☕️ Good morning.

The Fast Five → China weighs stock market rescue package, S&P 500 notches third straight record high close, Netflix pays $5 Billion for WWE’s ‘Raw’, unemployment rises in nearly a third of US states, and Red Sea turmoil sends economic shockwaves far and wide…

Your 5-minute briefing for Wednesday, January 24:

BEFORE THE OPEN

As of market close 1/23/2024.

PRE-MARKET:

MARKETS:

Nasdaq 100 futures rise 0.34% on Netflix's record Q4 subscribers.

Netflix soars 8.6% in extended trading with 260.8 million subscribers.

Strong tech gains in 2024 lift S&P 500 to new highs, confirming bull market.

Dow dips 0.25% on disappointing earnings; S&P 500 hits all-time high.

Upcoming earnings from AT&T, Freeport-McMoRan, Tesla, Las Vegas Sands, IBM.

Focus on U.S. Jan. manufacturing, services data, and Q4 GDP release later.

EARNINGS

What we’re watching this week:

Today: AT&T (T), Kimberly-Clark (KMB),

Tesla (TSLA) - expected: $.74 per share (-37.8% YoY) on $25.6 billion revenue (+5.2% YoY)

Thursday: Alaska Air (ALK), American Airlines (AAL), Blackstone (BX), McCormick (MKC), Visa (V)

Intel (INTC) - expected: $.45 per share. Revenue is forecast to land at $15.2 billion (+7.9% YoY).

Friday: American Express (AXP)

Full earnings calendar here

HEADLINES

S&P 500se (more)

Red Sea turmoil sends economic shockwaves far and wide (more)

As more tankers divert from Red Sea, Suez Canal, booming US oil industry gets another boost (more)

Boeing CEO to meet with senators scrutinizing 737 MAX 9 blowout (more)

Wall Street banks want to lure back loan deals lost to private credit (more)

Netflix is turning into cable TV (more)

P&G earnings show some consumers are getting used to higher prices (more)

Southwest Airlines flight attendants vote to approve strike authorization (more)

EBay to eliminate 9% of full-time workforce (more)

SAP plans job buyouts for 8,000 employees in restructuring plan (more)

Brex cuts 20% of staff amid reports of stalled growth, high burn (more)

Apple dials back car’s self-driving features and delays launch to 2028 (more)

'Pharma Bro' Martin Shkreli's lifetime drug industry ban upheld (more)

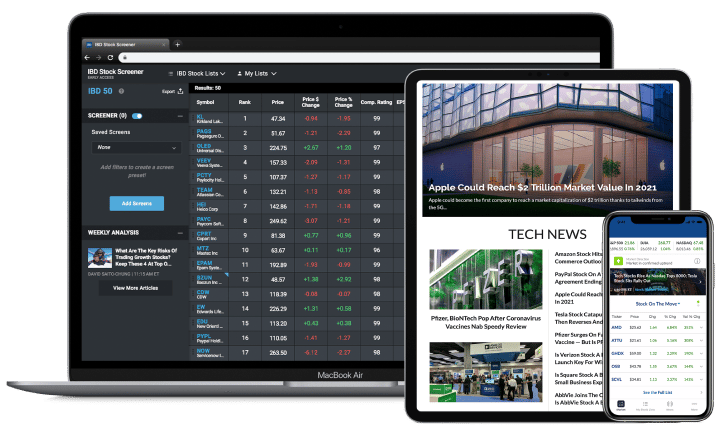

TOGETHER WITH INVESTORS BUSINESS DAILY

Invest smarter.

For over 35 years, Investor’s Business Daily has armed people like you with the tools and strategies to consistently outperform the market and prosper — no matter the conditions.

Now, in a single subscription, you can access all their pro-level tools and strategies designed to boost your profits.

“Investor’s Business Daily delivers information you

can’t get anywhere else.” -Mike G., subscriber

🔥 Exclusive Offer for MB readers: Grab IBD's Premium Annual Subscription today for only $249 ($349 for everyone else!) - it’s like getting 5 months free! Act quickly, this is a limited-time offer you won’t find anywhere else.

- please support our sponsors -

DEALFLOW

M & A | INVESTMENTS

Miss Universe brand owner sells 50% stake to Mexican businessman (more)

Sanofi to acquire Inhibrx for $1.7B (more)

Salas O’Brien, an engineering and technical services firm, received a minority growth investment from Blackstone (more)

Apkudo, a company specializing in supply chain automation for connected devices, acquired Mobile reCell, a provider of software-driven IT asset recovery for corporate-owned IT assets (more)

Empeq, a tech company tackling national security challenges through advanced materials analysis, received an investment from Leonid Capital Partners (more)

Summit Group, an independent provider of fiduciary and administrative services, acquired Sanctuary, a provider of services to entrepreneurs and families (more)

Pelican Energy Partners buys Stewart Tubular Products (more)

Monomoy acquires EnviroTech (more)

Bloomreach, a platform for e-commerce personalization, acquired Radiance Commerce, an enterprise-grade conversational commerce platform (more)

zvoove, a software provider for the temp staffing and cleaning industries in Europe, acquired Planbition, provider of a flexible workforce management solution (more)

Welligence Energy Analytics, an energy data & intelligence firm, has raised $41M in growth funding (more)

TPG invests in G&A Partners (more)

Angeles Equity Partners acquires Acieta (more)

H.I.G. Capital purchases CHA Consulting (more)

Cognizant acquires Thirdera from Sunstone Partners (more)

VC

ElevenLabs, a voice technology research company, raised $80M in Series B funding at a $1+ Billion valuation (more)

Silverfort, an identity protection company, raised $116M in series D funding (more)

Accent Therapeutics, a biopharmaceutical company focused on small molecule precision cancer therapies, raised $75M in Series C funding (more)

Elephas, a company developing an ex-vivo platform to assess how live patient biopsies respond to immunotherapies, raised $55M in Series C funding (more)

AiDash, an enterprise SaaS company making infrastructure industries climate-resilient and sustainable with satellites and AI, raised $50M in Series C funding (more)

Albedo, a company offering aerial quality imagery from space, raised $35M in Series A-1 funding (more)

ModernFi, a company providing a deposit network for banks, raised $18.7M in Series A funding (more)

S2 Genomics, a manufacturer of tissue sample preparation systems for single cell genomics assays, raised $16M in Series A funding (more)

Norm Ai, a company working for regulatory compliance with AI agents, raised $11.1M in Seed funding (more)

Masa Network, a builder of a decentralized data marketplace, raised $5.4M in Seed funding (more)

Neatleaf, a provider of a cultivation management platform, raised $4M in funding (more)

Kiefa, a cannabis SaaS platform, raised $2M in Seed funding (more)

FUNDRAISING

Myriad Venture Partners, an early-stage venture firm focused on AI, clean technology and enterprise B2B software, announced its launch with $100M of initial capital commitments (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

💼 Attn Interns: how to land an investment-banking internship at Goldman Sachs, Morgan Stanley, Lazard, and other Wall Street firms as the 2025 application race begins.

🍴 Calling all foodies: Yelp's Top 100 Places to Eat, 2024 - did your city make the list?

💰 Rev-share: MrBeast tested Elon Musk’s theory and took home $250,000.

🚀 Trending: Why do boomers and Gen Xers love Temu so much?

🔥 Don’t miss another day: For over 35 years, Investors Business Daily has learned what it takes to outperform the market and help investors like you gain an edge. Grab IBD's Premium Annual Subscription today for only $249 (normally $349) - it’s like getting 5 months free!

Know someone who would enjoy this?

What did you think about today's briefing?

~ Happy Birthday, M! 🎉

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.