Good morning.

The Fast Five → Trump: No intention of firing Powell, Bessent expects tariff standoff with China to de-escalate, Dow snaps four-day string of losses, Bitcoin rises above $93,000, and Elon is taking a step back from DOGE…

📌 Wall Street Pioneer's AI Warning: "I thought we had more time…"

A radical new AI development is about to blindside millions of Americans. This early pioneer just issued a warning explaining everything → *

Calendar: (all times ET) - Full Calendar

Today:

New home sales, 10:00A

Fed Beige Book, 2:00P

Tomorrow:

Initial jobless claims, 8:30A

Durable-goods orders, 8:30A

Your 5-minute briefing for Wednesday, April 23:

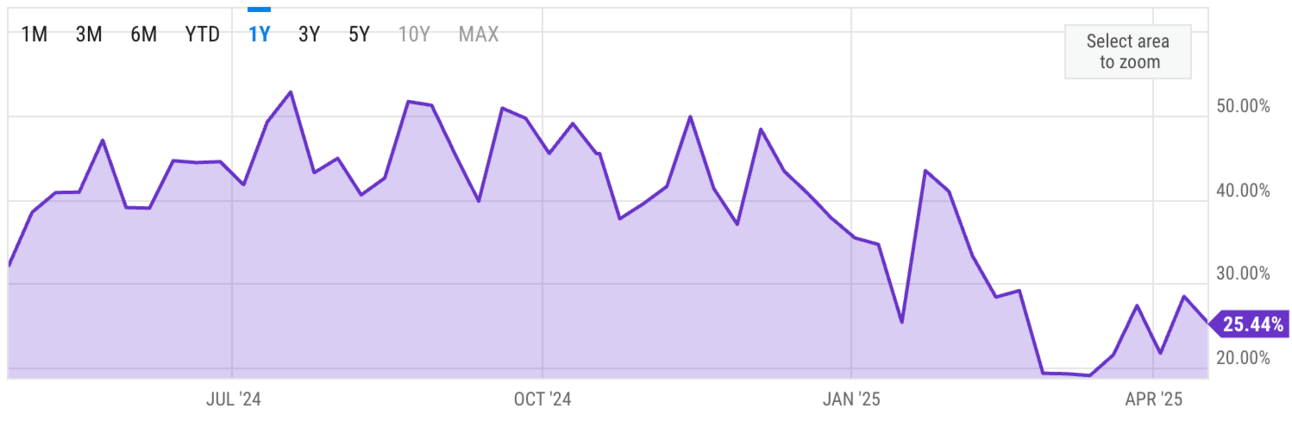

US Investor % Bullish Sentiment:

↓ 25.44% for Week of April 17 2025

Previous week: 28.52%. Updates every Friday.

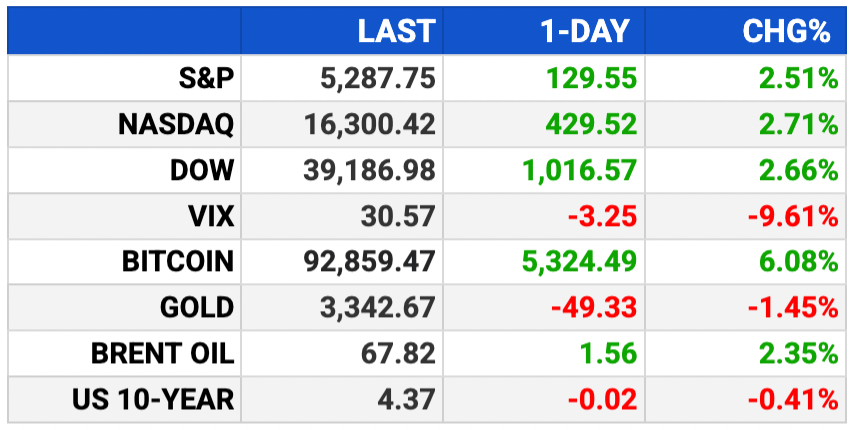

Market Wrap:

Futures rally: Dow +611 pts (+1.6%), S&P +1.8%, Nasdaq +2%.

Trump says he won’t fire Powell, reversing Monday’s attacks.

Tuesday: Dow +1,000 pts, S&P/Nasdaq +2%+ on easing trade fears.

Treasury Sec hints at China de-escalation; 145%/125% tariffs still in place.

Gold up 8% in April as investors seek safety.

EARNINGS

Here’s what we’re watching this week:

Today: AT&T $T ( ▲ 0.48% ), Boeing $BA ( ▲ 3.47% )

Chipotle $CMG ( ▲ 0.19% ) - earnings of $.28 per share on same-store sales growth of 2.2%

Thursday: American Airlines $AAL ( ▲ 0.43% ), Intel $INTC ( ▼ 1.56% ), PepsiCo $PEP ( ▲ 1.96% ), Procter & Gamble $PG ( ▲ 2.55% ), Southwest $LUV ( ▼ 0.48% )

Alphabet $GOOGL ( ▼ 1.42% ) - earnings of $2.01 per share (+6.3% YoY) on $89.2B revenue (+10.7% YoY)

INVESTMENT OPPORTUNITY | MODE MOBILE

This tech company grew 32,481%..

No, it's not Nvidia. It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Nasdaq ticker $MODE secured—invest at $0.30/share before their share price changes on 5/1.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

HEADLINES

Dow jumps 1,000 points Tuesday to snap four-day string of losses (more)

IMF slashes global outlook as WH says trade talks pick up pace (more)

Oil prices settle up nearly 2% on new Iran sanctions (more)

Elon is taking a step back from DOGE after Tesla "blowback" (more)

Tesla salvages first-quarter profit margins as car sales skid (more)

Summers says Trump ‘attack’ on IRS risks $1 trillion revenue hit (more)

Auto groups lobby Trump admin against parts tariffs in rare unified message (more)

Capital One's first-quarter profit rises on higher interest income (more)

OpenAI would buy Google’s Chrome browser, ChatGPT chief says (more)

Meta could take $7B hit this year due to China tariffs (more)

Chobani to invest $1.2 billion in New NY factory (more)

Rite Aid prepares to sell itself in pieces for second bankruptcy (more)

Yale considers private equity stake sales amid funding turmoil (more)

DEALFLOW

M+A | Investments

Thoma Bravo nears acquisition of Boeing's Jeppesen unit

Macquarie sells US and European asset management units to Nomura

Tonic.ai, a platform for privacy-preserving data synthesis, acquired Fabricate, a synthetic data generation product built by Mockaroo

Earned Wealth, a tech-enabled financial services firm created for doctors, acquired Chahal & Associates, an accounting and tax firm

VC

Altruist, a modern custodian for RIAs, raised $152M in Series F funding

Luma Financial Technologies, a structured products and insurance solutions provider, raised $63M in Series C funding

Sentra, a cloud-native data security company, raised $50M in Series B funding

Field Medical, a PFA technology company, raised $40M in Series A funding

Reco, a dynamic SaaS security company, raised $25M in additional funding

UbiQD, a quantum dot tech company, raised $20M in Series B funding

Uniqus Consultech, a provider of tech-enabled consulting solutions, raised $20M in Series C funding

AuthMind, an identity protection company, raised $19.3M in seed funding

Irrigreen, a robotic irrigation systems company, raised $19M in Series A funding

GreenFi, a climate-friendly banking and investing brand, raised $17M in funding

Ascertain, a healthcare tech company empowering care teams with AI, raised $10M in Series A funding

Arch Labs, a core contributor to Arch Network, raised $13M in Series A funding

Tally, a software platform for on-chain organizations, raised $8M in Series A funding

Hopper, a cybersecurity startup, emerged from stealth with $7.6M in Seed funding

Adaptive, a startup enabling non-coders to create software that personalizes computing with AI, raised $7M in Seed funding

Sesh, a fan engagement platform connecting people with their favorite artists, raised $7M in funding

OnePlanet Solar Recycling, a materials recovery company, raised $7M in Seed funding

Trust & Will, a digital estate planning company, received a $4.5M investment from Curql

Recce, a provider of data-native code review tools for data transformation projects and AI systems, raised $4M in funding

Ocient, a data analytics software solutions company, raised an undisclosed amount in Series B extension funding

CRYPTO

BULLISH BITES

🚨 “I've seen what comes next for AI. And frankly… It terrifies me.” *

😎 Flash Boys emerge from shadows to reorder stock trading.

✊ Crypto knocks on the door of a banking world that shut it out.

🏃🏻♂️ New PR? Humanoid robots in China competed in their first half-marathon.

👑 A chess set engineered by Rolls Royce.

DAILY SHARES

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.