☕️ Good Morning.

The Fast Five → Israel pledges ‘unrelenting attacks’ on Hamas, Bill Ackman covers bet against Treasurys, Chevron to buy Hess in oil megadeal, Amazon’s new humanoid robot could be a watershed moment for the industry, and Bitcoin soars to $35,000 on ETF optimism…

Here’s your 5-minute briefing for Tuesday:

BEFORE THE OPEN

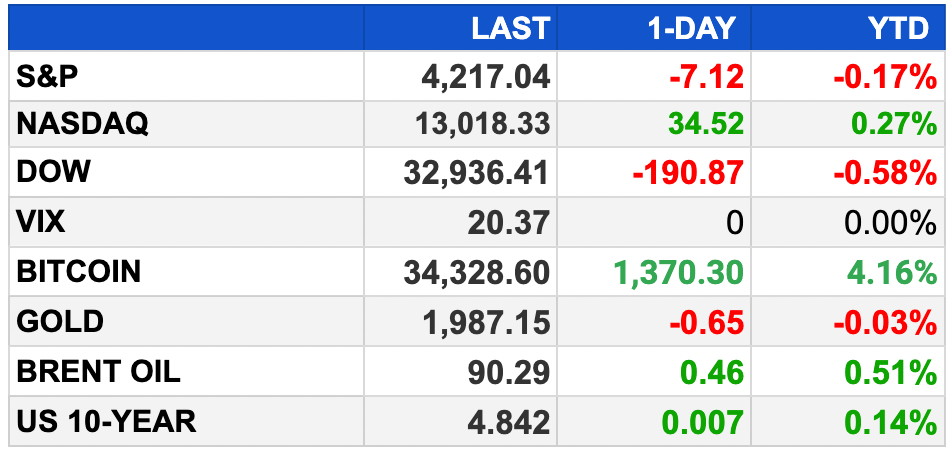

As of market close 10/23/2023.

MARKETS:

Stock futures rise slightly ahead of tech company earnings.

Mixed session on Wall Street as 10-year Treasury yield remains a focus.

Dow and S&P 500 down 0.6% and 0.2%, Nasdaq up 0.3% on Monday.

Spotify, General Motors, and Coca-Cola report earnings before the bell. Alphabet and Microsoft report after market close.

Investors will keep an eye on Meta reporting Wednesday and Amazon on Thursday. IBM and Intel to report later in the week.

Approximately 30% of S&P 500 companies expected to report this week.

Earnings season has generally exceeded Wall Street expectations so far.

Economic data on services and manufacturing sectors expected today.

EARNINGS

Here’s what we’re watching this week:

Today: Microsoft (MSFT), Alphabet (GOOGL)

Wednesday: Meta Platforms (META)

Thursday: Amazon.com (AMZN)

NEWS BRIEFING

Israel War Latest:

Ten-year U.S. Treasury yield hits 5% (more)

Republican search for new US House leader returns to square one (more)

Tesla says DOJ is probing personal benefits violations, vehicle range (more)

Retail credit card rates hit record high (more)

Bill Ackman covers bet against Treasurys, says ‘too much risk in the world’ to bet against bonds (more)

Goldman Sachs economists expect US home-price growth to slow next year (more)

BlackRock warns of US earnings stagnation, remains bullish on AI, Japan (more)

Chevron to buy Hess for $53 billion in latest oil megadeal (more)

VCs Marc Andreessen, John Doerr among among attendees at Schumer’s next AI forum (more)

Micron is building the biggest-ever U.S. chip fab, despite China ban

In this article (more)

Amazon's new humanoid robot pilots could be a watershed moment for the industry (more)

Apple, caught by surprise in generative AI boom, to spend $1 billion per year to catch up (more)

Apple’s job listings suggest it plans to infuse AI in multiple products (more)

Oil giant quietly ditches the world’s biggest carbon capture plant (more)

Halloween chocolate is pricier this year as cocoa price soars to highest in 44 years (more)

TOGETHER WITH COINSMART

Bitcoin’s up. CoinSmart it.

Buying Bitcoin is quick and easy with CoinSmart- The world's most accessible crypto exchange. Designed for beginners, built for experts. Get instant verification, 24/7 support, fully registered, safe and secure.

DEALFLOW

International Flavors & Fragrances mulls $3.5B sale of pharma unit (more)

Golden State Warriors legend Andre Iguodala has officially announced his retirement after a legendary 19-year career and launched Mosaic, a $200M venture capital fund (more)

HIG Capital weighs sale of sports media rights manager Sportfive (more)

Disney nears deal to sell $10-bln valued India business to Reliance (more)

Island, a leader in the enterprise browser market, raised $100M in its Series C financing round, which valued it at $1.5B (more)

Ternary, a provider of a multicloud spend management platform, raised $12M in Series A funding (more)

Creditly Corp., dba Credit Genie, a provider of a digital personal finance platform, raised $10M in funding (more)

Flash Pack, an adventure-travel company specializing in boutique trips for solo travelers in their 30s and 40s, raised $6.2M in funding (more)

Prism Data, a cash flow underwriting and data analytics platform provider, raised $5M in seed funding (more)

Basis, an AI platform for accounting firms, raised $3.6M in funding (more)

Revv, a software-as-a-service automotive repair diagnostics platform provider, emerged from stealth mode raising $2.1M in seed funding (more)

Laxis, a provider an AI assistant for revenue teams, raised $1.5M in seed funding (more)

Auction.io, a B2B SaaS provider of auction and e-commerce solutions, raised an undisclosed amount in funding (more)

Matter Bio, a longevity holding company focused on preserving genome integrity, received an investment from LifeSpan Vision Ventures (more)

M & A:

Databricks, the $43 billion analytics firm, acquires data startup Arcion for $100 million (more)

GameSquare (NASDAQ:GAME), a digital media, entertainment and technology company, acquired FaZe Clan (NASDAQ:FAZE), a gaming, sports, culture and entertainment company (more)

Aurora Payments, a payment technology company, acquired VN Systems, a merchant services provider (more)

Alaya.bio, a vivo gene delivery biotech company, acquired all assets previously owned by Ixaka France, a preclinical-stage immunotherapy biotech company specializing in in vivo CAR T-cell therapy (more)

Ooma, a provider of a smart communications platform for businesses and consumers, acquired 2600Hz, a provider of a business communications applications targeted at resellers and carriers, for approximately $33M (more)

SEW, a company specializing in AI-powered connected customer (CX) and workforce (WX) experience industry cloud platforms, acquired GridExchange, a provider of a transactive energy software platform, from Alectra Utilities Corporation (more)

PicnicHealth, a patient-centered healthcare evidence generation company, acquired AllStripes, a platform dedicated to generating evidence about the rare disease community (more)

Teleo Capital will merge Sharpen Technologies, a provider of cloud-based contact center software, and Plum Voice, a leader in AI-powered voice-based customer interaction technology (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

💰 Money Managers with $100 trillion start confronting end of the bull market

☎️ Telephone calls are turning into ‘appointment only’

🤖 Moody's has started using generative AI to create its reports

☕️ Order a Starbucks latté with one push of an iPhone button

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion for MarketBriefing? We’d love to hear it!

Send us a message -mb