Good morning.

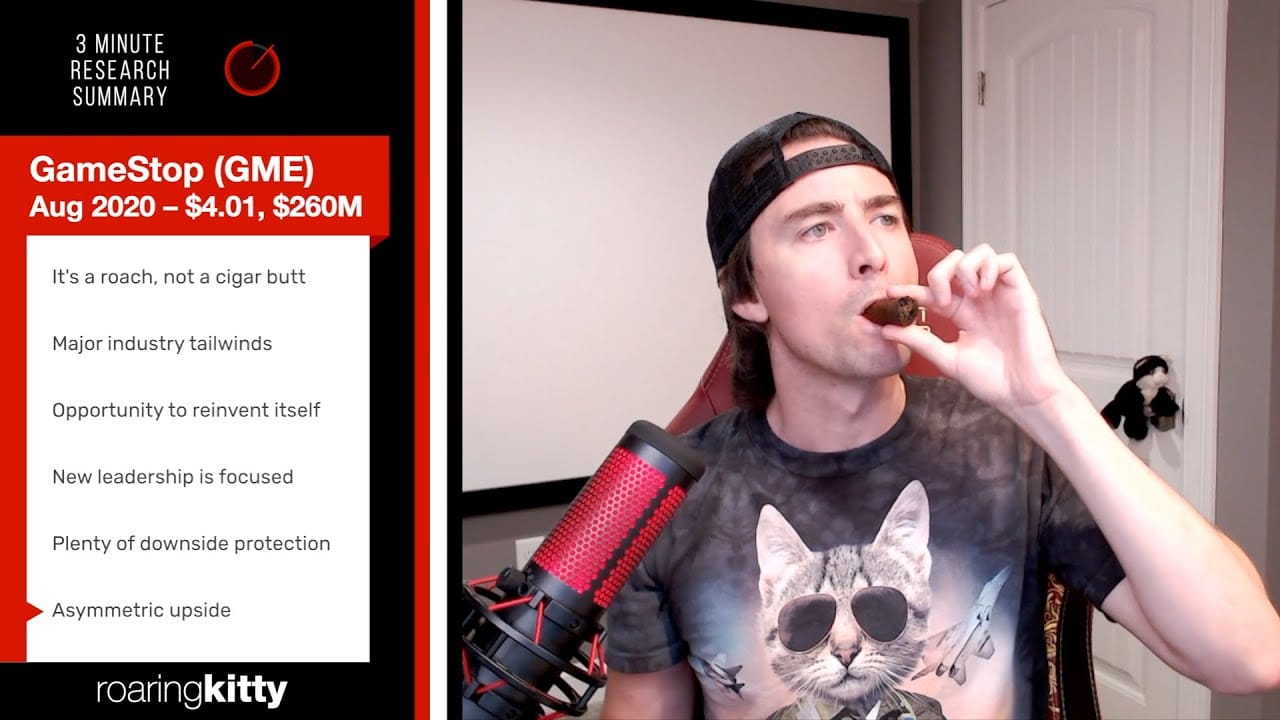

The Fast Five → Roaring Kitty’s YouTube return puts billions on the line for GameStop (watch it here @ 12p ET), jobs report Is set to confirm steady slowdown, ECB cuts interest rates for the first time in 5 years, Starbucks teams up with Grubhub, and short bets against Nvidia stand at $34 billion. Full briefing ahead after this question…

Calendar: (all times ET)

Today: | Unemployment rate, 8:30a |

Your 5-minute briefing for Friday, June 7:

US Investor % Bullish Sentiment:

↓ 39.04% for Wk of May 30 2024 (Last week: 47.04%).

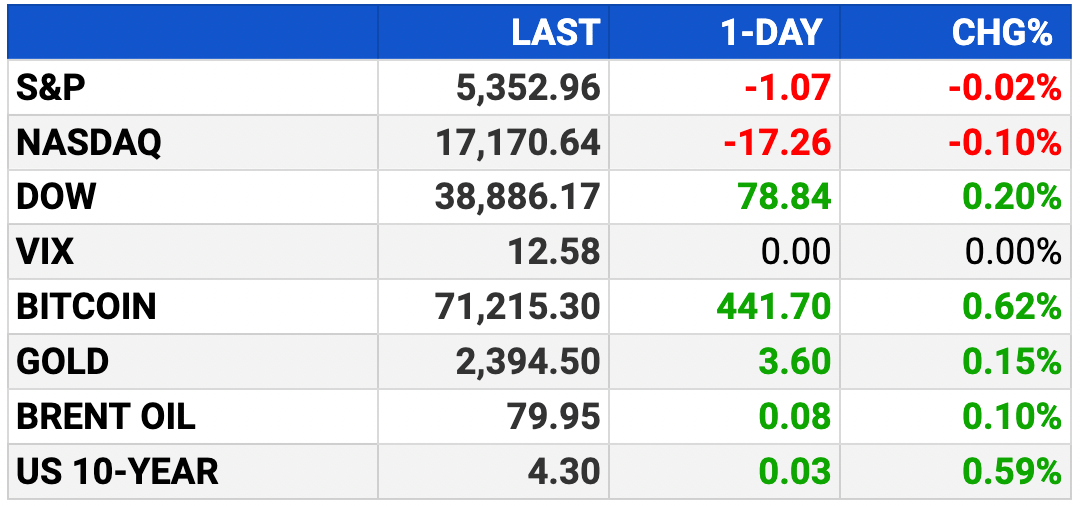

Market Recap:

Futures flat ahead of today’s payroll report.

Dow futures +67 points (0.18%), Nasdaq +0.17%, S&P +0.13%.

Regular trading: Dow +0.20%, S&P -0.02%, Nasdaq -0.09%.

Today: May payrolls; expect 190,000 jobs added, 3.9% wage growth.

Slowing economy may support Fed rate cuts.

Fed decision on rates next week; 70% chance of easing in September.

EARNINGS

What we’re watching this week:

Ciena (CIEN) - earnings of $0.15 per share (-79.7% YoY) on $894.9M revenue (-20.8% YoY)

Full earnings calendar here.

Exclusive Report: Master Uncertain Markets

Unlock Profit Opportunities with a Soaring Penny Stock

HEADLINES

US weekly jobless claims edge higher, Q1 labor costs revised lower (more)

US regulators to open antitrust probes into Nvidia, Microsoft and OpenAI (more)

Janet Yellen warns AI in finance poses ‘significant risks’ (more)

ECB cuts interest rates for the first time since 2019 (more)

Asia shares set for weekly gain on rate-cut rally (more)

China's May exports pick up pace, top forecast in boost to economic recovery (more)

Oil edges higher on OPEC+ reassurances but set for third weekly loss (more)

Short bets against Nvidia stand at $34 billion (more)

Tracking app company Life360 goes public (more)

ValueAct increases Salesforce stake to nearly $1 billion, sending shares up (more)

Musk could exit without 'motivating' pay deal, Tesla Chair warns (more)

Apple to debut passwords app in challenge to LastPass (more)

Starbucks teams up with Grubhub to reverse sales slump (more)

Bernard Arnault names son Frédéric at top of LVMH family holding group (more)

DEALFLOW

M+A | Investments

Robinhood acquires Bitstamp Ltd., a global crypto exchange (more)

Michael Bloomberg joins A-Rod Group trying to buy Timberwolves (more)

MNC Capital raises offer to acquire Vista Outdoor to over $3 billion (more)

Humane, the startup behind the AI Pin, in talks with HP, Telecoms to sell (more)

Chronus, a development platform offering mentorship and ERG management, acquired Imperative, an employee engagement platform (more)

Tenable, an exposure management company, acquired Eureka Security, provider of data security posture management for cloud environments (more)

Fixle, provider of home solutions in the proptech and insurtech sectors, acquired EasyHome, a developer of software solutions designed to modernize property care and management (more)

Wesco International, a provider of B2B distribution, logistics, and supply chain solutions, acquired entroCIM, data center and building intelligence software (more)

Sirion, a contract lifecycle management company, acquired Eigen Technologies, a document AI company for financial services (more)

Whizz, an e-bike subscription platform for last-mile delivery drivers, raised $12M in Series A funding (more)

VC

Vilya, a biotech company creating medicines that precisely target disease biology, expanded its Series A funding to $71M (more)

restor3d, a company specializing in 3D printed, personalized orthopedic implants, raised $70M in funding (more)

Twelve Labs, a video understanding company, raised $50M in Series A funding (more)

Nium, a global leader in real-time cross-border payments, raised $50M in Series E funding round (more)

Eko Health, a company applying AI for early detection of heart and lung diseases, raised $41M in Series D funding (more)

Advanced Medicine Partners, developer of innovative advanced medicines, received an additional $32M in financing (more)

LiveKit, a platform for building and scaling voice applications, raised $22M in Series A funding (more)

Tobiko Data, a data infrastructure startup, raised $21.8M in funding (more)

Vantage Discovery, a search and content discovery platform for ecommerce, raised $16M in Series A funding (more)

Understory, an insurance platform protecting industries from severe weather risk, raised $15M in Series A funding (more)

SiTration, a materials recovery company, raised $11.8M in Seed funding (more)

HyperSpectral, a spectral intelligence company, raised $8.5M in Series A funding (more)

Testsigma, an AI-powered, low-code test automation platform, raised $8.2M in funding (more)

Inventive, a startup building embedded AI for SaaS products, raised $6.5M in Seed funding (more)

Liminal, a company specializing in horizontal gen AI data security, raised additional $5M in funding (more)

Hoop, an AI task management platform, raised $5M in Seed funding (more)

Wevr, a creative production studio, $3.5M in funding (more)

Field Materials, a provider of AI software to control and verify construction and equipment spending, raised additional $3.5M (more)

Envisagenics, a biotech company developing of novel RNA splicing therapeutics, raised a Series B fundraising round (more)

CRYPTO

BULLISH BITES

⭐️ Rockstar: Nvidia CEO Jensen Huang, who has seen his wealth top $100 billion, sparks "Jensanity" in Taiwan.

💼 Stretching: Lululemon is coming to an office (and golf course) near you.

📈 Opportunity: Join Google and Amazon in backing AI drug discovery. *

🤑 Pursuits: Ultra-rich families fuel $20 billion private equity buyout wave.

🤖 Inside Look: How Apple fell behind in the AI arms race.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.