Good morning.

The Fast Five → Boeing hit by damning report, Jamie Dimon says AI is not just hype, FTC sues to block Kroger/Albertsons merger, Google steps up Microsoft criticism, and Bitcoin breaks $57,000 as big buyers circle…

Calendar: (all times ET)

Today: Durable-goods orders, 8:30a

Consumer confidence, 10:00a

Wed, 2/28: GDP, 8:30a

Thu, 2/29: Personal Consumption Expenditures (PCE), 8:30a ET

Fri, 3/1: Consumer sentiment (final), 10:00a ET

Your 5-minute briefing for Tuesday, February 27:

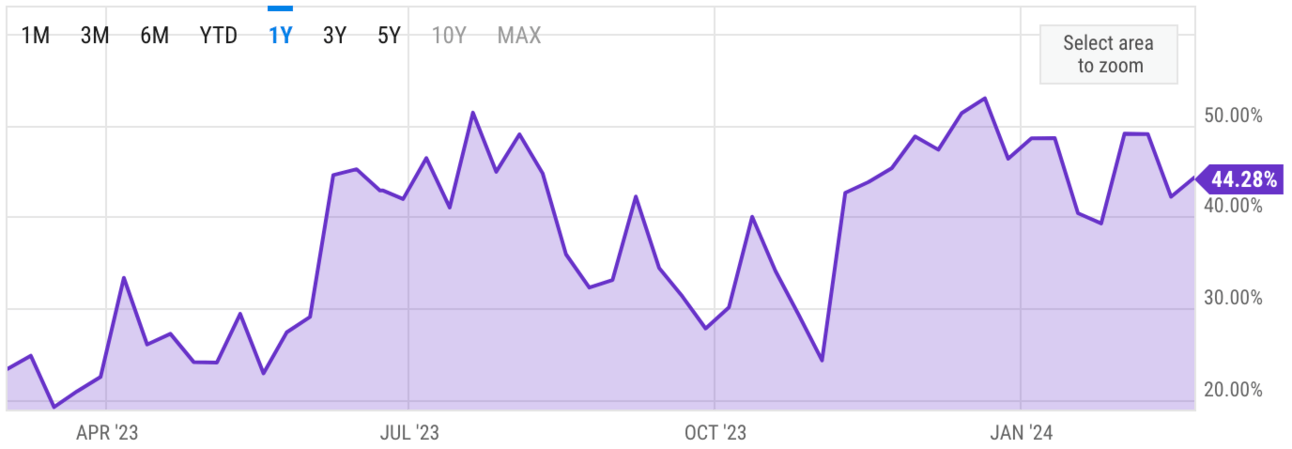

US Investor % Bullish Sentiment:

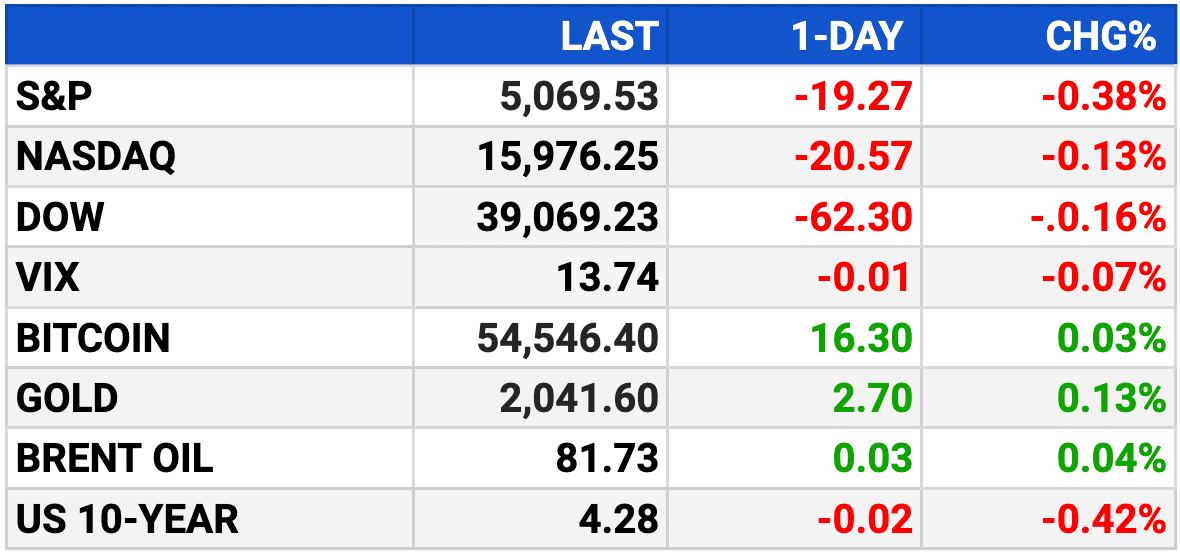

Market Recap:

S&P 500 dips 0.38%, Nasdaq down 0.13%, Dow slips 0.16%

Amazon joins Dow, replacing Walgreens Boots Alliance

Treasury yields edge up, 10-year at 4.276%

Stocks retreat after record highs, fueled by Nvidia earnings

Investors eye AI momentum amid economic and inflation concerns

January new home sales miss estimates at 661,000

Economic releases: January durable orders, wholesale inventories, consumer spending, PCE data

EARNINGS

What we’re watching this week:

Today: eBay (EBAY), VIZIO (VZIO)

Macy's (M) - earnings of $1.96 per share, (+14.6% YOY) on $8.2B revenue (-1.3% YoY)

Wednesday: Duolingo (DUOL)

Salesforce (CRM) - earnings per share of $2.09 (+24.4% YoY) on revenue of $8.5B (+1.6% YoY)

Thursday: Anheuser-Busch InBev (BUD)

Birkenstock (BIRK) - earnings per share of 10 cents on $312.4M in revenue

Full earnings calendar here

HEADLINES

Fed's Schmid: No need to 'preemptively' cut rates (more)

Yellen says global economy remains resilient, lauds US as growth driver (more)

Aviation safety panel finds Boeing culture included safety ‘gaps,’ fear of retaliation (more)

FTC sues to block Kroger, Albertsons merger, arguing it would raise grocery prices and hurt workers (more)

FTC complaint alleges H&R Block used deceptive marketing and unfairly deleted tax filer data (more)

Oil gains over $1 on possible shipping disruptions (more)

'Slam dunk' Treasury trade becomes test of patience as yields march higher (more)

Nvidia bets dominate US options market as AI fervor grows (more)

Soaring Japanese equities offer investors cozy distance from troubled China (more)

Altice USA spikes 50% on report Charter considering acquisition (more)

Alphabet drops during renewed fears about AI offerings' (more)

Google steps up Microsoft criticism, warns of rival's monopoly in cloud (more)

Shein considers London IPO amid US resistance to listing (more)

Disney activist demands AI strategy to boost shares (more)

41 locations of Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill and Fleming's to close (more)

A MESSAGE FROM GOLDENCREST METALS

Brace for Impact: Don't Be Fooled By The Mainstream Media

We're raising the alarm – Jamie Dimon of JPMorgan has just forecast a colossal economic disaster for 2024-2025. We're facing a potential collapse, with chaos from Ukraine to the Middle East, and the Federal Reserve gambling with our financial future.

Make no mistake – this is a battle for your survival. The U.S. debt is skyrocketing, posing an unprecedented threat. Even Wall Street giants are scared. The "booming" stock market? It's a bubble on the brink of bursting, and the media is painting a rosy picture – don't buy it!

Take control now. Our No-Cost Wealth Management Guide isn't just advice – it's your survival kit in this economic battlefield.

Don't be a spectator in this economic showdown. Get your no-cost guide NOW.

To your unshakeable prosperity,

-GoldenCrest Metals

Tip: If email is clipped by Gmail click “read online” in the top right corner

DEALFLOW

M+A | Investments

KKR to acquire VMware’s end-user computing biz from Broadcom for $4B (more)

Charter Communications weighs takeover of Altice USA (more)

UniCredit weighs acquisition of Warburg-backed Vodeno (more)

Billionaire Niel to buy $1.3 Billion stake in Sweden’s Tele2 (more)

CSR agrees to $3 Billion takeover by French rival Saint-Gobain (more)

Apollo considers merger for job-search website CareerBuilder (more)

Jasper, a generative AI app company, acquired Clipdrop, a provider of an AI image creation and editing platform (more)

Nautic Partners acquired SurfacePrep, a national and int'l distributor of surface enhancement solutions (more)

InsightRX, a software company leveraging pharmacology and AI, received Growth financing from CIBC Innovation Banking (more)

The Benecon Group, a developer of self-funded medical benefit programs for small/medium sized businesses, received a minority investment from Neuberger Berman (more)

VC

b.well Connected Health, a company empowering platform-enabled healthcare ecosystems, raised $40M in Series A funding (more)

mTab, a market insights platform provider, closed a $15M growth credit financing (more)

NLX, a provider of an end-to-end enterprise AI platform to power customer experiences for large and enterprise brands, raised $12M in Series A funding (more)

Power, a clinical trial marketplace, raised $12M in Series A funding (more)

FlowGPT, a platform fostering an open ecosystem for AI application creators and community, raised $10M in Pre-Series A funding (more)

Interview Kickstart, an education platform that enables working professionals to learn the skills required to achieve careers at tech companies, raised $10M in funding (more)

Prowler, an open cloud security company, raised $6M in Seed funding (more)

Myko AI, a developer of conversational AI for sales and revenue team data, raised $2.7M in Seed funding (more)

Mobly, a mobile software company, raised $2.5M in Seed funding (more)

Ad-Shield, a provider of adblock recovery solutions, raised $2M in Pre-Series A funding (more)

IPO

Abu Dhabi’s Multiply buys media firm in preparation for Unit IPO (more)

CRYPTO

BULLISH BITES

🏹 vs Goliath: The 9-month-old AI startup challenging Silicon Valley’s giants.

💾 Flop rock: Inside the underground floppy disk music scene.

👋 Movin’ out: Gen Z can save money by living with their parents -- but pays for it emotionally.

🚤 Mod vessel: A 570 horsepower electric wake boat.

🎥 Video: Why widespread tech layoffs keep happening despite a strong US economy.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.