Good morning.

The Fast Five → Wall Street heavyweights flag risk of market pullback, Burry reveals Nvidia and Palantir puts, retail traders post worst day since April, Denny’s stock up 50% after buyout bid accepted, and Apple prepares to enter low-cost laptop market…

📌 "Biggest Social Security Change Ever" -- The Financial Times called this new Trump initiative "a big pot of money for the American people." And The Motley Fool said that it could "pave the way for the biggest Social Security change ever." Get the details right here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Non-Farm Employment, 8:15A

ISM Services PMI, 10:00A

Tomorrow:

Unemployment Claims (tentative)

Your 5-minute briefing for Wednesday, Nov 5:

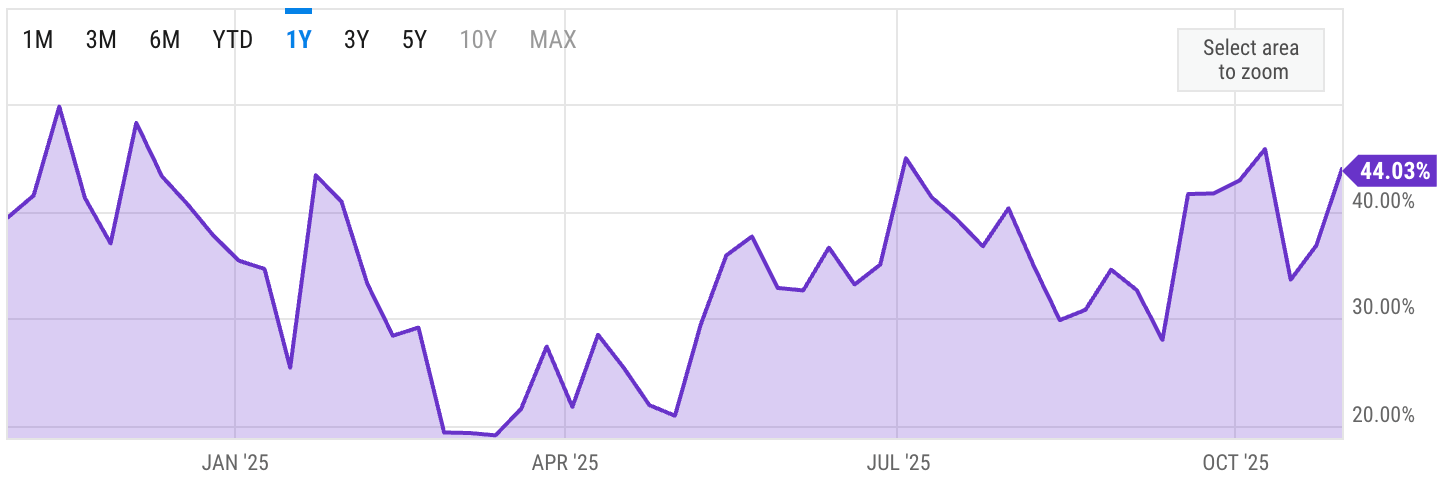

US Investor % Bullish Sentiment:

↑44.03% for Week of OCT 30 2025

Previous week: 36.86%

Market Wrap:

Futures mixed: Dow +36pts (0.1%), S&P –0.2%, Nasdaq –0.4%.

Tuesday: S&P –1.2%, Nasdaq –2%, Dow –251.

Palantir –8% post-earnings; valuation fears hit AI theme.

Some see tech pullback as temporary; AI capex still strong.

Investors lean on ADP, ISM, mortgages amid data blackout.

McDonald’s reports today; ~82% of S&P beats so far.

S&P 500 tracking ~12% blended Q3 earnings growth.

EARNINGS

Here’s what we’re watching this week:

Today: DoorDash $DASH ( ▲ 0.06% ), Duolingo $DUOL ( ▲ 1.65% ), Joby Aviation $JOBY ( ▼ 3.71% )

*McDonald's $MCD ( ▲ 0.65% ) - $3.33 EPS (-3.1% YoY), on $6.96B revenue (+1.3% YoY) and same-store sales growth of 2.5%

Robinhood $HOOD ( ▲ 0.61% ) - $.54 EPS, more than triple the $.17 EPS from the year-ago period – on $1.22B revenue (+90.8% YoY)

THU: Airbnb $ABNB ( ▲ 1.65% ), *Tapestry $TPR ( ▲ 3.15% ), *Warner Bros. Discovery $WBD ( ▲ 0.77% )

Forget about AI… There's a hot new trend on Wall Street… and it's all thanks to President Trump. His administration has begun to fast-track the operations of a handful of companies… Accelerating their potential profits.

That's why legendary investor Louis Navellier is now recommending these three stocks that are being fast-tracked »

HEADLINES

Retail traders post worst day since April as tech rally stumbles (more)

Trump's tariffs head to the Supreme Court (more)

Job openings in October slumped to the lowest level since Feb 2021 (more)

Asian markets pull back as stretched valuation fears jolt Wall St (more)

Apple prepares to enter low-cost laptop market for first time (more)

AMD outlook underwhelms investors following AI-fueled rally (more)

Major Tesla investor rejects Elon Musk’s $1 trillion pay deal (more)

Denny’s stock up 50% after company agrees to be taken private (more)

Palantir stock drops 6% on valuation concerns (more)

Supermicro plummets as earnings, revenue fall short (more)

IBM cutting thousands of jobs in the fourth quarter (more)

Pfizer, Novo bidding war for Metsera intensifies in takeover saga (more)

Amazon sends legal threats to Perplexity over agentic browsing (more)

a16z pauses famed TxO Fund for underserved founders, lays off staff (more)

Sequoia Capital's Botha steps down as top boss (more)

DEALFLOW

M+A | Investments

Eaton to buy Boyd Thermal for $9.5 bln

Starbucks to sell control of China business to Boyu Capital in $4 bln deal

Ovintiv to buy NuVista Energy in $2.7 bln deal

CBRE buys Pearce Services for $1.2 bln to grow infrastructure portfolio

Intuitive Machines to broaden space business with $800M deal for Lanteris Space Systems

CareScout completes acquisition of Seniorly

VC

Alleviate Financial Solutions, a financial services company, received a $150M growth investment

Hippocratic AI, a gen AI healthcare agents company, raised $126M in Series C funding at a $3.5B valuation

Sunflower Labs, the creator of the Beehive autonomous security drone system, closed a $16M Series B funding round

Mine Vision Systems, a vision-driven mapping & analytics company for underground mining operations, raised $12.5M in Series A funding

Parable, an intelligence platform for enterprise operations, raised $11M in Seed funding

Portal26, a GenAI adoption management platform, raised $9M in Series A funding

Downstream, an equipment rental, waste management, and site services marketplace, raised $8M in Series A funding

Investors Can’t Afford to Miss This

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector.

- A message from InvestorPlace Digest -

CRYPTO

BULLISH BITES

🗽 Zohran Mamdani wins NYC's mayor race.

🤖 "Layoff boomerangs" suggest replacing workers with AI isn't sticking.

🎓 Palantir thinks college might be a waste. So it’s hiring high-school grads.

❤️ Wait, people actually use Facebook Dating?

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.