Good morning.

The Fast Five → Biden curbs investing in Chinese tech, Apple debuts Intelligence AI, JPMorgan sues customers, VW to close Germany plants for the first time in its history, and Robinhood jumps into election betting…

⚠️ Did Wall Street just turn on AI?

From senior researcher, Kelly Brown

Calendar: (all times ET) - Full calendar here

Today:

Consumer confidence, 10:00 am

Tomorrow:

GDP, 8:30 am

Your 5-minute briefing for Tuesday, October 29:

US Investor % Bullish Sentiment:

↓ 37.70% for Week of October 24 2024

Last week: 45.45%. Updates every Friday.

Market Wrap:

Futures flat Monday night; Dow -35 points, S&P & Nasdaq unchanged.

Ford down 6% on low guidance; VF Corp jumps 23% on earnings beat.

Dow ends five-day loss streak; Nasdaq gains in 8 of last 9 sessions.

Oil dips post-airstrikes, but Treasury yields rising caps gains.

“Favorable macro but yields are a headwind,” says Adam Crisafulli.

EARNINGS

Here’s what we’re watching this week.

Wednesday: AbbVie (ABBV), Coinbase (COIN), DoorDash (DASH), eBay (EBAY), Eli Lilly (LLY), Microsoft (MSFT), Roku (ROKU), Starbucks (SBUX)

Meta (META) - earnings of $5.24 per share (+19.4% YoY), on $40.3B revenue (+18% YoY)

Amazon (AMZN) - earnings of $1.14 per share (+21.3% YoY) on $157.2B revenue (+9.9% YoY)

Apple (APPL) - earnings of $1.55 per share (+6.2% YoY) on $94.4B revenue (+5.5% YoY)

Friday: Wayfair (W)

See full calendar here.

HEADLINES

Wall Street closes higher ahead of megacap earnings, election (more)

Treasury yields resume climb after auctions stir supply anxiety (more)

Oil falls 6% on reduced risk of wider Middle East war (more)

Asian stocks set to rise with US election in focus (more)

Dimon says 'it's time to fight back' on regulation (more)

Apple debuts Intelligence AI with release of iOS 18.1 (more)

VW to close plants in Germany for the first time in its history (more)

JPMorgan sues customers over check fraud linked to glitch that went viral (more)

Trump Media surges 20% in final stretch of White House race (more)

Boeing to raise $22B to shore up finances, stave off downgrade (more)

Starbucks threatens to fire staff who don’t come back to office (more)

A MESSAGE FROM CHAIKIN ANALYTICS

Goldman Sachs’ AI warning

After warning of last year's historic bank run, weeks in advance...

Legendary stock-picker Marc Chaikin just stepped forward, with an alarming new prediction.

It was to do with a dramatic shift he sees coming to America's favorite tech stocks – one that Wall Street is already quietly preparing for.

For the past two years, famed institutions like Bank of America, Goldman Sachs, and Morgan Stanley have all championed the AI investing trend.

They've called it a "gold mine," "revolutionary," "the new electricity," and "magic sauce" for stocks.

Yet, in July 2024 their tune abruptly changed.

Each of those banks issued new, seemingly disconnected bearish warnings for AI stocks...

Mere weeks before the Dow dropped 1,000 points in the worst fall since the 2022 bear market.

Since then, millions of investors have been left to wonder...

How did Wall Street see it coming...

And most importantly – what do they see coming next?

Chaikin says the answer is simpler, but perhaps more sinister, than you might think.

During his 50 years on Wall Street, he actually invented the indicator that's still used by hundreds of banks, hedge funds, and brokerages to track the billions of dollars flowing in and out of stocks each day.

And his indicator signaled a bearish move in AI stocks...

The same week that Bank of America, Goldman Sachs, and Morgan Stanley issued their warning.

Today, nearly one in three investors owns an AI stock.

Millions more are exposed through ETFs and mutual funds.

If that describes you, Chaikin just released his newest stock warning – using the same indicator that signaled the summer tech selloff.

He'll explain to you why Wall Street always seems to come out on top during moments like this, while small investors suffer.

And how you can potentially get ahead of the next major market move – to never be blindsided by US stocks again.

Kelly Brown

Senior Researcher, Chaikin Analytics

DEALFLOW

M+A | Investments

OpenAI chair's AI startup Sierra gets $4.5 bln valuation in latest funding round (more)

AbbVie (ABBV), acquired Aliada Therapeutics, a biotech company focused on central nervous system diseases (more)

Ardian is in advanced talks to buy ICG-backed green firm Akuo (more)

Gruve, a services provider of innovative AI-driven solutions, acquired Lumos Cloud, a network consulting and training organization (more)

Ocuphire Pharma (OCUP), an ophthalmic biopharmaceutical company, acquired Opus Genetics, a gene therapy company for inherited retinal diseases (more)

Simpro Group, field service management solutions, acquired BigChange, a pioneer in job management software for the field services industry (more)

Grin, a virtual care platform offering digital oral health care solutions, received an investment from CareQuest Innovation Partners (more)

Island, an enterprise browser company, received an investment from Citi Ventures in Series D funding (more)

Tidal Cyber, a threat-informed defense company, received an investment from USAA and Capital One Ventures (more)

VC

Armis, a cyber exposure management & security company, closed a $200M Series D funding, increasing company valuation to a new high of $4.2B (more)

Reflexivity, innovative AI solutions for the investment industry, raised $30M in Series B funding (more)

Wildfire Systems, a financial tech platform for loyalty and reward programs, raised $16M in Series B funding (more)

Abstract, a company specializing in security data fabric and analytics, raised $15M in Series A funding (more)

Voze, a sales solution dedicated to empowering sales professionals in graycollar industries, raised $12M in a Series A funding (more)

Vendica Medical, a urology therapeutics company, raised $11M in funding (more)

Casap, an automation and fraud prevention platform, raised $8.5M in funding (more)

Oboe, a personalized learning company, raised $4M in Seed funding (more)

Cafeteria, a developer of a brand survey app for teens, raised $3M in funding (more)

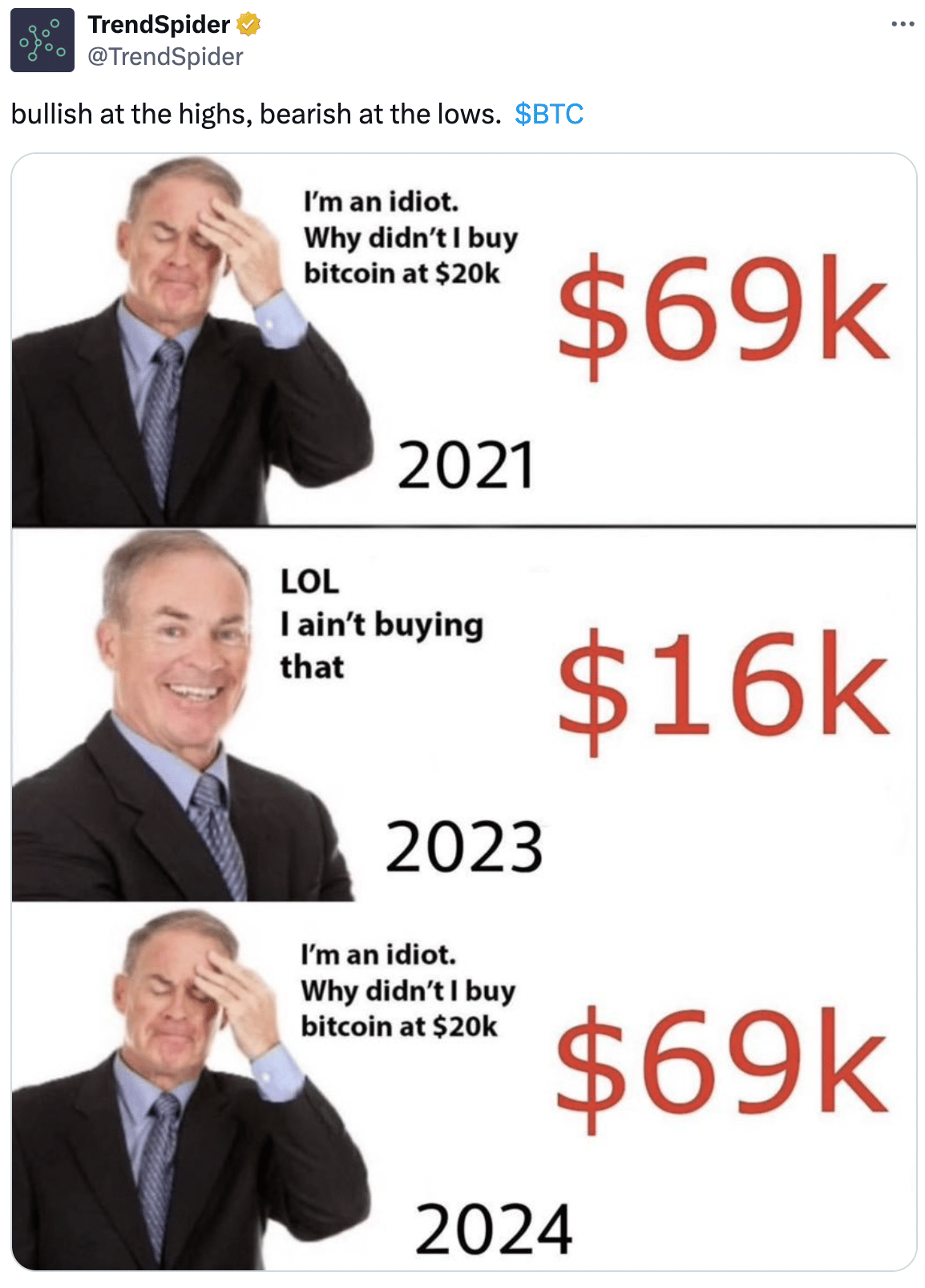

CRYPTO

BULLISH BITES

🎁 For MB Readers: For a limited time, get your 2024 Wealth Protection Guide from American Alternative Assets - send my guide » *

🔥 Peak Season: Stocks are entering the hottest period of the year.

🚀. Trending: Jeff Bezos is no longer relentlessly focused on customer satisfaction.

🪐 Pursuits: Former Disney star Bridgit Mendler talks scaling connectivity and resilience for space.

🤖 Next Level: Meet the ‘super users’ who tap AI to get ahead at work.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.