Good morning.

The Fast Five → Tesla soars 22% for best day in over a decade, Capri craters 46% after Tapestry deal blocked, Boeing workers reject latest offer, world economy at risk of low-growth malaise, OpenAI to release its next big model by December…

⚠️ Stocks Are at Record Highs, But Jovine Sees a Market Collapse Coming »

A message from Dylan Jovine

Calendar: (all times ET) - Full calendar here

Today:

Durable-goods orders, 8:30 am

Consumer sentiment, 10:00 am

Monday:

US leading economic indicators, 10:00 am

Your 5-minute briefing for Friday, October 25:

US Investor % Bullish Sentiment:

↓ 37.70% for Week of October 24 2024

Last week: 45.45%. Updates every Friday.

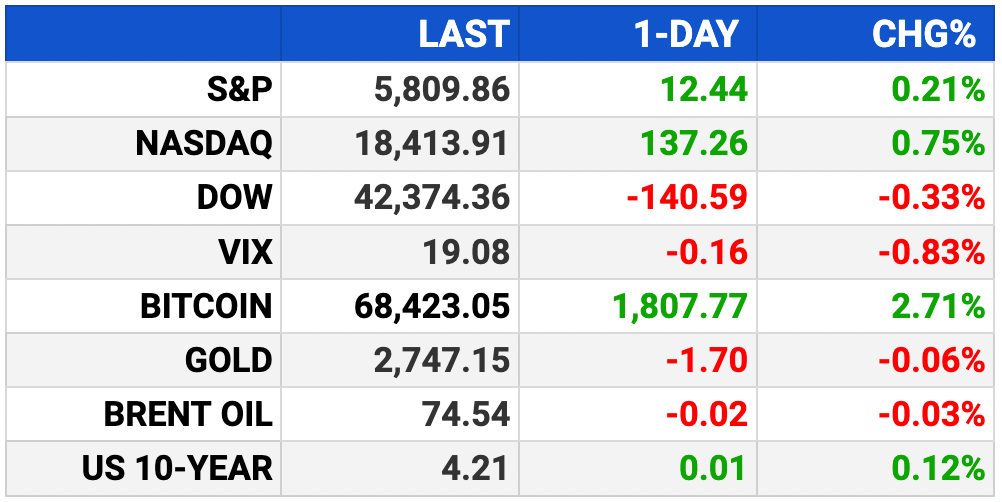

Market Wrap:

S&P, Nasdaq, and Dow futures flat overnight.

L3Harris +4% after beating Q3 expectations; Dexcom -3%.

Tesla rallied, boosting S&P and Nasdaq; best day in a decade.

Lower 10-yr Treasury yields helped tech stocks rebound.

Dow lagged, down 140 points on IBM and Boeing losses.

Indexes likely to snap six-week win streaks; Dow -2% this week.

EARNINGS

No earnings watched today. See full calendar here.

HEADLINES

Nasdaq, S&P rises as Tesla soars, yields pull back (more)

US business activity rises in October; price pressures easing (more)

Labor market plodding along, but jobs becoming more scarce (more)

IMF chief says world economy at risk of low-growth malaise (more)

Oil steadies after two-day drop as traders track Mideast tension (more)

US 30-year fixed-rate mortgage rises to 6.54% (more)

BlackRock says FDIC plan would hurt Investors, cost banks (more)

Boeing's shares fall after workers reject latest offer (more)

OpenAI plans to release its next big AI model by December (more)

Wells Fargo may lose $2 bln to $3 bln on its CRE office loan portfolio (more)

Morgan Stanley board names CEO Ted Pick its chair (more)

TOGETHER WITH MONEY.COM

You could be overpaying for car insurance

Car insurance rates have risen 20% since 2023.

Switching providers could save you hundreds a year.

See if you could save with Money’s top picks!

DEALFLOW

M+A | Investments

TKO Group to acquire some Endeavor sports assets for $3.25B (more)

JBS, Sigma vie for Kraft Heinz's $3 bln hot-dog business (more)

Jeff Vinik sells stake in NHL’s Tampa Bay Lightning to investor group (more)

Avangrid sells offshore wind lease to Dominion Energy for $160M (more)

Quikrete is in talks to acquire Summit Materials (more)

Keurig Dr Pepper raises its bets on energy drinks with $990M deal for Ghost (more)

Epicor, industry-specific enterprise software promoting business growth, acquired Acadia Software, a company specializing in connected worker solutions (more)

OneMagnify, a data science-driven marketing solutions provider, acquired Emodo, a company specializing in AI-powered programmatic marketing (more)

Socure, a provider of AI digital identity verification and fraud prevention, acquired Effectiv, a risk decision company, for $136M (more)

TalentNeuron, a provider of labor market analytics solutions, acquired HRForecast, strategic workforce planning software (more)

Agtonomy, a software company specializing in AI solutions for agriculture and industrial applications, received an investment from Allison Ventures (more)

Relay, special education and Medicaid solutions for K-12 school districts, received an investment from Resurgens Technology Partners (more)

VC

Finix, a payment processor enabling businesses to accept and send payments online and in-store, raised $75M in Series C funding (more)

Outrider, a leader in autonomous yard operations for logistics hubs, raised $62M in Series D financing round (more)

Simbe, a provider of Store Intelligence solutions, closed a $50M Series C equity financing round (more)

Concentric AI, a vendor of AI-based solutions for autonomous data security posture mgmt, raised $45M in Series B funding (more)

Nooks, an AI Sales Assistant Platform provider, raised $43M in Series B funding (more)

Urbint, an AI platform for identifying threats to workers, critical infrastructure, and communities, raised $35M in strategic funding (more)

Oncolens, an oncology health tech startup, raised $16M in Series A funding (more)

Attention, a platform that transforms customer conversations into actionable insights, raised $14M in Series A funding (more)

Dash Bio, a tech-enabled services for drug development, raised $6.5M in Seed funding (more)

Oloid, a provider of workplace tech for access and identity management, raised $6M in Series A1 funding (more)

Sociaaal, a mobile app studio specializing in non-gaming apps for Gen Z, raised $4M in funding (more)

Cascade AI, an AI assistant platform built to respond to HR inquiries, raised $3.75M in funding (more)

Aether, a platform for rooftop solar, raised $2.5M in seed funding (more)

Highnote, an audio collaboration platform, raised an additional $2.5M in funding (more)

Skyfire, a payment network built for the AI Agent economy, raised an undisclosed amount of funding (more)

interface.ai, a provider of agentic AI solutions for community banks, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🚨 Investor Alert: The same dangerous market signals are back—are you ready? *

🤖 Inside Look: Sam Altman’s energy ‘new deal’ is good for AI. What about Americans?.

🥽 Pursuits: Why Meta and Snap are spending billions on AR glasses.

🤫 Shhh: High atop Salesforce Tower, a secret club for geniuses from two shadowy VCs.

👜 On Top: What luxury slowdown? Hermes sales rise 11% in Q3.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.