☕️ Good Morning.

The Fast Five → Pentagon pushing U.S. defense industry to bolster Israel, worst bond selloff since 1787 marks end of free-money era, consumers starting to buckle for first time in a decade, gold holds gains, and french fries signals good news for economy…

Here’s your 5-minute MarketBriefing for Tuesday:

BEFORE THE OPEN

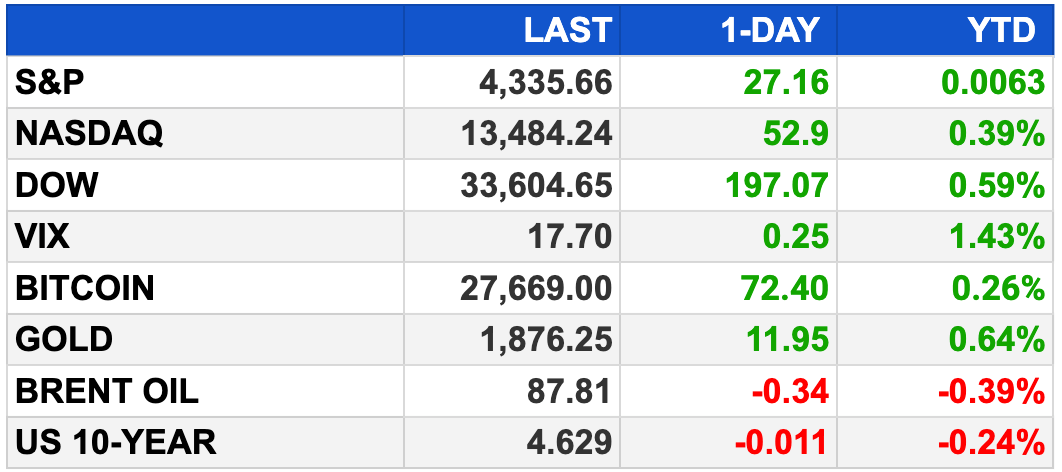

As of market close 10/9/2023.

MARKETS:

U.S. stock futures near flatline as Israel-Hamas conflict impact assessed.

Dow Jones futures flat, S&P 500 futures down 0.01%, Nasdaq 100 futures up 0.07%.

Monday's trading saw stocks initially lower, then turning positive.

Dow adds 197 points (0.6%), Nasdaq Composite gains 0.4%, S&P 500 adds 0.6%.

Energy and defense stocks surge as crude prices rise over 4%.

Hamas-Israel conflict leads to concerns about potential sanctions on Iran affecting global oil supply.

Investors await NFIB Small Business Survey data, August wholesale inventories, and PepsiCo earnings.

EARNINGS

Here’s what we area watching this week:

Today: PepsiCo (PEP)

Thursday: Delta Air Lines (DAL)

Friday: Wells Fargo (WFC), BlackRock (BLK), Citigroup (C)

NEWS BRIEFING

Pentagon pushing U.S. defense industry to bolster Israel in fight against Hamas (more)

Hamas official says group is open to discussions over truce with Israel (more)

Here’s what you need to know about the big jobs report Friday (more)

Long bonds’ historic 46% meltdown rivals burst of dot-com bubble (more)

Gold holds gains as markets mull rate pause, Middle East Crisis (more)

Consumers still order french fries with meals, signals good news for U.S. economy (more)

China targets 50% boost in computing power as AI race with U.S. ramps up (more)

Bank of America’s wrong-way rate bet hurts Moynihan’s growth pledge (more)

Hollywood writers ratify new contract with studios (more)

U.A.W. workers at Mack Truck go on strike (more)

Google announces new generative AI search capabilities for doctors (more)

Amazon takes on Starlink with satellite internet launch (more)

ChatGPT’s mobile app hit record $4.58M in revenue last month, but growth is slowing (more)

Cruise prices are way up as operators meet surging travel demand (more)

Activist investor Nelson Peltz seeks board seats at Disney (more)

How New York City is planning to spend $15 billion raised from a new congestion pricing toll (more)

DEALFLOW

Regent Craft, a manufacturer of all-electric seagliders, raised $60M in Series A funding (more)

Viewpoint Ventures, a venture capital firm focused on the future of insurance, launched with the close of its Viewpoint Fund I, at nearly $150M (more)

Glydways, a company develping an on-demand Personal Rapid Transit (PRT) system, raised $56M in Series B funding (more)

Sensigo, an AI-powered automotive data platform startup, raised $5M in seed funding (more)

Class Companion, an AI platform that empowers teachers to give instant, personalized feedback to students, publicly launched with $4M in seed funding (more)

SpecCheck, a startup that provides optical billing and customer management tools, raised $3.7M in seed funding (more)

Optilogic, a supply chain network design software company, secured a funding round of undisclosed amount (more)

CropX Technologies, a company specializing in digital solutions for agronomic farm management, received an investment from Neutre Impact in Series C funding (more)

First Resonance, a manufacturing software startup, received an investment from Emerson Ventures (NYSE: EMR) (more)

M & A:

HSBC buys Citi’s $3.6 Billion China retail assets in expansion (more)

BlackRock, Grain near purchase of Phoenix Tower Stake (more)

Prosperity Life Group’s SUSA acquires National Western for $1.9B (more)

Capital Square, Itochu purchase Build-for-Rent Community in Texas (more)

QHP Capital buys Applied StemCell (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

U.S. dollar ‘collapse’—shock $8 trillion predicted Fed inflation flip to spark a ‘critical’ Bitcoin, Ethereum, XRP and Crypto price boom to rival gold (more)

FTX’s Gary Wang tells court Alameda got ‘special privileges’ to exchange’s funds (more)

3 reasons why Ethereum price can't break $2K (more)

Binance launches new domain in UK ahead of new financial promotions regime (more)

Ripple CTO seeks community consensus for XRPL AMM feature adoption (more)

BULLISH BITES

👞 Birkenstock IPO: Is it Worth $10B? → Trung

And 4 other questions about the 249-year cult German footwear brand.

🚀 Meet the 24 New Startups in Techstars Seattle, as Accelerator Doubles Class Size? → Geekwire

This year’s cohort is made up of industry vets from diverse fields like healthcare and robotics. Founders hail from large tech companies such as Meta, Microsoft, and Nordstrom.

😬 When Startups Lose a Very Early Employee, They May Never Recover → WSJ

A study also found that when an employee hired in the startup’s second year leaves, the impact is minimal.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb