Good morning.

The Fast Five → Boeing CEO steps down in sweeping management shake-up (read his letter), Trump’s social media company set to trade today on Nasdaq, NYSE delists Fisker, Wall Street lifts S&P 500 target to 5500 by year-end, and cocoa is now more expensive than copper…

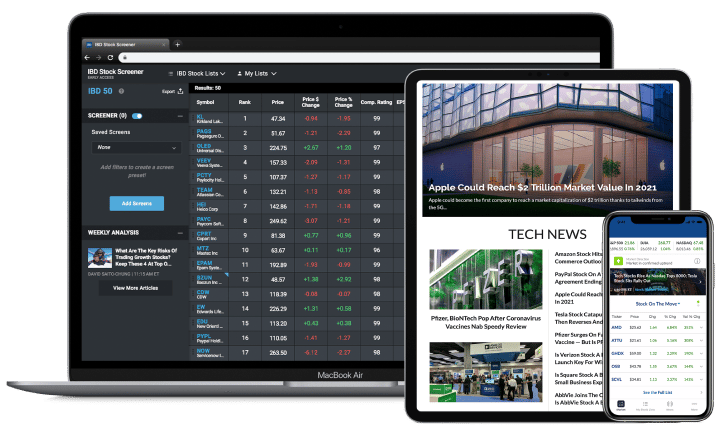

🔥 Exclusive Offer just for MB readers: Grab Investor's Business Daily Premium Annual Subscription today for only $249 ($349 for everyone else) - it’s like getting 5 months free! Act quickly, this is a limited-time offer just for you.

Calendar:

Today: Durable-goods orders, 8:30am ET

Consumer confidence, 10:00 am ET

THU 3/28: Initial jobless claims, 8:30am ET

Consumer sentiment, 10:00am ET

FRI 3/29: MARKET CLOSED (Good Friday)

PCE Index, 8:30am ET

Fed Chair Jerome Powell speaks, 11:30am ET

Your 5-minute briefing for Tuesday, March 26:

US Investor % Bullish Sentiment:

43.20% for Wk of Mar 21 2024 (Last week: 45.90%)

Market Recap:

U.S. stock futures flatline after Monday breather.

Dow edges up 11 points, S&P 500 and Nasdaq-100 add 0.1%.

Major averages dip slightly after last week's records.

March marks fifth winning month for U.S. stocks.

Today's data includes consumer confidence, durable goods orders, and Richmond Fed's manufacturing survey.

EARNINGS

What we’re watching this week:

Wednesday: Jefferies (JEF)

Walgreens Boots Alliance (WBA) - earnings of $.82 per share (-29.3% YoY). Revenue forecast to fall 2.9% to $35.9B.

Full earnings calendar here

HEADLINES

Biden admin announces $6 Billion to slash industrial emissions (more)

Cocoa is more expensive than copper as it tops $9,000 (more)

New home sales fall; median price lowest in more than 2-1/2 years (more)

Oppenheimer lifts S&P 500 target to 5500 on 'remarkable resilience' of US economy (more)

Junk market flashes warning as Fed eyes higher rates for longer (more)

Read Boeing CEO Dave Calhoun’s letter announcing departure (more)

Fisker deal talks with big automaker collapse, NYSE to delist stock (more)

Disney stock upgraded by Barclays as turnaround plan takes shape (more)

Nelson Peltz withholds votes from Disney CEO Bob Iger in proxy battle (more)

Consumers sue Apple, taking page from US Justice Department lawsuit (more)

Reddit options launch draws bulls as shares extend gains (more)

Trump wins pause of $454 million civil fraud ruling, averting asset seizures (more)

Citigroup says CEO's sweeping reorganization complete (more)

California restaurants cut jobs as fast-food wages set to rise (more)

TOGETHER WITH INVESTOR’S BUSINESS DAILY

Ready for next-level investing?

For over 35 years, Investor’s Business Daily has armed people like you with the tools and strategies to consistently outperform the market and prosper — no matter the conditions.

Now, in a single subscription, you can access all their pro-level tools and strategies designed to boost your profits — here’s what you’ll get…

✅ Unlimited Access to IBD Digital across platforms and devices

✅ Access to 14 exclusive IBD stock lists

✅ Recommended portfolio exposure levels to help manage risk

✅ Proprietary investing tools & IBD ratings for 5,000+ stocks

✅ Access to the IBD Stock Screener and IBD Stock Checkup® tools

✅ Educational webinars, podcasts, videos and much more…

“Investor’s Business Daily delivers information you

can’t get anywhere else.” -Mike G., subscriber

🔥 Exclusive Offer for MB readers: Grab IBD's Premium Annual Subscription today for only $249 ($349 for everyone else) - it’s like getting 5 months free! Act quickly, this is a limited-time offer you won’t find anywhere else.

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Blackstone reportedly eyes $1.9B sale of The Office Group (more)

Novo Nordisk strikes $1.1B deal to expand cardio business (more)

Qualcomm ends Autotalks deal over antitrust concerns (more)

Goldman Sachs mulls €3.5 Billion sale of B&B hotels chain (more)

Arsenal-led investor group acquires Poly-Wood (more)

Ingersoll Rand purchases ILC Dover from New Mountain Capital (more)

Nuvation Bio buys AnHeart Therapeutics (more)

Amex GBT acquires CWT (more)

Gilead Sciences (GILD), a biopharmaceutical company, acquired CymaBay Therapeutics, Inc. (CBAY), a company focused on innovative therapies for patients with chronic diseases, for approximately $4.3B in total equity values (more)

VC

Ediphi, an advanced cloud-based estimating solution, raised $12M in Series A funding (more)

Succinct, a developer of zero-knowledge proof tools, raised $55M in seed and Series A funding (more)

Edgewood Oncology, a clinical-stage biotech company focused on delivering BTX-A51 to patients with hematologic malignancies, raised $20M in Series A funding (more)

Finite State, a company specializing in comprehensive software risk management, raised $20M in Growth funding (more)

Circular, a provider of a sustainable sourcing platform, raised $10.5M in funding (more)

Goalsetter, a provider of a spending, saving, wealth building and financial education platform, raised $9.6M in Series A funding (more)

Foundational, a provider of a solution using advanced analysis to identify and prevent data issues in data platforms, raised $8M in Seed funding (more)

Airvine, a company developing a multi-Gigabit-speed wireless backhaul system, raised $6.2M in funding (more)

LIS Technologies Inc., a proprietary developer of advanced laser tech and only USA-origin patented laser uranium enrichment company, closed a $1.3M seed funding round (more)

Coker, a healthcare advisory firm, received an investment from Trinity Hunt Partners (more)

Aura Intelligent Systems, a digital imaging radar company, received an investment from Telechips (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

👀 Deeper look: Behind the plot to break Nvidia’s grip on AI by targeting software.

⚖️ The scoop: Trump's $464M bond reduced in NY civil fraud case.

💔 Shards of glass: Inside media's 12 splintering realities.

🛥 Keeping up with the Bezoses: Check out Zucks new $300M super yacht.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here »

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.