Good morning.

The Fast Five → OpenAI builds first chip, AMD tumbles after chip growth fails to inspire investors, Intel struggles to bounce back, Alphabet beats estimates on Google cloud growth, and Reddit is profitable for the first time ever…

🚨 'The Prophet': Fed could trigger rare stock event

From Stansberry Research

Calendar: (all times ET) - Full calendar here

Today:

GDP, 8:30 am

Tomorrow:

PCE index, 8:30 am

Initial jobless claims, 8:30 am

Your 5-minute briefing for Wednesday, October 30:

US Investor % Bullish Sentiment:

↓ 37.70% for Week of October 24 2024

Last week: 45.45%. Updates every Friday.

Market Wrap:

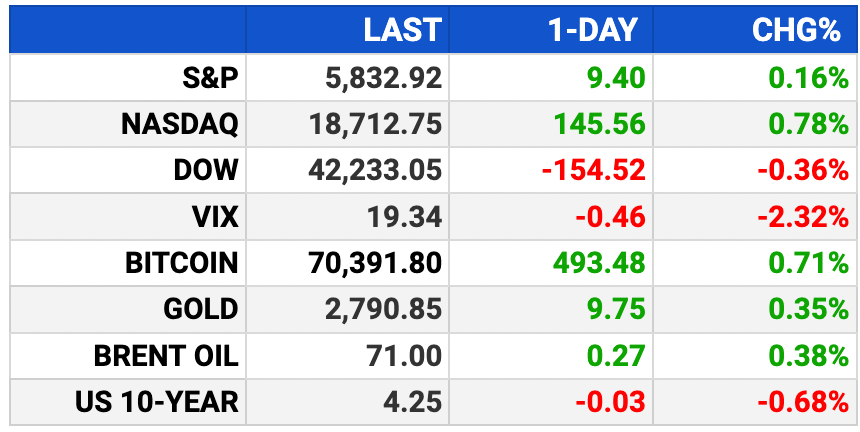

S&P and Nasdaq futures +0.3%, Dow +64 pts ahead of big tech earnings, GDP data.

Tues recap: Nasdaq hits new high (+0.78%), S&P +0.16%, Dow -0.36%.

Alphabet beats estimates; shares jump 5% on strong cloud growth.

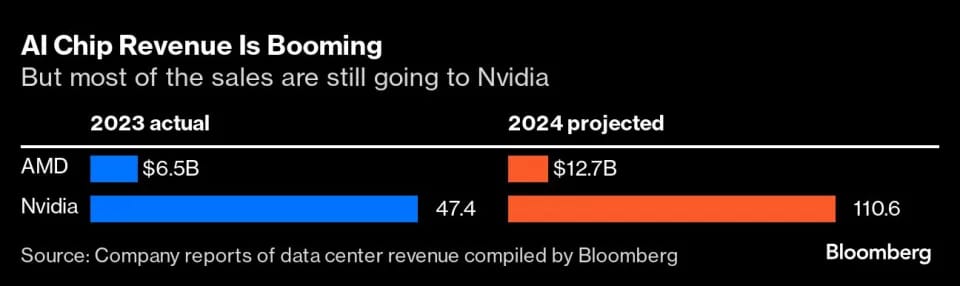

AMD falls 8% after hours on weak Q4 revenue guidance.

Meta, Microsoft report today; Apple, Amazon due tomorrow.

GDP forecast: 3.1% Q3 growth, inflation near Fed's 2% target.

EARNINGS

Here’s what we’re watching this week.

Today: AbbVie (ABBV), Coinbase (COIN), DoorDash (DASH), eBay (EBAY), Eli Lilly (LLY), Microsoft (MSFT), Roku (ROKU), Starbucks (SBUX)

Meta (META) - earnings of $5.24 per share (+19.4% YoY), on $40.3B revenue (+18% YoY)

Amazon (AMZN) - earnings of $1.14 per share (+21.3% YoY) on $157.2B revenue (+9.9% YoY)

Apple (APPL) - earnings of $1.55 per share (+6.2% YoY) on $94.4B revenue (+5.5% YoY)

Friday: Wayfair (W)

See full calendar here.

HEADLINES

Nasdaq jumps to record close as major tech names rise ahead of earnings (more)

Consumer confidence surges as election nears, job openings move lower (more)

Oil prices settle down on report of talks to end Lebanon war (more)

China ‘does not accept’ the EU’s EV tariffs, negotiations still ongoing (more)

Three governors urge end to Boeing strike as suppliers suffer (more)

Alphabet beats sales estimates on Google cloud growth (more)

Reddit is profitable for the first time ever, with nearly 100M daily users (more)

Trump Media jumps again as traders bet on election (more)

Volkswagen profit plunges 42% in third quarter amid sweeping overhaul (more)

Intel set for big drop in quarterly revenue as it struggles to bounce back (more)

Samsung’s sudden $122B wipeout shows the cost of sleeping on AI (more)

A MESSAGE FROM STANSBERRY RESEARCH

CNBC's 'Prophet' Issues Important Fed Warning

In March 2022, the Federal Reserve raised interest rates for the first time in five years.

It triggered a brutal bear market that wiped out $9 trillion of American wealth... and slashed the average investor's portfolio nearly in half.

Now, according to the man whom CNBC nicknamed 'The Prophet'...

This event could dictate the next decade of every American's financial life, and it's critical that you take steps now to prepare.

Kelly Brown

Senior Researcher, Stansberry Research

DEALFLOW

M+A | Investments

Arctos in talks to buy minority stake in the NFL’s Buffalo Bills (more)

Siemens nears deal to buy software group Altair (more)

BlackRock in talks to buy private credit firm HPS (more)

Thryv Holdings, Inc., (THRY), a provider of SaaS solutions for SMB's, acquires Infusion Software, Inc. (Keap), customer relationship management and marketing automation for SMBs (more)

ntrax, a provider of cultural exchange programs, acquired Gap 360, a company specializing in gap year travel experiences for young adults (more)

WellSky, a health care tech company, acquired Bonafide, an enterprise software solution for durable and home medical equipment companies (more)

Carta, a software platform for private capital, acquired Tactyc, software bringing forecasting and planning to private funds (more)

Akeyless, a security company, received a strategic investment from Deutsche Bank's Corporate Venture Capital arm (more)

RiseNow, a boutique advisory and strategy firm focused on procurement and supply chain, received an investment from Achieve Partners (more)

VC

Duetti, a music platform for catalog monetization for independent artists, raised $114M in funding (more)

DoorLoop, a property management software company, raised $100M in Series B funding (more)

GMI Cloud, an AI-native GPU cloud provider, raised $82M in total Series A funding (more)

Petfolk, veterinary and urgent care through network of "connected care" clinics, raised $36M in Series C funding (more)

Innoventric, a company specializing in transcatheter tricuspid regurgitation treatment, raised $28.5M in Series B funding (more)

Andium, a provider of remote-field monitoring and communications technologies, raised $21.7M in Series B funding (more)

Alimetry, a medical solutions company, raised US $18M in Series A2 funding (more)

Billd, a provider of financial solutions for commercial subcontractors, raised $17.5M in funding (more)

Brightwave, an AI financial research platform, raised $15M in Series A funding (more)

Cruisebound, a company providing digital cruise assistant services for first-time cruisers, raised $13M in funding (more)

Tilled, a startup that provides PayFac-as-a-Service solutions, raised $12.5M in funding (more)

Homee, an AI-driven direct repair network for the Property and Casualty insurance industry, raised $12M in Series C funding (more)

Table22, a provider of revenue-expanding e-commerce tools for merchants, raised $11M in Series A funding (more)

Matia, a data operations platform providing ingestion, reverse ETL, and catalog capabilities, raised $10.5M in funding (more)

Infinite Machine, a company building non-car vehicles, raised $9.3M in Seed funding (more)

CredibleMind, a mental wellbeing company, raised $7.5M in Series A funding (more)

Paterna BioSciences, a biotech company dedicated to solving male infertility, raised $6M in Seed funding (more)

Latii, a proptech startup for high-end dealers, architects, and homeowners, raised $5M in Seed funding (more)

RiPSIM, a software platform providing mobile network authentication credentials on demand, raised $5M in Seed funding (more)

HomeBoost, a home energy platform, raised $4M in Seed funding (more)

CRYPTO

BULLISH BITES

🎁 For MB Readers: Download your complimentary 2024 Wealth Protection Guide (limited time) - send my guide » *

🇺🇸 Early Birds: 50 million Americans have already voted.

📉 Inside Intel: CEO Pat Gelsinger fumbled the revival of an American icon.

🍔 McDonald's 2024 combo: Inflation, a health crisis and a side of politics.

👻 "R.I.P. treatment": At this haunted house in New York's TriBeCa, jump scares don't come cheap.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.