☕️ Good Morning.

The Fast Five → Wall Street cheered best Fed day since 2009, Intel unveils Mortgage rates slide <7% for first time since August, Intel unveils new AI chip to compete, Disney prepares for battle as activist Peltz seeks two board seats, and Blackstone goes all-in on Taylor Swift fandom with holiday video…

Here’s your 5-min briefing for Friday:

BEFORE THE OPEN

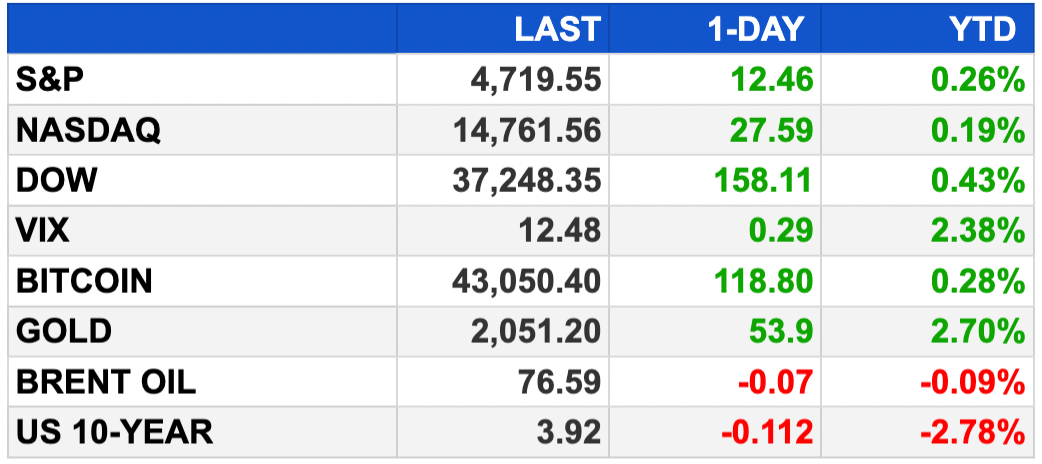

As of market close 12/14/2023.

MARKETS:

Dow closes at another record high, up 158 points, reaching 37,248.35.

S&P 500 gains 0.26%, inching closer to its all-time close from January 2022.

Nasdaq climbs 0.19%, still some distance from its record levels.

10-year Treasury yield falls below 4%, signaling bets on 2034 rate cuts.

Solar stocks rise as yields drop; Invesco Solar ETF gains over 8%.

Moderna shares surge 9.3% on positive trial data for cancer vaccine with Merck's Keytruda.

EARNINGS

What we’re watching:

Today:

Darden Restaurants (DRI) - expected: $1.73 per share (+13.8% YoY) on $2.7 billion revenue (+8.0% YoY)

Full earnings calendar here

NEWS BRIEFING

Five ETFs of major assets each up at least 1% in broad rally. Traders branch out of tech megacaps, boosting small-cap stocks.

US economy still resilient as retail sales beat expectations, layoffs stay low (more)

Congress passes $886 billion defense policy bill, Biden to sign into law (more)

Biden administration to impose inflation penalties on dozens of drugmakers (more)

Gen Z voters said Biden is doing "too little" on student loans (more)

Mortgage rates in US slide below 7% for First time since August (more)

China to run budget gap of 3% of GDP in 2024, issue special debt (more)

JPMorgan strategist sees a big credit ‘reckoning’ in 2024 (more)

Property crash draws short-sellers. Better late than never (more)

Top EVs are losing tax credits next year as U.S. boots China from supply chain (more)

GM's Cruise lay off 24% of its workforce (more)

Intel unveils new AI chip to compete with Nvidia and AMD (more)

Amazon courts sellers at China summit as Temu and Shein gain momentum (more)

Citi shuts muni business that once was envy of rivals (more)

Starbucks closed 23 U.S. stores to deter unionizing (more)

Google to test new feature limiting advertisers' use of browser tracking cookies (more)

Disney prepares for bitter battle as activist Peltz seeks two board seats (more)

Tesla is cutting prices again, in a different way (more)

"Average customer doesn't care terribly much about sustainability" says LVMH US head (more)

DEALFLOW

M & A | INVESTMENTS:

Blackstone, CPPIB take $1.2 Billion stake in Signature Bank deal (more)

OMV, ADNOC close to agreeing deal for chemicals company tie up (more)

Pfizer Inc. (PFE) completed the acquisition of Seagen Inc. (SGEN), a biotechnology company that discovers, develops and commercializes transformative cancer medicines (more)

PennSpring Capital, an investment firm focused on lower middle market opportunities, acquired Zirtual, a provider of virtual assistant services, from preeminent accelerator startups (more)

India's Adani Ports to sell Ennore terminal stake to MSC unit for $30M (more)

Citi's Mexico unit set to split off by late 2024 (more)

Quantum Workplace, a provider of an employee success platform, acquired TalentKeepers, a provider of employee engagement and retention solutions (more)

Edelman Financial Engines acquires New England Pension Plan Systems (more)

Delos Capital-Backed Le Sueur Buys Craft Pattern (more)

Thoma Bravo acquires majority stake in Hypergene (more)

Argosy Private Equity acquires controlling stake in Wize Solutions (more)

RF-backed Ally Waste buys Waste Consolidators (more)

Rubelmann Capital buys pet food distributor John A. Van Den Bosch (more)

Thoma Bravo Invests in BlueMatrix (more)

Pritzker Private Capital acquires HeartLand (more)

VC

Parse Biosciences, a provider of scalable single-cell sequencing solutions, raised $50M in financing from a Series C equity and the closing of a debt facility (more)

Amide Technologies, a biotech that synthesizes challenging peptides, $16.5M in total funding (more)

Friendlier, a reusable packaging company, raised $5M in funding (more)

Datalogz, a company specializing in ending Business Intelligence sprawl for data-mature organizations globally, raised $5M in funding (more)

Myrias Optics, a developer of all-inorganic printed meta-optics, raised $3M in Seed funding (more)

Cadenza Bio, a biotechnology company, raised $2.44M in Series Seed funding (more)

FUNDRAISING

Ara Partners, a private equity and infrastructure investment firm, closed over $3B in new capital commitments for ARA Fund III (more)

Sandbrook Capital closes inaugural climate infrastructure Fund at $1.5B (more)

BoxGroup, a venture capital firm, closed two funds, totaling $425M (more)

Playground Global, an early-stage venture capital firm investing in entrepreneurs who have developed breakthroughs in frontier technologies, raised $410M in new capital for Fund III (more)

Artis Ventures, a venture capital firms that partners with entrepreneurs driven to impact the world by reshaping and reinventing industries, announced the close of its fourth fund, TechBio II, at $200M (more)

A group of seasoned founders, CEOs, operators and VC’s announced the launch of Climactic, a NYC and SF-based venture capital firm, with a $65M inaugural fund dedicated to accelerating the growth of software-first climate tech startups (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🐂 Poetic: Bull was on the loose in Newark causing delays for NJ transit riders.

🦕 Relics? American colleges are losing their students and money.

🌺 Home away: Mark Zuckerberg is building a Hawaii compound suitable for the apocalypse.

🚙 Future things: Cars that change colors—and other new auto tech on the way.

🐝 Why wait? Start your own newsletter—Beehiiv has everything you need in a single platform (and super easy, too!)… start your free trial now

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.