☕️ Good Morning.

The Fast Five → Fed Chair Powell to deliver key speech @ noon ET, Biden pledges solidarity for Israel in visit to Tel Aviv, OpenAI in talks to sell shares at $86B valuation, ‘bond math’ shows bet on Treasurys could reap dazzling returns, and Amazon begins delivering medications by drone…

Here’s your 5-minute MarketBriefing for Thursday:

BEFORE THE OPEN

As of market close 10/18/2023.

MARKETS:

Stocks drop as earnings season progresses and yields surge.

Dow falls 0.98%, S&P 500 slides 1.34%, Nasdaq drops 1.62%.

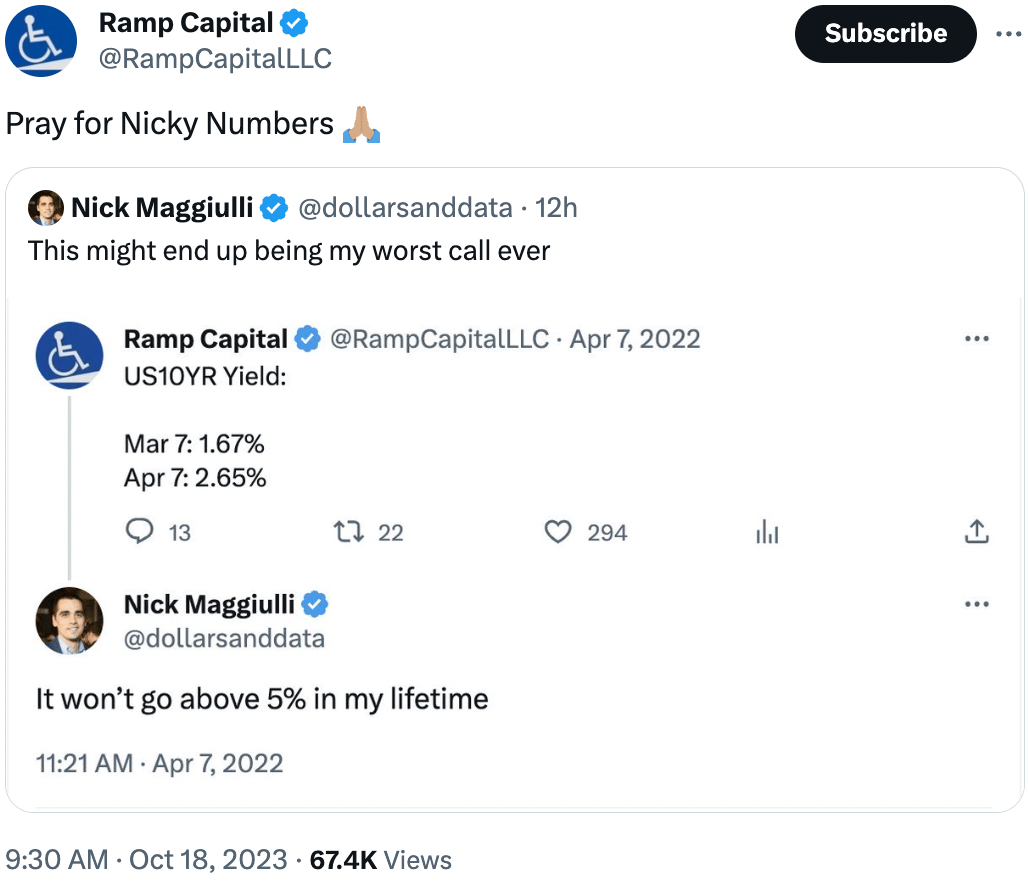

10-year Treasury yield surpasses 4.9%, highest since 2007; 30-year fixed mortgage rate hits 8%, highest since 2000.

J.B. Hunt and United Airlines decline due to earnings misses, while Procter & Gamble rises after beating expectations.

Over 10% of S&P 500 firms reported results, with about 78% surpassing analyst expectations.

Investors shift focus to revenue growth during earnings season.

Chip stocks like Nvidia and Advanced Micro Devices struggle following U.S. plans to tighten AI chip sales to China.

Wall Street monitors the ongoing Israel-Hamas war, with President Biden's visit to show solidarity.

EARNINGS

NEWS BRIEFING

Fed Chair Powell to deliver key speech today: Here’s what to expect (more)

Israel War Latest:

U.S. providing missiles to Ukraine ‘a mistake,’ Putin says; Russia and China ‘exchange views (more)

Jim Jordan loses second House speaker vote, as GOP weighs dwindling options (more)

10-year Treasury yield breaks above 4.9% for the first time since 2007 (more)

The 30-year fixed mortgage rate just hit 8% for the first time since 2000 as Treasury yields soar (more)

Bad news for commercial real estate: Architects report a big drop in business (more)

U.S. income inequality grew through pandemic years, Fed survey shows (more)

Health insurance premiums now cost $24,000 a year, survey says (more)

OpenAI is in talks to sell shares at an $86 billion valuation (more)

The ‘Ozempic effect’ is coming for everything — from kidney to heart disease treatments (more)

Walmart beefs up its third-party marketplace as it challenges bigger online rival Amazon (more)

Top Apple analyst says MacBook demand has fallen ‘significantly’ (more)

ChatGPT can now respond with images and search the web (more)

Amazon begins delivering medications by drone in Texas (more)

Amazon tests humanoid robot in warehouse automation push (more)

X, formerly Twitter, tests charging new users $1 to tweet, retweet (more)

PaintJet puts robots to work in construction and maintenance as labor shortage drags on (more)

The venture market is overcorrecting (more)

TOGETHER WITH IBD’s MARKETSMITH

Get the most powerful platform available.

And it doesn’t cost $1,000+ per month unlike other professional software and terminals. IBD’s MarketSmith gives you all the premium features in ONE platform at a fraction of the price.

Even better? You won’t pay extra to access the powerful database or features like algorithmic Pattern Recognition—they’re all included. Give MarketSmith a try and get 6-weeks for just $49.95 (save $175!) - limited time only.

DEALFLOW

Gridiron Capital, LLC, an investment firm focused on partnering with founders, entrepreneurs, and management teams, closed Gridiron Capital Fund V and its affiliated funds (“Gridiron V”), at $2.1B (more)

P&G to weigh $1 billion sale of VS Sassoon’s China business (more)

Warburg-backed Princeton Digital to raise $1B in debt (more)

Tillman Infrastructure is seeking a $500M capital injection (more)

Vanguard sells stake in Ant joint venture, accelerating China exit (more)

Infineon signs semiconductor supply deal with automakers Hyundai, Kia (more)

AutoNation drops bid for UK auto dealer Pendragon (more)

Actym Therapeutics, a provider of a new drug modality to treat solid tumors, raised $59.5M in Series A funding (more)

Darwinium, a provider of a digital security and fraud prevention platform, raised $18M in Series A financing (more)

Objective, a provider of an outcome-driven search platform, Objective Search, raised $13M in funding (more)

Scorability, a provider of a platform for matching athletes with college athletics programs, raised $11M in Seed funding (more)

HawkEye 360, a defense technology company for space-based radio frequency (RF) data and analytics, raised additional $10M in Series D-1 funding (more)

Allara, a provider of a virtual care platform, raised $10M in Series A funding (more)

Providence invests in Populous (more)

Gero, a biotechnology company focused on aging and chronic diseases, closed $6M in a Series A extension round (more)

Hallmark Health Care Solutions, a healthcare technology company specializing in workforce management solutions, received a growth Investment of undisclosed amount (more)

Parhelia Biosciences, a company specializing in sample preparation for tissue staining and spatial analysis, raised an undisclosed amount in Series A funding (more)

Matic, an embedded insurtech platform provider, raised $20M as an extension to its Series B (more)

Perch Energy, a clean energy technology platform and community solar servicer that connects solar developers with consumers, raised $30M in Series B funding (more)

Bedrock Energy, a technology startup that designs, constructs, and delivers geothermal heating and cooling systems, raised $8.5M in Seed funding (more)

Carefull, a provider of an AI-powered financial safety platform, raised $16.5M in Series A funding (more)

M & A:

L Catterton-backed Hydrow in talks to acquire rival Cityrow (more)

Australia's Mirvac to acquire land lease operator Serenitas for $643M (more)

Stax Payments, a payment technology provider, acquired Atlantic-Pacific Processing Systems (Apps), a provider of a digital platform delivering real-time data (more)

Whitehaven buys Coking coal mines from BHP (more)

Havencrest Homecare acquires WCHC (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

⏳ The Art of the 15-Minute Meeting → WSJ

If your next meeting can’t be an email, maybe it can just be 15 minutes.

🏃🏻♂️ What Fast-Moving Companies Do Differently → HarvardBR

Speed has now become a true strategic advantage. And it’s a critical driver of the resilience companies today are working hard to build.

👑 JFK Is Getting the ‘Crown’ Treatment in a Netflix Series → RobbReport

Forget the Windsors. It’s the Kennedy family’s time to shine.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb