☕️ Good Morning.

‘The Big Short’ Michael Burry makes big bet against the market, USB to pay $1.4 billion over fraud in mortgage-backed securities, Russia calls emergency key rate meeting as Ruble plummets, near-term inflation outlook lowest since 2021, and DeSantis urges Iger to accept end of ‘special privileges’…

Here’s your market briefing for Tuesday:

BEFORE THE OPEN BEFORE

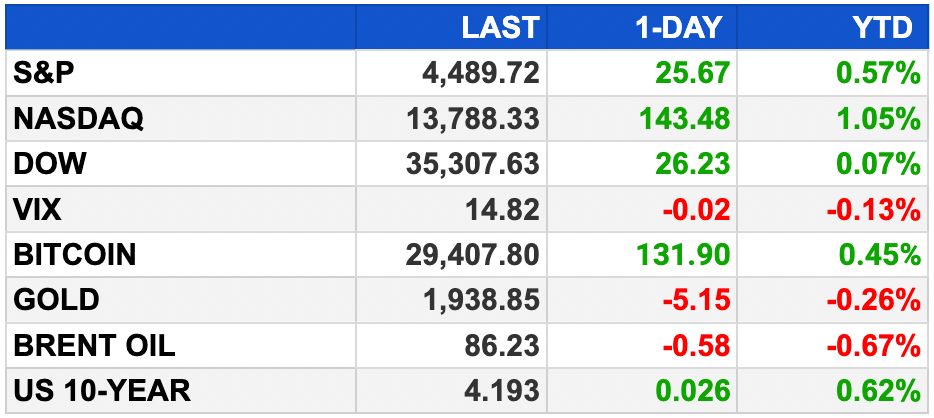

As of market close 8/14/2023.

MARKETS:

Stock futures rise slightly in overnight trading Monday.

Futures tied to S&P 500 inch 0.1% higher; Nasdaq-100 futures up 0.2%; Dow Jones futures edge up 16 points.

Homebuilders D.R. Horton and Lennar gain about 2% each after Berkshire Hathaway reveals new positions; NVR adds about 1%.

Discover Financial falls about 5% after CEO resignation.

Rebound in semiconductors and technology boosts S&P 500 and Nasdaq by 0.58% and 1.05%; Dow adds 0.07%.

Stocks recover from last week's selloff, led by information technology sector and Nvidia's 7.1% gain.

Analysts, including Alicia Levine of BNY Mellon, expect more consolidation as yields stay high.

Earnings week starts with Home Depot, followed by Target and Walmart.

Wall Street awaits July retail sales data, import/export price data, and August's NAHB housing market index for economic insights.

EARNINGS

What we’re watching this week:

Today: Home Depot (HD), Sea Limited (SE)

Wednesday: Cisco Systems (CSCO), PENN Entertainment (PENN), Roblox (RBLX), The Trade Desk (TTD),

Thursday: Walmart (WMT), Tapestry (TPR)

Friday: Palo Alto Networks (PANW)

Full earnings calendar here

NEWS BRIEFING

The Fed is playing a waiting game to try to avoid a recession (more)

Hedge funds prepare for legal battle with SEC over fee disclosures (more)

Zero-Day options cement presence in reversal-ridden stock market (more)

Michael Burry, famous for 'Big Short,' bought bearish options against S&P, Nasdaq 100 (more)

Buffett’s Berkshire cuts Activision, unveils D.R. Horton, NVR and Lennar bet (more)

Hawaiian Electric shares drop 30% on concern about potential liability from Maui wildfires (more)

Russia calls emergency key rate meeting as Ruble plunges (more)

Brazil’s economic activity caps first half of year with bigger-than-expected gain (more)

ExecFlow:

DeSantis urges Iger to drop Disney lawsuit, accept the end of ‘special privileges’ (more)

Tesla cuts China prices again as competition intensifies (more)

Nikola plunges after battery fires spur recall, sales halt (more)

US Steel rejects a $7.3B offer from rival Cleveland-Cliffs; considers alternatives (more)

FDA hands approval to Janssen's BRCA-positive prostate cancer combo tablet (more)

Falling real estate prices have property owners asking for tax cuts (more)

TikTok’s strange trend of humans playing robots spurs hope for US shopping (more)

Zuckerberg says ‘it’s time to move on’ from Elon Musk cage fight (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

Mastercard to buy stake in MTN’s $5.2B Fintech Unit (more)

MSCI to acquire remaining stake in Burgiss for $697M in cash (more)

Chesapeake to complete Eagle Ford basin exit with SilverBow deal (more)

Agnelli family's Exor buys $2.8B stake in Philips (more)

SoftBank in talks to buy Vision Fund's 25% stake in Arm (more)

ADNOC mulls raising Covestro bid to $12.6B to spur talks (more)

ABN Amro CFO says stake sale to proceed despite political crisis (more)

Credit Suisse retail investors plan lawsuit challenging UBS buyout (more)

Check Point, a provider of cyber security solutions, acquired Perimeter 81, a Security Service Edge (SSE) company, for approx. $490M (more)

PDI Technologies, a company delivering solutions and insights for retail and petroleum wholesale ecosystem, acquired Skupos, a provider of a platform that empowers retail by connecting independent convenience stores and CPG brands (more)

Radisys, a subsidiary of Jio Platforms Limited and a global provider of open telecom solutions, acquired Mimosa Networks, a provider of connectivity products, from Airspan Networks Holdings Inc (NYSE American: MIMO) (more)

TYLin, an infrastructure consulting firm, acquired Architectural Engineers Collaborative (AEC), a privately held structural engineering firm (more)

Roper Technologies (Nasdaq: ROP), acquired Syntellis Performance Solutions, a provider of cloud-based performance management and data solutions for healthcare, financial institutions, and higher education, for a net purchase price of $1.25B, including a $135M tax benefit resulting from the transaction (more)

Saksoft, a company which specializes in Enterprise Applications, Augmented Analytics, Intelligent Automation and Enterprise Cloud, acquired Solveda Group, a software design and development company (more)

Access Holdings, a digitally-enabled middle market investment firm announced it has raised approximately $805M in new capital (more)

CRYPTO

BULLISH BITES

💻 WeWork was once worth $47 Billion…

They're now on the brink of bankruptcy (again). Here's their Series-D pitch deck...

🤖 Generative AI-nxiety...

Leaders are feeling disoriented and concerned about the new technology. Here are four key risks to understand — and advice on how to address them.... (continue reading)

Know someone who would enjoy this?

What did you think about today's briefing?

Thank you for reading. Have any suggestions for MarketBriefing? We’d love to hear it. Share your suggestions here… -mb