Good morning.

The Fast Five → Wall Street can’t keep up with Nvidia’s sales growth, Cathie Wood backs Trump for US economy, US regulators single out four banks for flawed 'living wills', ByteDance taps Broadcom to develop AI chip, and Apple and Meta discuss AI partnership…

Calendar: (all times ET)

TUE 6/25: | Consumer confidence, 10:00a |

WED 6/26: | New home sales, 10:00a |

THU 6/27: | Initial jobless claims, 8:30a |

FRI 6/28: | PCE index, 8:30a |

Your 5-minute briefing for Monday, June 24:

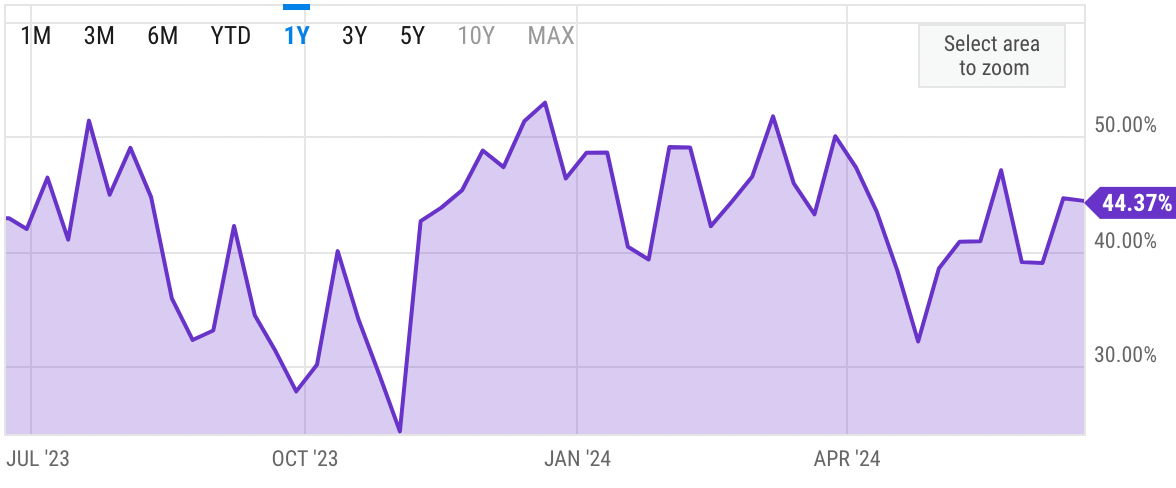

US Investor % Bullish Sentiment:

↓ 44.37% for Wk of June 20 2024 (Last week: 44.59%)

Market Recap:

Stock futures flat as H1 2024 nears record highs.

Dow, S&P 500 futures steady; Nasdaq 100 up 0.2%.

S&P 500 hit record, gained 0.6% last week.

Nvidia fell 4% last week.

AI enthusiasm boosts market; S&P 500 up 15% YTD.

Earnings: FedEx, Micron, Walgreens, Nike.

EARNINGS

Here’s what we’re watching this week:

Tuesday:

FedEx (FDX) - earnings of $5.36 per share on $22.1B revenue (+0.7% YoY)

Micron Technology (MU) - earnings of $0.51 per share on $6.7B (+77.6% YoY)

Nike (NKE) - earnings of $0.84 per share (+27.3% YoY) on $12.9B revenue (+0.2% YoY)

Full earnings calendar here.

| Sponsored |

| Maximize 2024: Uncover "9 Stocks Poised for Growth |

| As we step into 2024, seize strategic opportunities in the market. Discover "9 Stocks Set to Soar," handpicked for their potential. Act Now: Before diving into our report, consider the opportunities 2024 holds. The time is ripe.Go HERE to Get Their Names And Ticker Symbols |

| By clicking the link you are subscribing to the Summa Money Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy |

| Privacy Policy/Disclosures |

HEADLINES

The market is in its longest stretch without a 2% sell-off since the financial crisis (more)

Credit spreads widen on political jitters, Treasuries rally (more)

Treasury receives $556.7M from auction of airline warrants (more)

US official says no decision yet on whether to prosecute Boeing (more)

Four banks singled out for flawed 'living wills' by US regulators (more)

Dollar steady; yen wobbles as intervention worries linger (more)

Asia shares slip as inflation, politics call for caution (more)

Yen under pressure even as Japan steps up its verbal warnings (more)

China wants EU tariffs on EVs gone by July 4 as talks resume (more)

ByteDance working with Broadcom to develop advanced chip (more)

Nvidia to launch in Middle East amid US curbs on AI exports to region (more)

Apple and Meta have discussed AI partnership (more)

Trump previews debate attacks against Biden’s economy (more)

Hedge funds’ bullish copper bets run into China’s slowdown (more)

Big Food tries to offset obesity drug blow with vitamins, meals (more)

(sponsored)

Weird Pattern Could Send This AI Stock Soaring

Every time this pattern has appeared...

For the last 244 years...

It's given everyday Americans a shot at massive returns.

The last time this pattern appeared:

Google jumped 5,700%...

Netflix shot up 14,400%...

Amazon soared a mind-blowing 160,000%...

All the best,

Simmy Adelman, Publisher

Behind the Markets

- please support our sponsor -

DEALFLOW

M+A | Investments

UPS announces sale of Coyote Logistics unit to RXO for $1 bln (more)

Brazil gym chain Smart Fit confirms talks for stake in Velocity (more)

Japanese trading house Mitsui buys Shale Gas asset in Texas (more)

SoundHound (SOUN), a voice AI company, acquired Allset, an online ordering platform connecting restaurants and local customers (more)

knownwell, a primary care and metabolic health company, acquired Alfie Health, an obesity management clinic (more)

Nextracker (NXT), intelligent solar tracker and software solutions, acquired Ojjo, an energy and solar power generation company, for approximately $119M (more)

Honeywell (HON), an integrated operating company, acquired CAES Systems Holdings, a radio frequency technologies company, from Advent International, for $1.9B (more)

Altaris purchases Sharecare (more)

KKR buys Superstruct Entertainment from Providence (more)

Hanwha acquires Philly Shipyard (more)

VC

BillionToOne, a precision diagnostics company, raised $130M in Series D funding at an over $1B+ valuation (more)

HeyGen, an AI video generation platform for businesses, raised $60M in Series A funding at a $500M post-money valuation (more)

The Picklr, an indoor pickleball franchise, raised a Series B funding, at $59M valuation (more)

Daydream, a search and discovery shopping platform, raised $50M in Seed funding (more)

Amplify Life Insurance, a digital platform for wealth-building through permanent life insurance, raised $20M in Series B funding (more)

Maxterial, a material science company, raised nearly $8M in Series A funding (more)

MEandMine, a startup for classroom well-being using AI to identify psychological risks in children, raised $4.5M in funding (more)

Coeptis Therapeutics (COEP), a biopharmaceutical company developing cell therapy platforms closed on $4.3M in financing (more)

Backstroke, a generative AI messaging platform, raised $2M in Seed funding (more)

CRYPTO

BULLISH BITES

💔 Liquidation: The fight over Fisker’s assets is already heating up.

🚀 AI Superproject: It’s too late to get in on Nvidia … but not it’s “silent partners” *

🇷🇺 Cutting Ties? Coca-Cola (and dozens of others) pledged to quit Russia, but they’re still there.

💻 Pushback: Ending hot desking is the latest return to office tactic.

🤝 Dealmaking: The New York power lunch is back.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.