☕️ Good Morning.

The Fast Five → Blinken emphasizes ‘deep commitment’ to Israel after talks, Biden to visit Israel tomorrow in effort to avoid escalation, Yellen says U.S. can afford financial support to both Israel and Ukraine, big-money funds are betting against credit, and time is running out for ‘Year of the Bond’ as losses mount…

Here’s your 5-minute MarketBriefing for Tuesday:

BEFORE THE OPEN

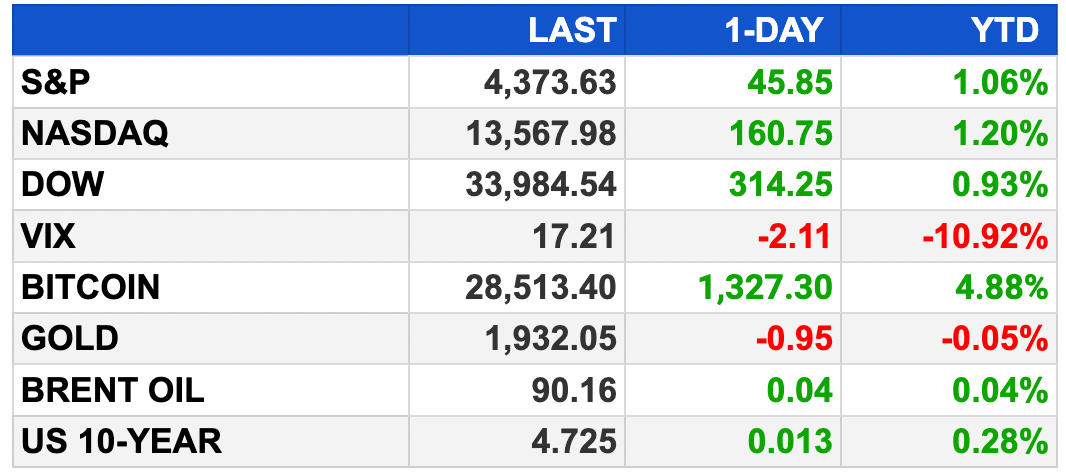

As of market close 10/16/2023.

MARKETS:

U.S. stock futures edge higher as earnings season progresses.

Dow, S&P 500, and Nasdaq rose despite higher Treasury yields.

Small caps, Russell 2000, gained 1.6%.

53 S&P 500 companies and five Dow firms set to report earnings.

Notable reports today: Johnson & Johnson, Bank of America, Goldman Sachs, and Lockheed Martin.

Strong earnings from Charles Schwab and JPMorgan Chase boost market sentiment amid Israel-Hamas conflict concerns.

Fresh economic data includes retail sales, industrial production, housing market index, and business leaders survey.

EARNINGS

Here’s what we’re watching this week:

Today: Bank of America (BAC), Goldman Sachs (GS), Johnson & Johnson (JNJ)

Wednesday: Netflix (NFLX), TESLA (TSLA)

NEWS BRIEFING

Israel War Latest:

Time is running out for the ‘Year of the Bond’ as losses mount (more)

Americans ♥️ Treasuries: reading Goldman’s flow report (more)

S&P 500 rally in Q4 "more likely than not" despite headwinds - Morgan Stanley (more)

53% of Gen Z see high cost of living as a barrier to financial success. They’re ‘buckling down,’ BofA exec says (more)

American work-from-home rates drop to lowest since the pandemic (more)

Real estate brokers pocketing up to 6% in fees draw antitrust scrutiny (more)

Country Garden in final hours to avoid first dollar bond default (more)

US to tighten rules aimed at keeping advanced chips out of China (more)

Lululemon surges to 52-week high on plans to join S&P 500t (more)

In rare move, Ford chairman calls on UAW to make a deal and end ‘acrimonious’ talks (more)

Hollywood’s AI issues are far from settled after writers’ labor deal with studios (more)

Walmart staffed up for holidays; US retailers cautious about economy (more)

Microsoft-owned LinkedIn lays off nearly 700 employees — read the memo here (more)

LinkedIn cuts 668 jobs in second layoff round this year (more)

Rolls-Royce set to cut 2,500 jobs in efficiency drive (more)

Spotify is launching a personalized in-app Merch Hub (more)

YouTube gets new AI-powered ads that let brands target special cultural moments (more)

UC Berkeley unveils plan for $2B space research center just 7 miles from Stanford (more)

TOGETHER WITH INVESTORS BUSINESS DAILY

Experience IBD for just $1

IBD Digital gives you an edge in the market with one-of-a-kind investing tools and analysis designed for investors at every level. Try IBD Digital for one full month. Here’s what you get…

Unlimited access to IBD Digital across platforms and devices

Access to 14 exclusive IBD stock lists

Proprietary investing tools & IBD ratings for 5,000+ stocks

Best-in-class training webinars, podcasts, videos and more

Don’t miss out on this limited-time offer you won’t find anywhere else!

DEALFLOW

Shield Capital, a venture capital firm, closed its inaugural fund, Shield Capital Fund I, L.P. , at $186M (more)

Mirantis, a company building and managing open cloud software infrastructure for developers, received $35M in Venture Loan from Horizon Technology (more)

Pantomath, a provider of a data pipeline observability and traceability platform, raised $14M in Series A funding (more)

Urban Sky, a stratospheric technology and remote sensing company, raised $9.75M in Series A funding (more)

Leucine, a digitalized pharmaceutical manufacturing company, raised $7M in Series A funding (more)

CuraSen Therapeutics, a clinical-stage company developing small molecule therapies to treat neurodegenerative disease, received up to $5.8M in investment from Alzheimer’s Drug Discovery Foundation (ADDF) (more)

AnySignal, a radiofrequency technology company, raised $5.0M in seed funding (more)

Blue Wolf Capital invests in Logistec (more)

FEP invests in Reliable Residential (more)

Godspeed Capital invests in Stengel Hill Architecture (more)

Aquarian partners with Obra Capital (more)

Aronora, a clinical-stage biotech company, received an investment from NYBC Ventures (more)

InfoBionic, a virtual telemetry company for cardiac remote patient monitoring, raised an undisclosed amount in the initial closing of its Series D funding (more)

M & A:

Searchlight, BCI acquires Consolidated Communications (more)

Novo buys experimental heart drug for up to $1.3B (more)

Access Healthcare, a company specializing in revenue cycle management (RCM) and healthcare services, acquired Envera Health, a patient engagement services provider (more)

Precision Optical Technologies, a company specializing in optical networking technologies, acquired Opticonx, a manufacturer of fiber optic cabling components and systems (more)

Globe Life (NYSE: GL), a life insurance company acquired Evry Health, a business-to-business health insurance company (more)

Wind Point Partners buys Assisi Pet Care (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

Cryptocurrencies rise, sending bitcoin over $30,000 at one point, on optimism for a new ETF (more)

Bitcoin whipsawed by false report claiming SEC approval of ETF (more)

FTX’s Gary Wang tells court Alameda got ‘special privileges’ to exchange’s funds (more)

Tether freezes 32 Crypto wallets holding $873,118 linked to terrorism and warfare in Israel, Ukraine (more)

Asia emerges as a promising haven amid the Crypto winter (more)

BULLISH BITES

❓ Who Funds Hamas? A Global Network of Crypto, Cash and Charities → Reuters

🚲 ‘People are Happier In a Walkable Neighborhood’: The US Community that Banned Cars → TheGuardian

A new housing development outside Phoenix is looking towards European cities for inspiration and shutting out the cars. So far residents love it.

📉 How Birkenstock’s Weak Debut Mistimed the Shaky IPO Market → Bloomberg

Bad timing on LVMH earnings undercut conservative pricing. Rubrik, Turo said among firms to put IPOs on slower track.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion for MarketBriefing? We’d love to hear it!

Send us a message -mb