Good morning.

The Fast Five → Biggest rate cut in 16 years comes down to next inflation report, Boeing reaches deal with union to avoid strike, Fed must decide if quarter-point cut will be enough, bull market limps into 2-yr birthday, and Trump pledges ‘100% tariff’ for countries that shun dollar…

⚠️ When the largest bank in the US says a crisis is coming - you need to listen »

From Behind The Markets

How far will the Fed cut rates this month?

Calendar: (all times ET) - Full calendar here

Today: Wholesale inventories, 10:00 AM

Tomorrow: [no notable]

Wednesday: Consumer price index (CPI), 8:30 AM

Your 5-minute briefing for Monday, September 9:

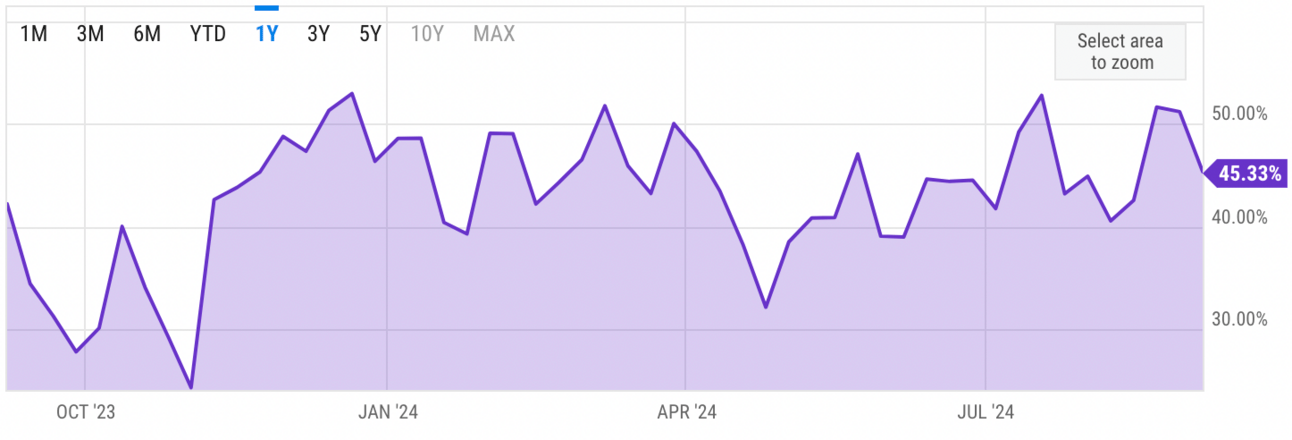

US Investor % Bullish Sentiment:

↓ 45.33% for Week of September 05 2024

Last week: 51.16%. Updates every Friday.

Market Wrap:

Stock futures dip after tough week for equities.

Last week: S&P lost 4.3%, Nasdaq 5.8%, Dow 2.9% in worst week since early 2023.

August jobs report: 142K payroll growth, missing expectations; unemployment fell to 4.2%.

CPI and PPI reports this week may guide Fed’s rate decision.

Market sees 71% chance of 25 bps rate cut, 29% for larger cut.

EARNINGS

Here’s what we’re watching this week:

Today: Oracle (ORCL)

Dave & Buster's (PLAY) - earnings of $0.84 per share (+40% YoY) on $560.7M revenue (+3.4% YoY)

Thursday: Kroger (KR)

Adobe (ADBE) - earnings of $4.53 per share (+10.5% YoY) on revenue of $5.4B (+10.2% YoY)

Full earnings calendar here.

HEADLINES

Bull market limps into 2-yr birthday with soft economic landing in doubt (more)

Fed must decide if quarter-point cut will be enough (more)

Yellen 'probably done' when Biden ends term (more)

Trump pledges ‘100% tariff’ for countries that shun dollar (more)

Bond market rally rides on how fast the Fed will cut rates (more)

Equity funds see major outflows on growth concerns (more)

Asia shares dragged by Wall St dive, bonds bullish (more)

China says its huge market is opportunity not threat to US (more)

Dell, Palantir to join S&P 500; shares of both jump (more)

New iPhone will use Arm’s chip technology for AI (more)

European luxury shares’ $240B rout is just the beginning (more)

A Message from Behind The Markets

“The most predictable crisis in history”

When the largest bank in the U.S. says a crisis is coming - you need to listen.

The Wall Street Journal warns, "America's bonds are getting harder to sell."

Bloomberg says, "Homebuyers are starting to revolt."

JP Morgan calls it, "The most predictable crisis in history."

- sponsored message -

DEALFLOW

M+A | Investments

Couche-Tard asks Seven & i for talks after $38.5B offer rejected (more)

US regulator approves BlackRock's $12.5B deal for Global Infrastructure Partners (more)

Texas Capital agrees to $400M health-care deal, cuts jobs (more)

Star Entertainment to sell interest in casino building amid regulatory problems (more)

Vocus in advanced talks to buy TPG Telecom’s fiber assets (more)

The Bank of New York Mellon Corporation, a NYC-based financial services company, acquires Archer, a tech-enabled managed account solutions provider to the wealth management industry (more)

Subway grows franchise-backed debt pile in $2.34B deal (more)

MyndYou, conversational AI solutions for healthcare, received a strategic investment from WindRose Health (more)

DEO, a company specializing in metal additive manufacturing, received a $3.5M strategic investment from Mizuhio Bank (more)

Exacto, solutions for the agricultural, turf, and ornamental horticulture markets, received an investment from S2G Ventures and Skyline Global Partners (more)

VC

24M, a battery innovations company, raised $87M in Series H funding, at $1.3B valuation (more)

6K, a leader of engineered materials for lithium-ion batteries and additive manufacturing, closed $82M as part of its Series E funding round (more)

Anytime AI, a company developing an AI legal assistant for plaintiff lawyers, raised $4M in funding (more)

Fastn, a software application development platform provider, raised $2.6M in Seed funding (more)

CRYPTO

BULLISH BITES

🔥 On Fire: Look before leaping into the world’s hottest stock market.

💰 Ad Share: Google and DOJ return for round two of their antitrust fight.

🛻 Buyer Guide: The $100,000 electric truck market is here.

🐭 Inside Look: The palace coup at the Magic Kingdom.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.