Good morning.

The Fast Five → Big Tech earnings arrive with Nasdaq 100 on brink of correction, Trump promises American crypto "going to the moon", a Fed rate cut is finally within view, fast-food chains battle for diners, and Apple agrees to first US labor deal…

Former hedge fund manager: Prepare for the 2024 Wall Street reckoning »

Calendar: (all times ET)

TUE, 7/30: | Consumer confidence, 10:00 AM |

WED, 7/31: | FOMC interest-rate decision, 2:00 PM |

THU, 8/1: | Initial jobless claims, 8:30 AM |

FRI, 8/2: | Employment report, 8:30 AM |

Your 5-minute briefing for Monday, July 29:

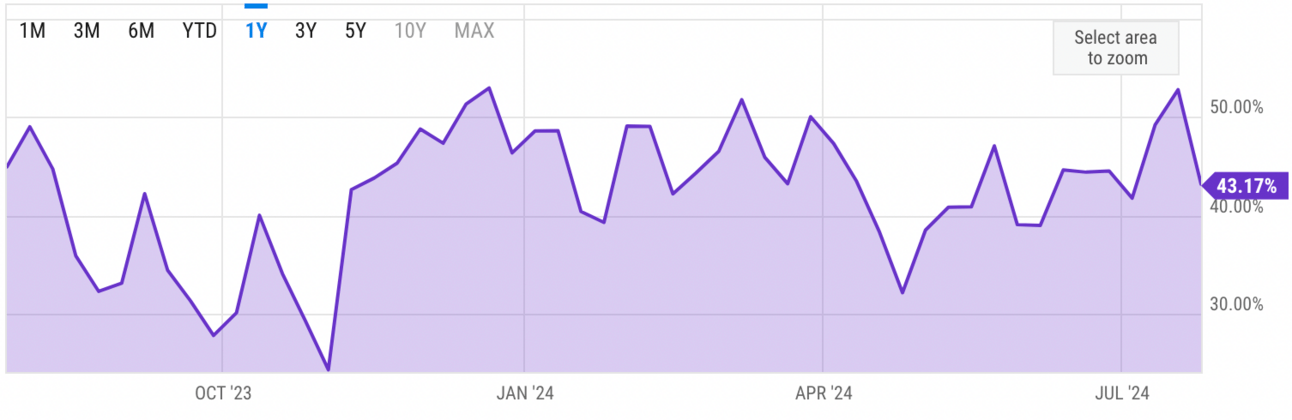

US Investor % Bullish Sentiment:

↓ 43.17% for Wk of July 25 2024 (Last week: 52.75%)

Chart updates every Friday.

Market Recap:

Stocks jumped Friday, ending a turbulent week.

Dow +1.64%, S&P +1.11%, Nasdaq +1.03%.

Driven by strong GDP report and Fed rate cut expectations.

3M +23%, best day since 1972.

Microsoft, Amazon +1%, Meta Platforms +3%.

June PCE index: +0.1% monthly, +2.5% yearly, meeting expectations.

Dow +0.8% for the week, fourth consecutive positive week.

EARNINGS

Here’s what we’re watching:

Today: McDonald's (MCD)

Tuesday: Advanced Micro Devices (AMD), JetBlue Airways (JBLU), Live Nation (LYV), PayPal Holdings (PYPL), Restaurant Brands (QSR), SoFi Technologies (SOFI), Starbucks (SBUX)

Microsoft (MSFT) - earnings to be up 8.9% YoY, while revenue is forecast to rise 14.5% to $64.4B

Procter & Gamble (PG) - earnings of $1.37 per share, flat on a year-over-year basis, on $20.8B revenue (+1% YoY)

Thursday: Amazon (AMZN), DoorDash (DASH), DraftKings (DKNG), Hershey Foods (HSY), Intel (INTC), Moderna (MRNA), Roblox (RBLX), Roku (ROKU), Sirius XM (SIRI), Twilio (TWLO), Wayfair (W), Wendy's (WEN)

Apple (AAPL) - earnings of $1.34 per share (+13.6% YoY) on $84.4B revenue (+10.4% YoY)

Full earnings calendar here.

HEADLINES

A Fed rate cut is finally within view (more)

Yellen rebuffs Trump argument on dollar hurting manufacturing (more)

G20 agrees to tackle taxation of the super-rich, but forum not yet decided (more)

Hedge fund study on US Treasury issuance fuels debate (more)

US home insurers suffer biggest loss of century in 2023 (more)

BOJ's victory lap on deflation paves way for rate-hike cycle (more)

Reeves promises to ‘fix the foundations’ of Britain’s economy (more)

Apple agrees to first US labor deal (more)

Apple intelligence to miss initial launch of upcoming iOS 18 overhaul (more)

Fast-food chains battle for low-income diners with summer value meals (more)

Delta meltdown is Buttigieg’s latest headache (more)

Debut of Bill Ackman's new fund delayed (more)

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

DEALFLOW

M+A | Investments

Vital Energy, Northern Oil and Gas buy Point Energy shale assets for $1.1B (more)

Regional lender WesBanco to buy smaller rival Premier Financial in $959M deal (more)

Thoma Bravo to seek $2.74B in Nasdaq stake sale (more)

Apollo Funds to buy IGT’s gaming, Everi in $6.3B deal (more)

Analytic Partners, a commercial analytics company, acquires Magic Numbers, a marketing analytics firm (more)

Riveron, a business advisory firm, acquired Yantra, a technology and advisory services provider (more)

Tunespotter, a “music moment” search and fan engagement platform at the nexus of pop culture, acquired What-song.com, a search engine built on movie, TV show soundtracks, and playlists (more)

Summer Fridays, a skincare and hybrid makeup brand, received an investment from TSG Consumer Partners (more)

VC

Cowbell, a provider of cyber insurance for small and medium-sized enterprises, raised $60M in Series C funding (more)

DocketAI, an AI revenue enablement startup, raised $15M in Series A funding (more)

SlicedHealth, cloud solutions for hospitals to optimize revenue and manage compliance, raised $5M in Series A funding (more)

Noded AI, a maker of note-taking and task management software, raised $4m in funding (more)

That's why Fidelity – the world's 4th largest asset manager – has acquired $11 billion worth of bitcoin. They're desperate to claim their stake in this modern gold rush. And you should be, too. But before you buy bitcoin (or any other crypto), you'll want to watch this interview. In it, an 11-year crypto veteran names his #1 crypto to buy (it's not bitcoin or Ethereum).

CRYPTO

BULLISH BITES

📉 That sudden market drop was scary for investors but long overdue.

☕️ Your cup of coffee is already expensive, but it’s about to get even worse.

What did you think about today's briefing?

Have a comment or suggestion?

💌Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.