☕️ Good morning.

The Fast Five → S&P hits new all-time high, India overtakes Hong Kong as world’s fourth-largest stock market, voice cloning startup ElevenLabs achieves unicorn status, Wall Street opposition to Trump collapses, and Mr Beast nears $100 million TV deal with Amazon…

Your 5-minute briefing for Tuesday, January 23:

BEFORE THE OPEN

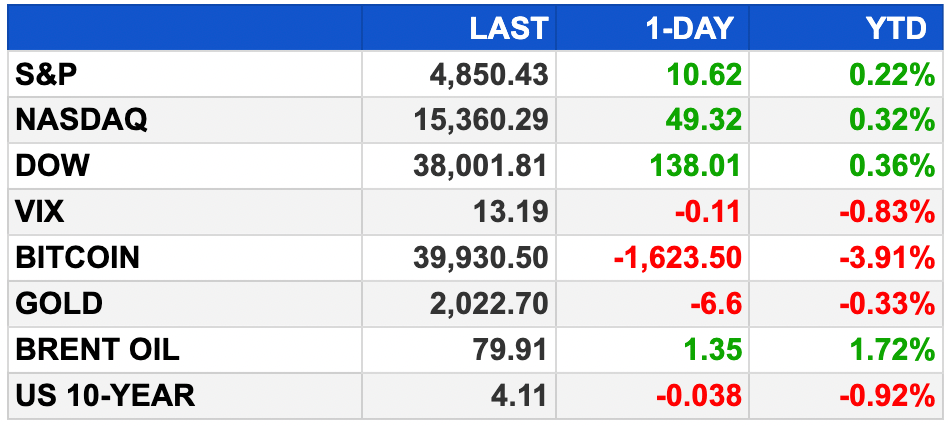

As of market close 1/22/2024.

PRE-MARKET:

MARKETS:

Dow reaches new record, up 138.01 points.

S&P 500 and Nasdaq also hit fresh all-time highs.

Macy’s rejects $5.8B private takeover proposal, shares rise.

SolarEdge announces layoffs, stock climbs approximately 4%.

Archer-Daniels-Midland plunges over 24% on weak earnings guidance.

B Riley Financial faces investigation tied to securities fraud.

Wall Street's strength tied to Fed’s handling of inflation and economic cooling.

Traders scale back Fed rate cut expectations for March.

Key economic reports this week may Fed's monetary policy outlook.

EARNINGS

What we’re watching this week:

Today: 3M (MMM), Johnson & Johnson (JNJ), Procter & Gamble (PG)

Netflix (NFLX) - expected: $2.22 per share. Revenue is forecast to rise +11% YoY to $8.7 billion

Wednesday: AT&T (T), Kimberly-Clark (KMB),

Tesla (TSLA) - expected: $.74 per share (-37.8% YoY) on $25.6 billion revenue (+5.2% YoY)

Thursday: Alaska Air (ALK), American Airlines (AAL), Blackstone (BX), McCormick (MKC), Visa (V)

Intel (INTC) - expected: $.45 per share. Revenue is forecast to land at $15.2 billion (+7.9% YoY).

Friday: American Express (AXP)

Full earnings calendar here

HEADLINES

Wall Street opposition to Trump collapses, as ‘pipe dream’ of primary defeat ends (more)

The Fed's big miss on inflation has doomed the US to recession this year, top economist says (more)

Morgan Stanley, JPMorgan say buy the dip after Treasury rout (more)

Repo market may throw a fit, spur Fed to action (more)

SEC probes B. Riley deals with client tied to failed fund (more)

Investment bankers are starting to see Mexico as a money spinner (more)

Western Digital (WDC) surges replacing Nvidia as Morgan Stanley's top pic (more)

Boeing faces more pressure as United CEO vents frustrations (more)

Cargo theft spiked over 57% in 2023 vs. 2022 (more)

Voice cloning startup ElevenLabs lands $80M, achieves unicorn status (more)

Years of PR disasters led to a major change for Facebook, and news sites are paying the price (more)

TikTok cuts jobs as tech layoffs continue to mount (more)

Alphabet’s Moonshot X Lab cuts staff, turns to outside investors (more)

LVMH’s Arnault set to propose sons Alexandre, Frederic for company’s boardl (more)

TOGETHER WITH CLICKUP

Connect your team in minutes.

Turn TBD into EOD with the world’s most powerful productivity tool. With ClickUp, you can: Automate sprints and routine tasks, Streamline communication in one Workspace, and recover cash spent on multiple work apps!

Please support our sponsors

DEALFLOW

M & A | INVESTMENTS

Macy’s urged by Arkhouse to open books after rejecting takeover bid (more)

Sony ends $10B merger with India's Zee (more)

Sunoco to buy NuStar Energy in $7.3B deal as it expands midstream business (more)

Archway Dental Partners, a provider of a dental platform, received an investment from Martis Capital, and Din Ventures (more)

PowerSchool (PWSC), provider of cloud-based software for K-12 education in North America, acquired Allovue, a provider of K-12 financial planning software in the US (more)

Service Compression, LLC, a provider of natural gas compression services, closed a preferred equity investment from Warburg Pincus, through its Capital Solutions Founders Fund (more)

Bloom Nutrition, a provider of health supplements, received $90M in financing (more)

Deloitte buys Giant Machines (more)

Gas station owner Sunoco buys NuStar Energy for $7.3B (more)

Goldman-backed Nextiva buys contact center firm Thrio (more)

PE-backed RoadSafe purchases B.C. Cannon (more)

MAI Capital Management buys WaterStone Investment Counsel (more)

Gryphon-backed Kano acquires Super Lube and Synco Brands (more)

VC

Talofa Games, a gaming studio developing social fitness games, reportedly raised $6.3M in Seed funding (more)

Tandem, a provider of an app for couples to manage their finances together, raised $3.7M in seed funding (more)

3Daughters, a clinical development company, raised over $2M in first tranche of Seed funding (more)

Bolt Navigation, a developer of Handheld Surgical Navigation systems, closed its Series B financing (more)

FUNDRAISING

Wynnchirch Capital, a middle market private equity firm, closed its sixth private equity fund, Wynnchurch Capital Partners VI, at $3.5B (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🐝 Social buzz: Mr Beast nearing $100 million TV deal With Amazon.

🚘 Must-see: Ford’s impressive new 48-inch digital dashboard is a lot of Android for one car.

😤 Powershift: The end of workplace loyalty—can it be repaired?

🤖 AI-nxiety: This MIT study says AI won't take my job. But it doesn't make me feel too sure that AI won't take my job.

🙌 One app to replace them all: Get everyone working in a single platform designed to manage any type of work. Try ClickUp now -- it's Free »

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.