Good morning.

The Fast Five → Global bond tantrum is worrisome start to new year, inflation report could rattle markets further, Trump’s new economist makes the case for 20% tariffs, Bezos sees no threat in space race, and Zuck slams Apple on its lack of innovation…

📈 Quantum computing may soon leapfrog today's technology in the same way the microchip decimated room-sized conventional computers.

And one tiny $800 million firm could hold the keys to this total disruption.

- Behind The Markets

Reader Sentiment: What’s Your Short-Term Outlook on the Market?

🟩🟩🟩🟩🟩🟩 📈 BULLISH 62%

🟨🟨🟨🟨⬜️⬜️ 📉 BEARISH 38%

Results from Sunday’s poll

Comments:

📉 “Two years of 20% plus growth is unsustainable for a third year. P/E ratios are at all-time highs. M2 money supply is just now recovering from COVID, so most of the activity preceding ~October '24 is anomalous. Yield curve is still inverted, in the short term. Commercial real estate defaults and refinancings are still pending, possible causing serious financial woes in big cities; without interest rate relief, defaults could be tragic. China is getting ready to flood the market with cheap goods, from air conditioners to cars. Stagflation is on the way.”

📈 “I think in the short run the market will be volatile but over the continuation of the year I suspect it will be better.”

📉 “Bond market says so!”

Calendar: (all times ET) - Full calendar

Today:

Monthly federal budget, 2:00P

Tomorrow:

Producer price index, 8:30A

Fed Beige Book, 2:00P

Your 5-minute briefing for Monday, January 13:

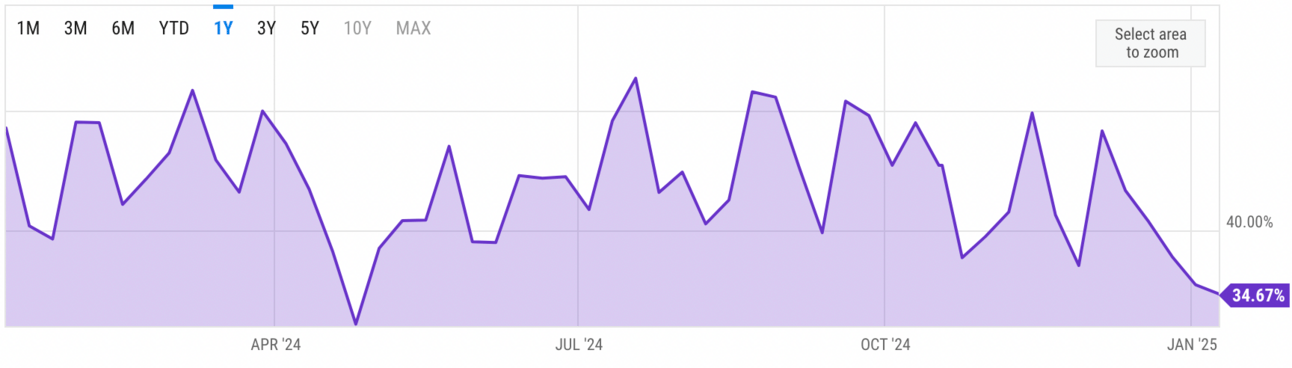

US Investor % Bullish Sentiment:

↓ 34.67% for Week of January 09 2025

Previous week: 35.44%. Updates every Friday.

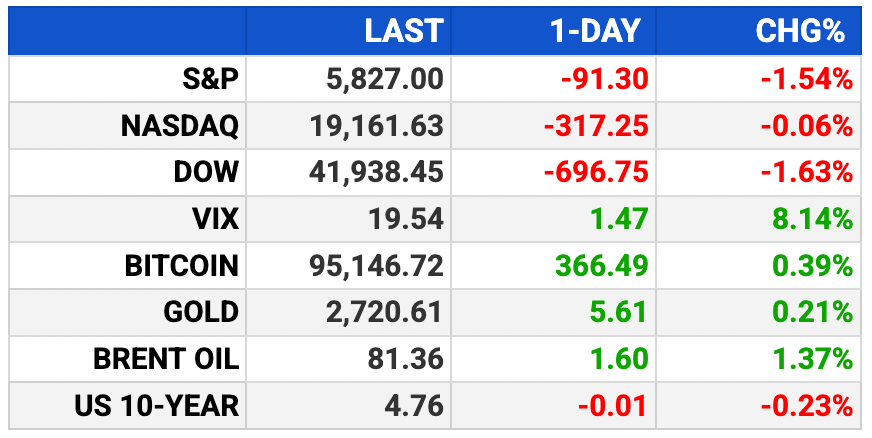

Market Wrap:

Stock futures flat ahead of data-heavy week.

Last week: Dow, S&P -1.9%, Nasdaq -2.3%.

Key reports: CPI (Wed), PPI (Tue), big banks' earnings start Wed.

Fed likely to hold rates steady amid inflation concerns.

EARNINGS

Here’s what we’re watching:

JP Morgan Chase (JPM) - earnings of $4.04 per share (-7.6% vs Q3 and up 32.9% from Q4 2023) on $41.5B revenue

UnitedHealth (UNH) - earnings of $6.75 per share (+9.6% YoY) on $101.8B revenue (+7.7% YoY)

Friday:

SLB (SLB) - earnings of $.90 per share (+4.7% YoY) on $9.2B revenue (+2.2% YoY)

HEADLINES

Biden delays enforcement of order blocking Nippon Steel, U.S. Steel deal (more)

IMF chief sees steady world growth in 2025, continuing disinflation (more)

Surprising Dec US payrolls jump supports longer Fed pause (more)

Towering dollar after solid jobs data leaves peers struggling (more)

Oil hits more than 3-month high as US sanctions hit Russia exports (more)

US sanctions on Russian oil to hit China and India hard (more)

China, UK resume economic talks after 6-year hiatus (more)

Trump’s new economist makes the case for 20% tariffs (more)

Jamie Dimon says tariffs can help resolve competition, security issues (more)

US bank regulator gives BlackRock February deadline on bank stake (more)

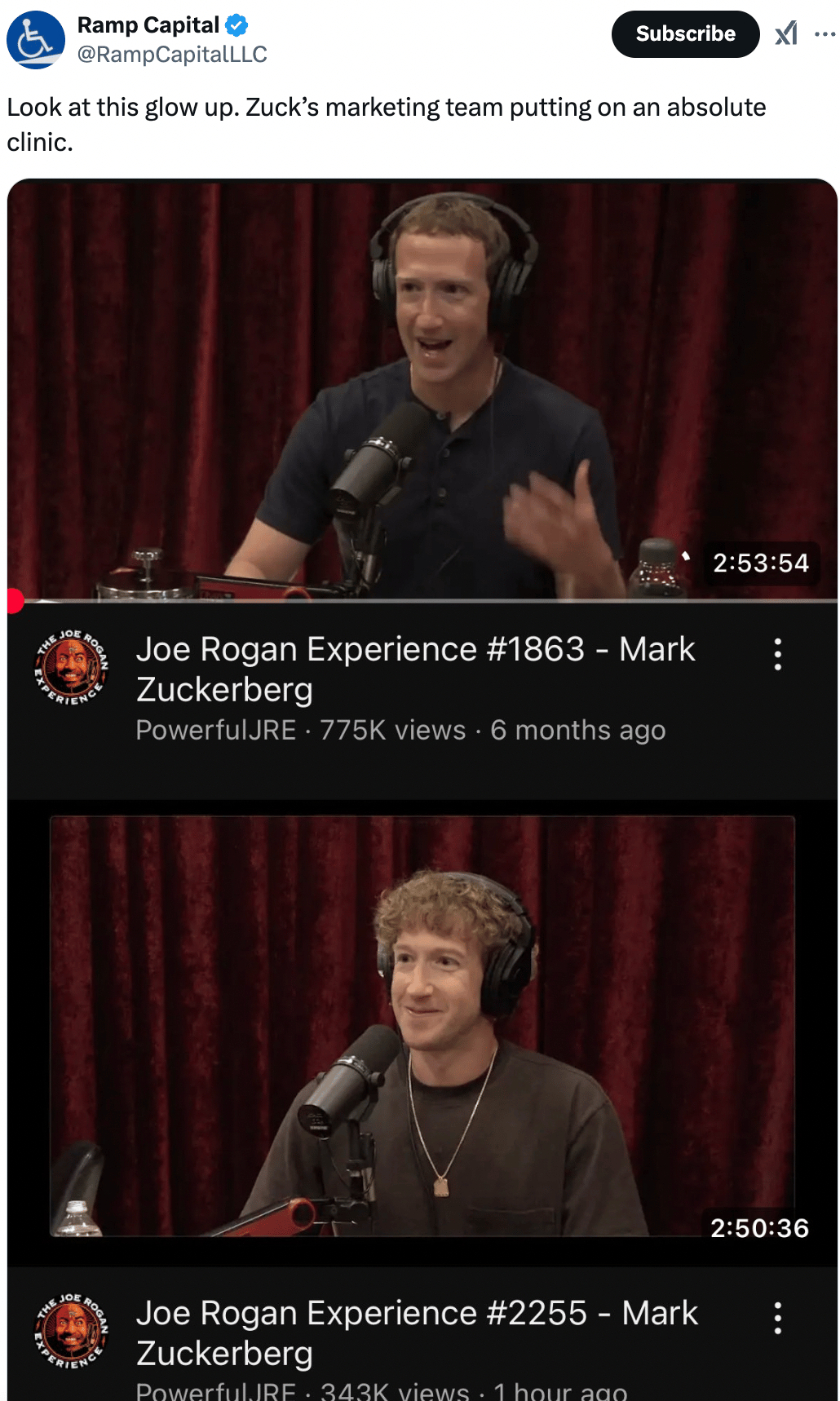

Zuckerberg slams Apple on its lack of innovation and ‘random rules’ (more)

Bezos sees no threat from Musk-Trump ties in space race (more)

A MESSAGE FROM BEHIND THE MARKETS

AI is converging with another breakthrough technology...

Which could cause a second wave of massive AI profits.

Already, we've seen stocks in a tiny AI subsector soar 133% in 15 days...

496% in 10 weeks...

And 604% in 8 weeks.

So if you've missed out on the first wave of big AI profits...

Simmy Adelman, Publisher

Behind the Markets

DEALFLOW

M+A | Investments

J&J in talks to buy $10 billion biotech Intra-Cellular (more)

Blackstone mulls $4 bln-plus sale of Liftoff (more)

Bain Capital raises bid for Australia's Insignia to $1.8B, matches CC Capital (more)

Biogen proposes buying remaining stake in Sage in $442M deal (more)

Intercontinental Exchange, a global provider of tech and data, acquired the American Financial Exchange (AFX), an electronic exchange for direct lending and borrowing for American financial institutions (more)

VC

Origis Energy, a renewable energy and decarbonization solution platform, raised $415M in funding package for the Swift Air Solar project in Texas (more)

Innovaccer Inc., a healthcare AI company, raised $275M in Series F funding round (more)

Timberlyne Therapeutics, a clinical-stage biopharma company focused on the development of autoimmune therapies, raised $180M in Series A funding (more)

Ouro Medicines, a biotech company developing immune reset therapeutics, launched with $120M in Series A funding (more)

A2 Biotherapeutics, a clinical-stage cell therapy company developing logic-gated cell therapies, raised $80M in Series C funding (more)

Light Horse Therapeutics, a developer of small molecule therapeutics, raised $62M in Series A funding (more)

Air, a purpose-built platform for creative operations, raised $35M in Series B funding (more)

PrettyDamnQuick, an operational data platform for profitable commerce, raised $25M in Series A funding (more)

RLTYco, a provider of comprehensive resources for real estate professionals, raised $20M in Series A funding (more)

RheumaGen, a cell and gene therapy company, raised $15M in Series A funding (more)

Nema Helath, a solution for virtual trauma and PTSD care, raised $14.5M in Series A funding (more)

Biosphere, a startup developing advanced bioproduction systems, raised $8.8M in Seed funding (more)

Prudentia Sciences, an AI-powered technology platform for life sciences, raised $7M in funding (more)

Abstract, an AI company developing a legislative and regulatory platform, raised $4.8M in Seed funding (more)

CRYPTO

BULLISH BITES

😔 The psychological toll of California's catastrophic fires.

📈 Dozens of Congress members outperformed the stock market in 2024. Here’s who gained the most - and why.

👍 After nearly 100 episodes, here are the five best pieces of founder advice I learned as a host of Found.

🚷 Detour: Massachussetts road signs.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.