Good morning.

The Fast Five → Market’s fate rests on Big Tech earnings, HK court orders China Evergrande to liquidate, Fed rate decision could signal March cut, United Airlines resumes Boeing 737 MAX 9 flights, and world's largest cruise ship sets sail from Miami…

Calendar:

Wednesday, 1/31: Fed interest-rate decision, 2:00p ET

Friday, 2/2: US unemployment rate, 8:30a ET

MarketBriefing has a new design thanks to the talented Li Zeng. We think it offers a more readable experience - we hope you agree. Enjoy.

Your 5-minute briefing for Monday, January 29:

BEFORE THE OPEN

As of market close 1/26/2024. Bitcoin as of 1/28/2024

Pre-Market:

Markets:

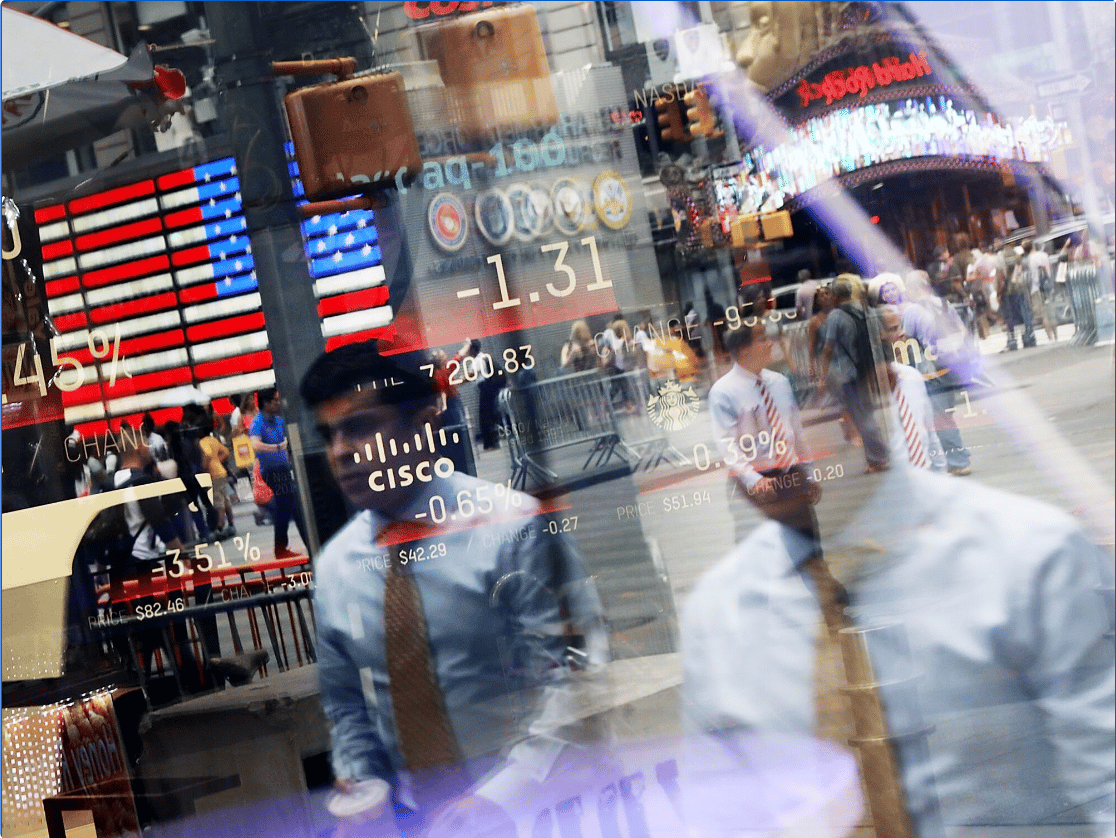

Mixed U.S. stock futures ahead of tech earnings and Fed meeting.

Dow futures down 0.15%, S&P 500, Nasdaq 100 futures stable.

Last week saw strong economic growth and lower-than-expected inflation.

Market cautious after Intel and Tesla's disappointing earnings.

Busiest earnings week with tech giants like Microsoft, Apple, and Amazon.

Also watching Dow components like Boeing and Merck.

Fed's two-day policy meeting expected to keep rates steady.

Nearly 97% probability of no rate cut, per fed funds futures market.

EARNINGS

What we’re watching this week:

Today: SoFi Technologies (SOFI)

Tuesday: JetBlue Airways (JBLU), Pfizer (PFE), Starbucks (SBUX), UPS (UPS)

Alphabet (GOOG) - expected: $1.59 per share (+51.4% YoY) on $85.3B revenue (+12.2% YoY)

Microsoft (MSFT) - expected: $2.78 per share (+20.3% YoY) on $61.1B revenue (+15.9% YoY)

Wednesday: Boeing (BA)

Thursday: Atlassian (TEAM), Honeywell (HON), Meta Platforms (META)

Amazon (AMZN) - expected: $.80 per share. Revenue expected to rise 11.4% to $166.2B

Apple (AAPL) - expected: $2.10 per share for Apple’s fiscal Q1 (+11.7%) on $117.9B revenue (+0.06% YoY

Friday: Chevron (CVX), Exxon (XOM)

Full earnings calendar here

HEADLINES

Fed rate decision could be the prelude to a March cut (more)

US to announce billions of dollars in subsidies for advanced chips (more)

Oil prices higher after Iran-linked drone strikes kill U.S. troops; Biden vows retaliation (more)

First-of-its-kind campaign fundraiser in the works with Bill Clinton, Barack Obama and Biden (more)

China plans to merge 3 bad debt asset managers with sovereign wealth fund, state media reports (more)

United Airlines resumes Boeing 737 MAX 9 flights after inspections (more)

Big pharma at a crossroads, as Merck, J&J, others prepare to lose revenue from blockbuster drugs (more)

Chevron says California plays a risky game with climate and gasoline (more)

Elon Musk plans to build a new content moderation center for X in Austin (more)

LVMH founder Bernard Arnault overtakes Elon Musk as richest person in the world (more)

Spotify CEO says Apple's app store changes are a 'new low' (more)

Tesla to spend $500M to bring its Dojo supercomputer project to Buffalo factory (more)

World's largest cruise ship sets sail from Miami (more)

TOGETHER WITH RAD AI

RAD AI is an essential AI technology that tells brands who their customer is, and how to best create content that significantly boosts ROI. And 3X revenue growth this year suggests it's working.

Major clients like Hasbro, MGM, and Sweetgreen — 6,000+ investors already trust RAD including VCs, Fidelity and execs from Google/Amazon. Over $27M invested, backed by Adobe Fund for Design.

Get in on the ground floor! Learn more and invest here.

83% Subscribed, Invest Before Feb. 16th, Closing Soon.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

- please support our sponsors -

DEALFLOW

M+A | Investments

Carlyle mulls a $1B sale of tech services firm HSO (more)

Kain Capital, a private equity firm focused on the technology enablement of healthcare services companies, has exercised a follow-on investment in MY DR NOW (more)

ObjectiveHealth, an integrated specialty research network and technology company, received a strategic growth investment from Vitruvian Partners (more)

TraceGains, a company which specializes in compliance and networked product development software, acquired NutriCalc, a provider of nutritional calculation software (more)

DFW Capital Partners closes investment in Harris CPAs (more)

HGGC invests in True North Advisors (more)

VC

Thentia, a company specializing in regulatory technology, raised $38M in Series B extension (more)

Proof Technology, Inc., a service of process and e-filing technology platform company, closed a $30.4M Series B funding (more)

Axiom, a startup that uses advanced cryptographic proofs to give smart contract developers access to more data on-chain, raised $20M in Series A funding (more)

Granata Bio, a biopharma company, announced the close of a $14M Series A funding round led by GV (more)

GreenSpark, a provider of a software platform for the metal recycling industry, raised $9.4M in funding (more)

Chunk Foods, a plant-based space company, raised additional $7.5M in Seed funding (more)

Digs, a provider of an AI collaboration platform for home builders and homeowners, raised $7M in Seed funding (more)

RagaAI, a technology company specializing in AI testing, raised $4.7M in funding (more)

TextQL, a startup building an AI data analyst that connects clients to business intelligence tools, semantic layers, and existing documentation, raised $4.1M in Pre-Seed funding (more)

C16 Biosciences, a maker of Palmless™, a platform for sustainable palm oil alternatives, raised $3.5M in Grant from Bill & Melinda Gates Foundation as well as a $1M investment from Elemental Excelerator (more)

Legalyze.ai, an AI startup for lawyers, raised $100K in funding (more)

OnPoint Healthcare Partners, an AI-enabled technology services provider that offers a suite of solutions to hospitals and medical groups, received growth funding (more)

IPO

Reddit advised to target at least $5 Billion valuation in IPO (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🤝 Powershift: The introverts have taken over the US economy.

👀 Watching: Federal judges will soon decide whether crypto can be regulated like stocks and bonds.

🙌 Game-changer: Google’s Lumiere brings AI video closer to real than unreal.

🔎 In the spotlight: Unhappy workers cost US firms $1.9 Trillion.

✈️ Storied travel: This is what a $10 Million vacation looks like.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.