☕️ Good Morning.

The Fast Five → Biden signs 45-day funding bill to avert shutdown, trial of former FTX head Sam Bankman-Fried begins tomorrow, student loan payments are back, once unthinkable bond yields now the new normal, and Humane’s ‘AI Pin’ makes its debut at Paris Fashion Week…

Here’s your 5-minute MarketBriefing for Tuesday:

BEFORE THE OPEN

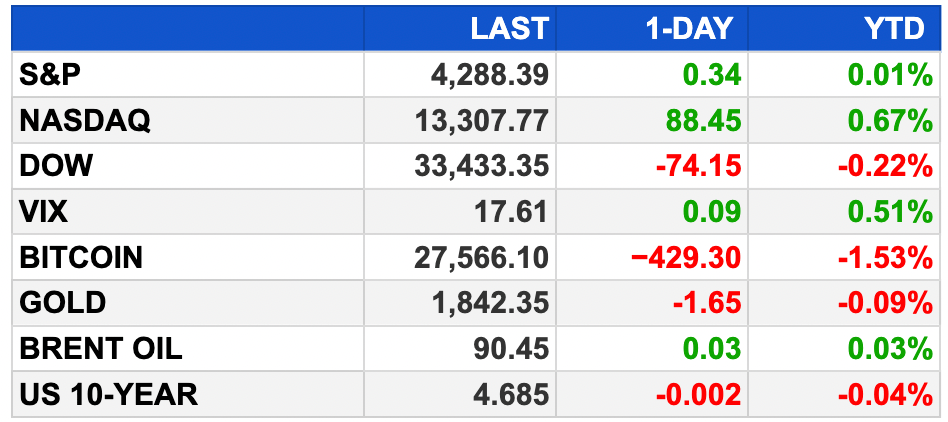

As of market close 10/2/2023. Bitcoin as of 10/1/2023.

MARKETS:

Stock futures nearly unchanged.

Short-term agreement in Washington averts government shutdown.

Dow down 0.2%, S&P 500 up 0.01%, Nasdaq up 0.67%.

10-year Treasury yield tops 4.7%, highest since October 2007.

September marked by disappointing stock performance.

Key reports including payroll data and earnings season ahead.

Today: Job Openings and Labor Turnover Survey for August, with expectations of 8.8 million job openings.

EARNINGS

Here’s what we’re watching this week:

Tuesday: McCormick & Company (MKC)

Wednesday: Tilray (TLY)

Thursday: Lamb Weston (LW), Conagra (CAG)

NEWS BRIEFING

Big tech spared as bond selloff rattles stocks (more)

US bond market signals the end of an era (more)

Student loan bills resume for 40 million Americans (more)

US warned China to expect updated export curbs in October-US official (more)

Fed Chair Powell visits York to talk about the economy with business leaders (more)

US manufacturing sector nears recovery; construction spending solid (more)

Trump's civil fraud trial in New York explained (more)

China Evergrande shares set to resume trade today (more)

Euro Falls to Weakest Level This Year While Dollar Gains Show No Sign of Easing (more)

Canada Stocks Erase 2023 Gain, Fall Further Behind US Peers (more)

GM furloughs another 160 workers due to UAW strike (more)

World’s second richest man LVMH's Bernard Arnault under investigation in Paris over connections to Russian oligarch (more)

Microsoft CEO calls Google mobile search argument 'bogus' (more)

WeWork Misses $95 Million in Interest Payments (more)

UAW workers and Mack Trucks reach deal to avoid strike (more)

Tesla misses estimates for quarterly deliveries, factory 'downtime' to blame (more)

Airbnb Is Fundamentally Broken, its CEO Says. He Plans to Fix It (more)

Hedge funds using computers to sell up to $30 billion of stocks soon - UBS (more)

Venture capital is opening the gates for defense tech (more)

Kaiser Permanente workers say deal unlikely to avert strike (more)

Retail theft proving to be 'very serious issue' for industry (more)

Spirit Aero CEO resigns as former Boeing exec named interim head (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

Bain Capital reportedly considers U.S. LBM stake sale at $7B value (more)

Bain, Cinven are said to pick banks for €10 billion Stada exit (more)

Bain Capital invests in Masan (more)

Bill Ackman interested in a deal to take Elon Musk’s X Public (more)

Wells Fargo sells $2 billion stake in Norwest Fund Investments (more)

SingTel to sell stake in Trustwave for $205 million (more)

Cultivate Power, a distributed solar and storage project developer, raised a $10M investment from Generate Capital (more)

Kafene, a provider of a point-of-sale financing platform, raised additional $12.6M in Series B funding (more)

AI Clearing, a provider of an AI-powered autonomous construction progress tracking and quality control platform, raised $14M in Series A funding (more)

Health Data Analytics Institute (HDAI), an artificial intelligence (AI) company focused on empowering clinicians, optimizing care pathways, and improving patient outcomes, received $31M in Series C financing (more)

League One Volleyball (LOVB), a volleyball professional league, raised $35M in funding (more)

Farther, a wealth management firm, raised $31M in Series B funding; valued at $131M (more)

Health Data Innovations, a healthcare data integration platform for care providers and payers, received an investment from Hughes & Company (more)

BXVentures, a venture studio and climate tech specialist, launched a global climate tech venture studio fund (more)

Titan Flood, a managing general agent (MGA) specializing in the private residential flood market, received an investment from K2 Insurance (more)

Qube Technologies, a provider of continuous emissions monitoring technology, received a Series B funding from Riverbend Energy Group (more)

M & A:

Slate Capital-backed O’Donnell Metal Deck acquires Tombari Structural Products (more)

Rithm Capital purchases Specialized Loan Servicing (more)

ZCG-backed Unimed buys MedSupply Florida (more)

Advent, Warburg Pincus acquires Baxter’s BioPharma Solutions Business (more)

TPG acquires Forcepoint’s G2CI cybersecurity business (more)

Stanley Capital Partners purchases Roboyo (more)

CRYPTO

BULLISH BITES

🎃 The $650M+ Spirit Halloween Business

Spirit Halloween has over 1,450 pop-up shops and makes all its money in only 2 months → Trunge

♟. The Game Theory of the Auto Strikes

As the United Auto Workers strike against Detroit’s Big Three drags on, a classic behavioral theory provides a way to figure out how long they may continue → Wired

🧨 Why the Impact From Higher Rates May Still Be Coming → Bloomberg

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb