money in 2024 - and get ready for the dramatic shift to come."

For the exact stocks to buy - and SELL - before Inauguration Day, click here.

Regards,

Kelly Brown

Senior Researcher, Chaikin Analytics

- sponsored message -

DEALFLOW

M+A | Investments

General Mills acquires Whitebridge Pet Food for $1.45 billion (more)

Cargotec to sell cargo business to Triton for over $500M (more)

Silverfort, an identity security company, announced the acquisition of Rezonate, an identity-first security provider for cloud environments (more)

Genesis Therapeutics, a company providing AI technologies to create medicines, announced an equity investment from NVIDIA's NVentures (more)

Agility Robotics, a company developing bipedal Mobile Manipulation Robot DigitⓇ, received a strategic investment from Schaeffler Group (more)

VC

Metsera, a clinical-stage biopharma company, raised $215M in Series B funding (more)

TRexBio, a biotech company decoding human tissue immune biology to create new therapeutics, raised $84M (more)

SwiftConnect, a network for connecting people to the right place at the right time, closed a $37M Series B financing (more)

Vaulted Deep, a biomass carbon removal and storage company, raised $32.3M in Series A funding (more)

Stepful, a company dedicated to empower healthcare training for allied health professional jobs, raised $31.5M in Series B funding (more)

Accelsius, a cooling systems company, raised $24M in Series A funding (more)

Homethrive, a provider of technology-enabled caregiving solutions, raised $20M in funding (more)

Partsol, a Cognitive AI developer of the proprietary Absolute Truth algorithms, raised $17.5M in funding (more)

Gitai, a space robotics startup, raised additional $15.5M in funding (more)

Impilo, a digital health platform, raised $11.5M in Series A funding (more)

Ecolectro, a green hydrogen tech company, raised $10.5M in Series A funding (more)

Influur, a professional networking platform for influencers, raised $10M in Series A funding (more)

Serenity, an AI-powered EHS software solutions, closed a $5.5M Series A funding round (more)

OneSkin, a biotech skin health brand, closed its Series A funding (more)

SurePath AI, a company specializing in governing gen AI for the enterprise, closed a $5.2M Seed funding (more)

Sunthetics, an AI tech company serving chemical and pharmaceutical companies, raised $4M in Seed funding (more)

High Basin Brands, a spirits company, raised $4M in Seed funding (more)

CRYPTO

BULLISH BITES

🚨 Investor Alert: Has the tech stock selloff finally arrived? *

💰 Grit Capital: Private equity finds yet another way to keep the money coming in.

🤯 Shocker: The Onion wins Alex Jones’ Infowars in bankruptcy auction.

🏀 Brava! Adidas signs first NIL deal with girls’ high school basketball player.

☠️ So Incline’d: Take the ‘death stairs’… if you dare.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.