Good morning.

The Fast Five → Oil markets brace for shock after US attack on Iran, US calls on China to prevent Iran from closing Strait of Hormuz, Dow/S&P/Nasdaq futures slide, Wolfspeed files for bankruptcy, and Tesla rolls out robotaxis in Texas test…

The Pentagon Has an Antidote to Oil Wars

While the stock market trembles at the thought of soaring gas prices... Guess what?

The Pentagon is focusing on a quiet discovery deep under the Utah desert. A discovery that could protect us all from "wartime" energy prices — get the details here *

Calendar: (all times ET) - Full Calendar

Today:

Existing home sales, 10:00A

Tomorrow:

Consumer confidence, 10:00A

Powell testifies to House Financial Services Committee, 10:00A

Your 5-minute briefing for Monday, June 23:

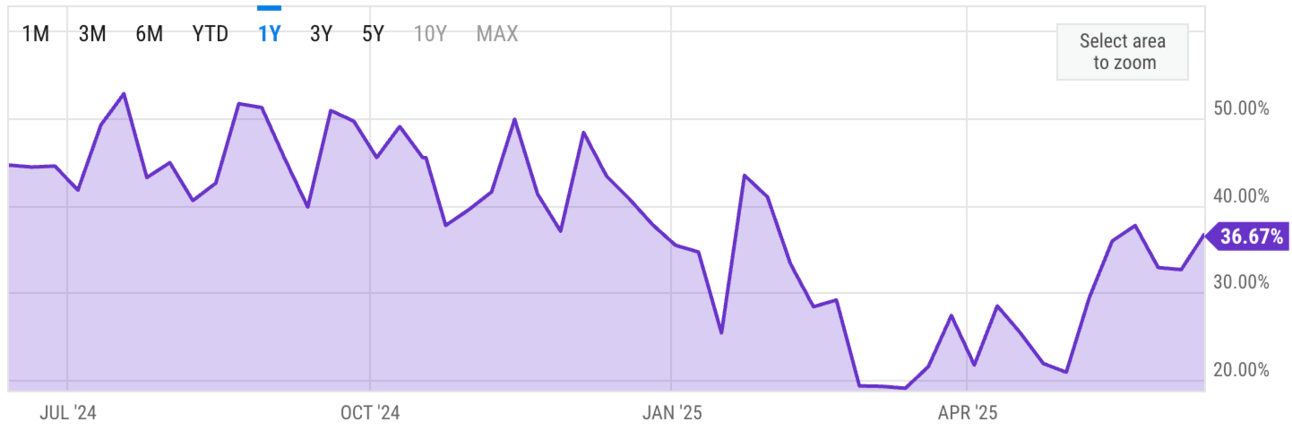

US Investor % Bullish Sentiment:

↑ 36.67% for Week of JUN 12 2025

Previous week: 32.66%.

Market Wrap:

• Dow futures -109 pts (-0.3%); S&P -0.3%; Nasdaq 100 -0.4%

• US enters Israel-Iran war, strikes 3 Iranian nuclear sites

• Oil futures +3.8% to ~$77; risk of $100+ if Strait of Hormuz is blocked

• Trump: “There will be either peace, or there will be tragedy for Iran”

• Rubio urges China to pressure Iran to keep key trade route open

• Conflict shifts oil price baseline to $80s range, analysts say

• S&P lost 0.15% last week, now ~3% from record high

EARNINGS

Light earnings week. Here’s what we’re watching:

Today: KB home $KBH ( ▲ 0.76% )

Tuesday:

FedEx $FDX ( ▲ 1.39% ) - $5.85 eps (+8.1% YoY), on $21.8B revenue (-1.3% YoY)

Wednesday: General Mills $GIS ( ▼ 0.4% ), Jefferies $JEF ( ▲ 0.49% )

Micron Technology $GIS ( ▼ 0.4% ) - $1.59 eps (+156.4% YoY) on $8.8B revenue (+29.7% YoY)

Thursday: McCormick $MKC ( ▲ 0.02% )

Nike $NKE ( ▼ 0.32% ) - $.12 eps (a notable drop from $.99 eps earned in the year-ago period. Revenue declined 15.1% to $10.7B

When billionaires like Bill Gates, Jeff Bezos, Warren Buffett, and Mark Zuckerberg all quietly bet on the same thing...you should pay attention.

HEADLINES

US Urges China to Prevent Iran from Closing Strait of Hormuz, Disrupting Oil

Dow, S&P 500, Nasdaq futures slide, oil rises after US strikes on Iran (more)

Options Traders Wrestle With Stocks’ Muted Reaction to War Risk (more)

Dollar firms as markets brace for Iran response to US attacks (more)

Gold edges higher in Asia after US joins Israeli attacks on Iran (more)

Gulf markets end higher, shielded from turmoil after the US strike on Iran (more)

Tesla rolls out robotaxis in Texas test (more)

US strikes in Iran spark airline cancellations and travel turmoil (more)

Meta approached Perplexity before massive Scale AI deal (more)

Social Security cost-of-living adjustment may be 2.5% in 2026 (more)

US semiconductor maker Wolfspeed to file for bankruptcy (more)

Kroger to close around 60 stores nationwide over next 18 months (more)

DEALFLOW

M+A | Investments

Haveli Investments to buy Couchbase for ~$1.5B

Commerce Bancshares to acquire FineMark for $585M

Redwire acquires Edge Autonomy

HG Insights acquires TrustRadius

Tron to go public via reverse-merger with SRM

NovaSpark Energy, a provider of mobile hydrogen generation systems, received an investment from Boot64 Ventures

VC

Juniper Square, a provider of connected fund software and services, closed its Series D round at a $1.1B valuation, raising $130M

Slide, a BCDR platform for MSPs, raised $25M in Series A funding

Sedai, a self-driving cloud company, raised $20M in Series B funding

Paradigm Therapeutics, a biopharmaceutical company, received an additional investment of $12.6M from Eshelman Ventures

Alta, a personalized styling companion service, raised $11M in Seed funding led

Warp, a tech-powered middle-mile logistics company, raised $10M in Series A funding led by Up.Partners and Blue Bear Capital

SportsVisio, a sport analytics platform for athlete, coach, and fan, raised $3.2M in additional funding

CRYPTO

BULLISH BITES

🚨 This could be the antidote to "wartime" energy prices. *

✅ Circle gets buy rating after Senate passes stablecoin bill.

🤔 AQR’s Cliff Asness sides with Jim Chanos in critique of Michael Saylor’s strategy.

🤖 How Christian Klein’s AI bet turned SAP into Europe’s most valuable company.

✍️ Weird-shaped notebooks make me want to write again.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.