Good morning.

The Fast Five → Investors are betting on a market melt-up, Trump rethinks candidates for Treasury Secretary, Musk endorses Howard Lutnick for the job, Treasuries see 2024 gains dwindle, and Samsung plans $7.2 billion buyback…

📉 CNBC's 'Prophet': Fed could trigger rare stock event »

From Stansberry Research

Calendar: (all times ET) - Full calendar

Today:

Home builder confidence index, 10:00 am

Tomorrow:

Building permits, 8:30 am

Your 5-minute briefing for Monday, November 18:

US Investor % Bullish Sentiment:

↑ 49.84% for Week of November 14 2024

Last week: 41.54%. Updates every Friday.

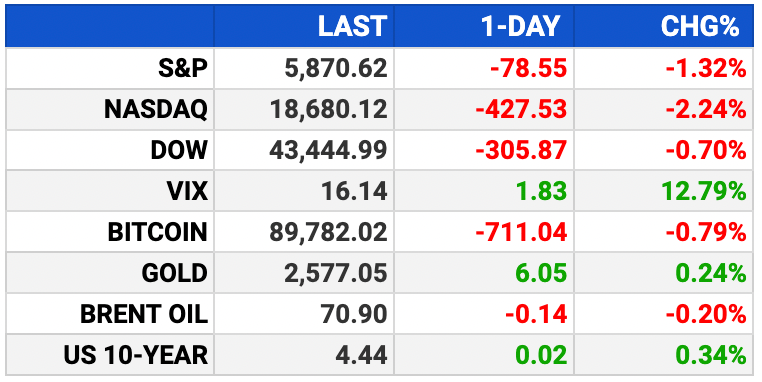

Market Wrap:

Futures mixed: Dow -16 pts, S&P +0.1%, Nasdaq +0.2%.

Dow 43,444, S&P 5,870, Nasdaq 18,680 as postelection rally fades.

Powell: Fed not rushing cuts; year-end rates seen at 4.25%-4.5%.

Key earnings: Nvidia (Wed), Walmart, Target, Palo Alto this week.

Strong earnings: 93% of S&P firms reported; 75% beat EPS, 61% beat revenue.

EARNINGS

Here’s what we’re watching this week. Full calendar »

Tuesday: Lowe's (LOW)

Walmart (WMT) - earnings of $.53 per share, up 3.9% (YoY) on $166.4 billion revenue (+4.4% YoY)

Nvidia (NVDA) - earnings of $.74 per share (+85% YoY) on $33.0 billion revenue (+82% YoY)

Deere (DE) - earnings of $3.93 per share (-52% YoY) on $9.3 billion revenue (-32.7% YoY)

HEADLINES

Solid US retail sales in October underscore economy's resilience (more)

Strong US data feeds doubts about Fed December rate cut (more)

Treasuries see 2024 gains dwindle with December Fed cut at risk (more)

Oil settles down 2% on weaker Chinese demand, Fed rate cut uncertainty (more)

Dollar sitting pretty, yen bears wary of BOJ hawks (more)

China targets critical metal exports anticipating further US tech, trade curbs (more)

Elon Musk endorses Howard Lutnick for Treasury Secretary (more)

Samsung plans $7.2B buyback after share price plunges (more)

Alibaba to raise $5 billion in dual currency bond deal (more)

ByteDance's valuation hits $300 billion (more)

Utilities want Trump, Republicans to save IRA tax credits (more)

Millennium, Capula, Tudor pile Bitcoin ETFs into portfolios (more)

A MESSAGE FROM STANSBERRY RESEARCH

CNBC's 'Prophet' who called dot-com crash issues warning

As AI stocks send the stock market to new highs every other month, the mainstream media is warning investors to prepare for another 2000-style tech crash.

But the man CNBC nicknamed 'The Prophet' is going against the crowd.

He accurately predicted the dot-com crash in 2000, and today, he has a controversial new warning about the AI craze.

It could dictate your next decade of success – or failure – in the U.S. stock market.

- sponsored message -

DEALFLOW

M+A | Investments

Nordic Capital closes in on deal for Astorg's Anaqua (more)

SalesRabbit, a field sales management platform, acquired RoofLink, a CRM solution designed for roofers (more)

RealWear, an AR market company, acquired Almer Technologies, a company specializing in ultra-compact, user-friendly AR headsets (more)

GrayMatter, an analytics products and services company, acquired Servy, an enterprise self-service platform for hospitality (more)

PMWeb, a provider of software for construction projects and asset portfolios, received a strategic growth investment from Bregal Sagempunt (more)

VC

Firefly Aerospace, an end-to-end responsive space services provider, raised $175M in Series D funding (more)

Radiant Industries, an advanced nuclear technology company, raised $100M in Series C funding (more)

Beta Bionics, a company specializing in the development of advanced diabetes management solutions, raised $60M in Series E funding (more)

Plantible Foods, a tech company leveraging plants to promote the longevity of people and the planet, closed a $30M Series B funding round (more)

Bluespine, an AI-driven claims cost reduction platform for self-insured employers, raised $7.2M in Seed funding (more)

Mithrl, an AI-powered platform empowering scientific research, raised $4M in Seed funding (more)

FROM OUR RESEARCH PARTNERS

CRYPTO

BULLISH BITES

🚨 Investor Alert: Wall Street legend who called dot-com crash issues warning *

👀 Inside Look: How crypto became the biggest winner of Trump 2.0.

🤯 From boardroom brawls to IPO ready: Inside Klarna’s wild year.

💰 Pursuits: Big bet on sunshine makes Indian entrepreneur a billionaire.

🦋 What is Bluesky? The fast-growing social platform welcoming fleeing X users

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.