Good morning.

The Fast Five → China insists no tariff talks are underway, Nvidia stock drops on report Huawei is developing rival AI chip, IBM plans to invest $150 billion domestically, Temu adds ‘import charges’ to goods, and the best (and worst) stocks during Trump's first 100 days…

Huge Energy Discovery in Utah

The Department of Energy says it could power America for millions of years.

And both grizzled oilmen and clean energy supporters love it: Energy Secretary Chris Wright called it "an awesome resource," while Warren Buffett, Jeff Bezos, Mark Zuckerberg, and Bill Gates are all directly invested.

Calendar: (all times ET) - Full Calendar

Today:

Advanced retail inventories, 8:30A

Advanced wholesale inventories, 8:30A

Consumer confidence, 10:00A

Job openings, 10:00A

Tomorrow:

PCE index, 8:30A

Your 5-minute briefing for Tuesday, April 29:

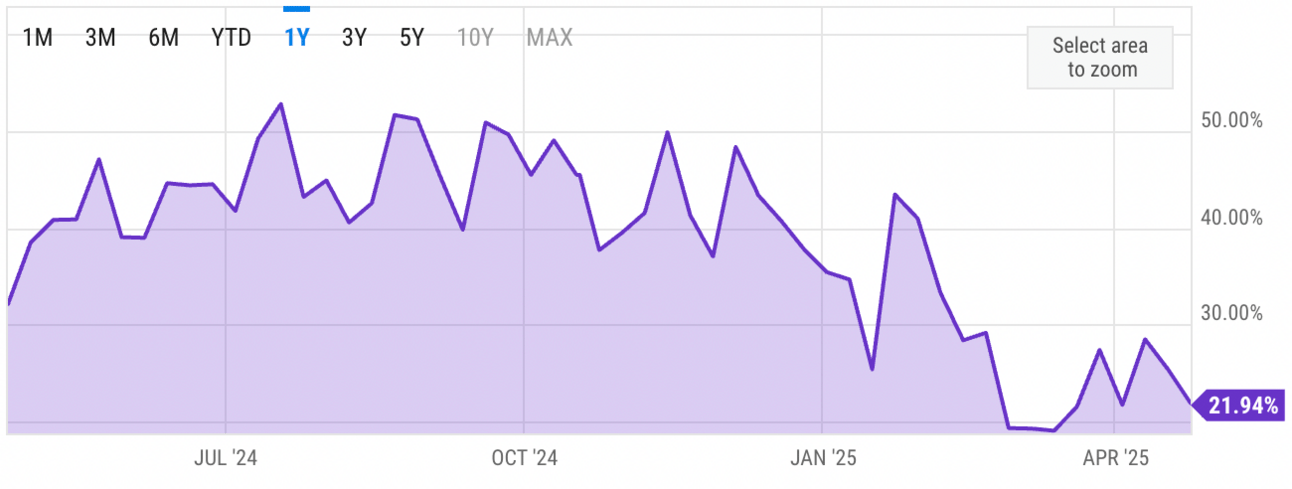

US Investor % Bullish Sentiment:

↓ 21.94% for Week of April 24 2025

Previous week: 24.44%. Updates every Friday.

Market Wrap:

S&P +0.1%, Dow +0.3%, Nasdaq -0.1%; S&P up 5 days straight.

AAPL, META +0.4%; MSFT -0.2%, AMZN -0.7% ahead of earnings.

Bessent: China must move first; U.S.-India trade deal likely soon.

April: S&P -1% MTD, Dow -4%, Nasdaq +0.4%.

Big week: GDP, inflation, and Friday’s jobs report.

EARNINGS

Big earnings week. We’ll be posting in two-day increments:

TODAY:

Coca-Cola $KO ( ▼ 0.84% )

General Motors $GM ( ▲ 0.49% )

JetBlue $JBLU ( ▼ 1.52% )

Pfizer $PFE ( ▲ 0.62% )

SoFi $SOFI ( ▲ 4.63% )

Snap $SNAP ( ▲ 2.52% )

Spotify $SPOT ( ▲ 2.44% )

Starbucks $SBUX ( ▼ 0.06% )

Visa $V ( ▼ 0.16% )

WEDNESDAY:

➤ Meta $META ( ▲ 0.45% ) - expected $5.20 eps (+10.4% YoY) on $41.4B revenue (+13.4% YoY)

Caterpillar $CAT ( ▲ 0.2% )

eBay $EBAY ( ▼ 2.23% )

Etsy $ETSY ( ▲ 0.04% )

Robinhood $HOOD ( ▼ 1.05% )

Yum! Brands $YUMC ( ▲ 2.57% )

SIGNAL | From OUR RESEARCH PARTNERS

Our “Backdoor” AI Investment

If you are looking for the perfect retirement stock...

Your search is over.

AMD, NVIDIA, META... none of these companies could exist without this firm.

And it’s only about $20 a share.

The Biggest Economic Story Nobody's Talking About (Yet)

Amazon, Google, and Tesla are quietly investing billions of dollars in this idea, which is already popping up in places like Shreveport, Louisiana, San Francisco, and Texas.

HEADLINES

S&P 500 ekes out fifth winning day as Big Tech earnings loom (more)

Extra-murky economic data is dropping this week (more)

Trump is giving automakers a break on tariffs (more)

Bessent: It’s up to China to de-escalate trade tensions (more)

JPMorgan traders turn bullish on US stocks but warn of pain to come (more)

Nvidia stock drops on report Huawei is developing rival AI chip (more)

Microsoft: US can’t afford falling behind China in quantum computers (more)

Amazon launches first Kuiper internet satellites, taking on Starlink (more)

IBM plans to invest $150B domestically in latest tech sector pledge (more)

Intel CEO announces 20,000 as tech giant loses $821M in Q1 (more)

Mass layoffs in trucking and retail coming (more)

Temu adds ‘import charges’ after Trump tariffs (more)

DEALFLOW

M+A | Investments

Merck KGaA acquires SpringWorks Therapeutics for $3.9B

Airbus finalizes deal to acquire Spirit AeroSystems assets

DoorDash offers $3.6B for Deliveroo

Sabre sells hospitality software unit to TPG for $1.1B

Mediobanca launches $7.15B bid for Banca Generali

Wenger Corporation, a manufacturer of performing arts equipment, acquired Creative Conners, expanding its automation and rigging solutions portfolio

Smartlinx, a workforce management platform for the senior care industry, acquired StafferLink, contingent labor management capabilities

FundThrough, a fintech platform for invoice factoring, acquired Ampla to expand its digital-first funding solutions for SMBs

VC

Overture Life, a company specializing in embryology lab procedures, raised $20.6M, bringing its total funding to $57M

Veza, an identity security company, raised $108M in Series D funding led by NEA at a valuation of $808M

Lightrun, an observability platform for developers, raised $70M in Series B funding

NetFoundry, a secure networking solutions provider, raised $12M in a venture funding

Cipher Surgical, a laparoscopic surgical tech company, closed a $10M Series A funding round

Gestalt Diagnostics, an AI-powered digital pathology company, raised $7.5M in Series A funding

Deferred, a provider of 1031 exchange solutions for real estate investors, raised $3.6M in Seed funding

CRYPTO

BULLISH BITES

🚀 New drilling breakthrough spawns second shale boom *

🤖 Duolingo will replace contract workers with AI.

🤑 Donald Trump Jr. co-founds new private members club with a $500,000 fee.

🎲 Las Vegas lures Seattle millionaires fleeing taxes on their wealth.

🏈 The coolest (and craziest) watches at the NFL Draft.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.