Good morning.

The Fast Five → Blowout US employment report reinforces economy's resilience, activist Starboard Value takes $1 Billion stake in Pfizer, Bond traders buckle up for ‘no landing’, Apple moves away from annual product releases, and ports rush to reopen after first major strike in decades…

🚨 Wall Street Legend: “Sell this tech stock now"

A message from Chaikin Analytics

Calendar: (all times ET) - Full calendar here

Today: Consumer credit, 3:00 pm

Tomorrow: US trade deficit, 8:30 am

Your 5-minute briefing for Monday, October 7:

US Investor % Bullish Sentiment:

↓ 45.45% for Week of October 03 2024

Last week: 49.62%. Updates every Friday.

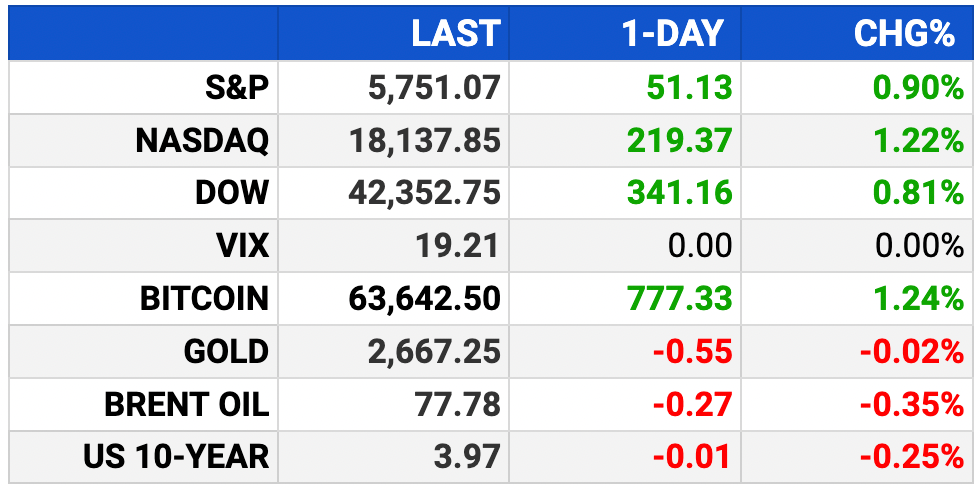

Market Wrap:

Futures steady Sunday after Friday's rally.

Modest weekly gains for all indexes; Dow hit a record high.

Jobs report boosts hope for Fed "soft landing."

"Don’t fight the trend or the Fed" — Truist’s Lerner.

Election & potential volatility are still concerns.

Key data: Fed minutes (Wed), CPI (Thu).

EARNINGS

Earnings we’re watching this week:

Tuesday:

PepsiCo (PEP) - earnings of $2.29 per share (+1.8% YoY), on $23.8B revenue (+1.7% YoY)

Thursday:

Delta Air Lines (DAL) - earnings of $1.55 per share (-23.6% YoY) on $14.77B revenue (+1.5% YoY)

JPMorgan Chase (JPM) - earnings of $4.01 per share (-7.4% YoY) on $41.7B revenue (+5.1% YoY)

See full earnings calendar here.

HEADLINES

Blowout US employment report reinforces economy's resilience (more)

Ports rush to reopen after first major strike in decades is suspended (more)

Inflation is set to reassure a labor market-focused Fed (more)

S&P’s $8 Trillion rally will be tested by tricky earnings season (more)

Dollar on a roll after US jobs data and Middle East flare-up (more)

Markets brace for Middle East oil supply shock (more)

Goldman says surging Chinese stocks may advance another 20% (more)

The EU has voted in favor of massive tariffs on Chinese EVs (more)

Apple slowly moves away from its annual product release strategy (more)

Waymo is first customer for Hyundai AV foundry (more)

Blackstone, Gulf sovereign fund eye private-fund stakes (more)

Wynn Resorts says it gets UAE's first gambling license (more)

A MESSAGE FROM CHAIKIN ANALYTICS

Wall Street Legend Issues New AI Sell Alert

Nearly 1 million people around the world follow 50-year Wall Street veteran Marc Chaikin for his surprisingly accurate stock predictions.

And in the aftermath of the biggest tech selloff since 2022...

He says, "While I predict a select few tech stocks will roar back from here – and potentially soar triple digits – one AI company's day in the sun has come to an end. You must get off this sinking ship - NOW."

Regards,

Kelly Brown

Senior Researcher, Chaikin Analytics

- sponsored message -

DEALFLOW

M+A | Investments

Rio Tinto in talks to buy lithium miner Arcadium (more)

Vista Outdoor strikes deal to sell itself in two parts for $3.4 bln (more)

Activist Starboard Value takes $1 bln stake in Pfizer (more)

Tencent, Guillemot family mulling buyout of Ubisoft (more)

Denmark's DSV raises $5.5B for Schenker acquisition (more)

New York Sun owner nears £550 Million deal for Telegraph (more)

Tempur Sealy sells $1.6 Billion loan for mattress firm purchase (more)

Better Earth, sustainable foodservice packaging solutions, acquired Betterbin, a SaaS platform for recycling and composting education (more)

Spreetail, a global ecommerce company, announced the acquisition of Echo, an AI-powered customer insights platform (more)

SLR, a leader in sustainability solutions, acquired Malk Partners, an ESG advisory firm (more)

SingleStore, a database that empowers users to transact, analyze and search petabytes of data, acquired BryteFlow, a data integration platform (more)

Sysdyne Technologies, cloud-native solutions for ready-mix concrete operations, received a strategic growth investment from Insight Partners (more)

Sporttrade Inc., a sports betting operator, received a strategic investment from SIG Sports Investments (more)

VC

STG Logistics, containerized logistics services, closed a $300M debt and equity financing package (more)

Rippl, a company specializing in virtual dementia care, raised $23M in Series A funding (more)

Voyage AI, a developer of RAG tools to reduce AI hallucination, raised $20M in Series A funding (more)

AirOps, a company that helps marketers build and scale AI growth workflows, raised $15.5M in Series A funding (more)

Valdera, an AI-driven sourcing platform for chemicals and raw materials, raised $15M in Series A funding (more)

Vieu, an AI-powered warm introductions company, raised 11M in funding (more)

Reducto, a startup unlocking data behind complex documents, raised $8.4M in seed funding (more)

Clout Kitchen, a consumer AI startup with operations in L.A. and Manila, raised $4.45M in seed funding (more)

Connected Data, a data-driven debt management tech company, raised £2.2M in funding (more)

City Detect, an AI-powered platform that helps cities identify, manage, and mitigate urban decay, raised $2M in Seed funding (more)

AMAKA Studio, a tech startup specializing the gig economy and creator landscape, raised $2M in Seed funding (more)

Infinite Giving, a proprietary fintech platform for nonprofits, raised $2M in Seed funding (more)

Zive AI Inc., an AI-enabled fund management solution provider, raised $1M in seed funding (more)

CRYPTO

BULLISH BITES

🚨 Wall St. Legend: Man who called AMZN crash issues new well alert *

😱 Turnaround? Lots more on the ongoing mess that is Intel.

😡 Making Enemies: Airbnb arbitrage is Generation Z's latest side hustle.

🏈 Pursuits: From Cleveland to Chicago, NFL teams dream of domed stadiums.

🔊 Futuristic Hi-Fi: Behold the world’s most expensive active speaker system.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.