☕️ Good morning. Today: Jobless claims report @ 10:00 am ET

The Fast Five → Blinken stranded after Boeing 737 breaks down, Spirit Airlines shares sink 20% in second day of losses after blocked merger, EV owners unable to charge in freezing weather, Apple sales ban restarts today, and Samsung packs newest Galaxy smartphones with AI to beat Apple…

Your 5-minute briefing for Thursday, January 18:

BEFORE THE OPEN

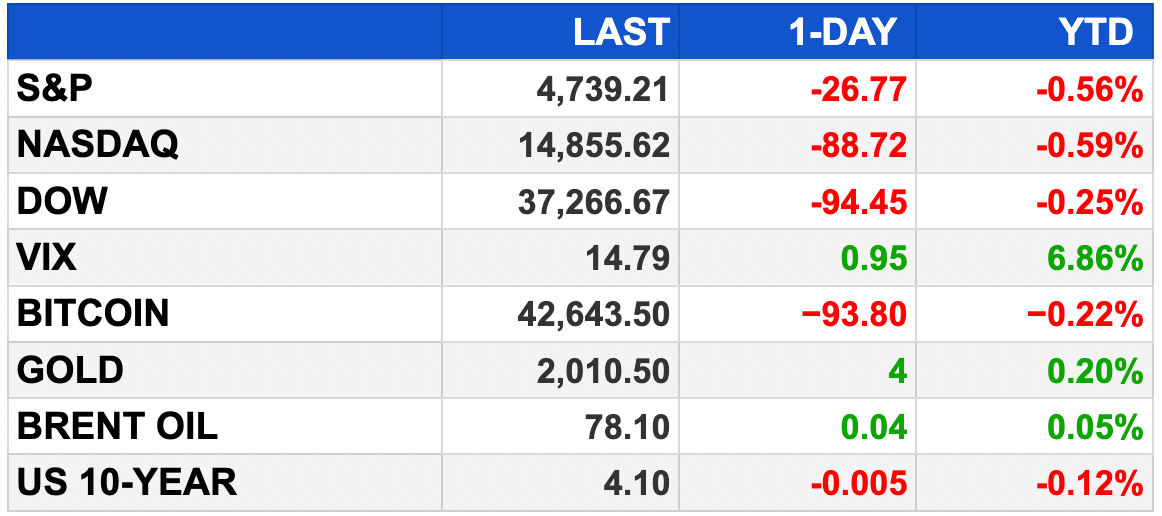

As of market close 1/17/2024.

PRE-MARKET:

MARKETS:

Flat U.S. stock futures post 3rd Dow losing day.

Dow futures down 0.01%, S&P 500 -0.04%, Nasdaq 100 -0.09%.

Discover -7% despite Q4 revenue beat.

Wednesday: Dow -0.25%, S&P 500 -0.56%, Nasdaq -0.59%.

10-year Treasury yield above 4.1% raises rate cut concerns.

Markets eye March rate cut with 56% probability.

Today: jobless claims, housing starts, building permits, Bostic speech.

EARNINGS

What we’re watching this week:

Today: Charles Schwab (SCHW)

Kinder Morgan (KMI) - expected: $.30 per share (-3.2% YoY) on $4.4 billion revenue (-3.7% YoY)

Friday:

Travelers (TRV) - expected: $5.00 per share (+47% YoY) on $10 billion revenue (+13.1% YoY)

Full earnings calendar here

HEADLINES

10-year Treasury yield hits five-week high after strong retail sales data (more)

Retail sales rose 0.6% in December, topping expectations for holiday shopping (more)

Biden proposal could drop overdraft fees to as low as $3 (more)

Homebuilder sentiment improves for second straight month, following drop in mortgage rates (more)

Sorry, millennials, Gen Zers are coming for boomers’ houses (more)

Red Sea crisis could last a year with Houthi attacks ‘just increasing’ (more)

Jamie Dimon warns ‘all these very powerful forces’ will impact U.S. economy in 2024 and 2025 (more)

Sheryl Sandberg is leaving Meta’s board (more)

Apple Watch sales ban restarts Today (more)

Apple faces US antitrust lawsuit as soon as March (more)

Samsung packs newest Galaxy S24 smartphones with AI functions to beat Apple (more)

JPMorgan to hire this year on wealth, dealmaking revival (more)

Google CEO says more job cuts are needed in 2024 in order to reach ‘ambitious goals’ (more)

Bayer unveils significant job cuts as part of broader revamp (more)

'Wake-up call' for EV owners — unable to charge in deep freeze (more)

TOGETHER WITH RadAI

This AI Startup Investment is Winning

RAD AI has developed technology that transforms the $633B MarTech industry. Its award-winning AI tells brands who their customer is and how to best create content for them.

1) $27M raised from 6,000+ investors, including VCs, execs at Google and Amazon. Backed by Adobe Fund for Design.

2) Dubbed “essential AI” for brands looking to attract new audiences and boost ROI.

3) 3X revenue growth, clients include Hasbro, Sweetgreen, MGM and more.

83% Subscribed, Invest Before Feb. 16th, Closing Soon.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

~ please support our sponsors ~

DEALFLOW

M & A | INVESTMENTS

Holcim’s Europe head says firm looking at 20 small acquisitions (more)

Japan's Mizuho hunting for deals to bolster asset management business (more)

Italy clears Telecom Italia’s €22 billion grid sale to KKR (more)

Indian govt to sell up to 3.5% stake in NHPC (more)

Visa (V) completed its acquisition of Pismo, a global cloud-native issuer processing and core banking platform (more)

GoPro (GPRO) acquired Forcite Helmet Systems, a company specializing in embedding technology into helmets (more)

Accel-KKR announced that it’s reached an agreement with American Express (AXP) to acquire Accertify, a wholly owned subsidiary that provides fraud prevention, chargeback management, account protection, and payment gateway solutions (more)

CIVC Partners, L.P., a middle market private equity firm focused on investments in the business services sector, acquired Datavail Corp., a data managed services provider, from a group of growth investors led by Catalyst Investors (more)

Parse Biosciences, a provider of accessible and scalable single cell sequencing solutions, acquired Biomage, a data analysis software company (more)

TRC purchases Locana from Transom and Angeleno Group (more)

HATCo, a new healthcare venture capital firm, to acquire Summa Health (more)

Snyk, a developer security company, acquired Helios, a leader in capturing application runtime data (more)

FEP acquires Precision Garage Door Service (more)

Wind Point Partners buys MOREgroup (more)

Apprio, a provider of specialized healthcare technology solutions and services for hospitals and health systems with a focus on automized solutions, received an investment from HCAP Partners (more)

Blueshift, a company that helps brands automate and personalize engagement across every marketing channel using AI, received a $40M growth investment from Runway Growth Capital (more)

MidOcean Partners invests in The Re-Sourcing Group (more)

VC

Noctrix Health, Inc., a medical device company, closed a $40M Series C financing (more)

Panacea Financial, a financial technology company dedicated to providing financial services to doctors and doctors’ practices, raised $24.5M in Series B funding (more)

ZymoChem, a provider of a carbon-efficient bio-manufacturing platform, raised $21M in Series A funding (more)

Granata Bio, a biopharma company focused on the infertility medication market, raised $14M in Series A funding (more)

Oxford Medical Simulation, a company specializing in virtual reality healthcare training, raised $12.6M in Series A funding (more)

Cyrano Therapeutics, a regenerative medicine company, raised $9.0M in Series B funding (more)

Palm Tree Crew, an entertainment, hospitality, and investment holding company, recently closed a $6M funding round at a $150M valuation (more)

Tandem PV, a company specializing in perovskite solar technology, raised additional $6M in funding (more)

Second Front Systems, a corporation accelerating the delivery of mission-critical solutions in the US/Europe/Australia/NATO, received an investment from Booz Allen Ventures, the venture capital arm of Booz Allen Hamilton (BAH), NEA and Moore Strategic Venture (more)

FUNDRAISING

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

📈 True/False: What’s the ‘January effect’ for stocks? Is it real?

📚 enTitled: Do you have ‘Bookshelf Wealth’?

💼 Now hiring: ‘New-collar’ workers, no degree necessary.

🌴 ‘California Forever’: The new California city backed by Silicon Valley billionaires will be about 18,600 acres (less than half the size of the purchased land).

🥽 Worth it? "I spent the morning with the Apple Vision Pro" — got to experience firsthand what the hype is all about.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.