☕️ Good Morning. Q2 earnings start this week: Delta, Wells Fargo, Pepsi, JPMorgan, all report.

Apple supplier Foxconn pulls out of $19.5B chip project, Turkey agrees to back Sweden’s NATO bid, China slides to brink of deflation, Cava dubbed the new Chipotle, and Threads now the fastest growing app in history…

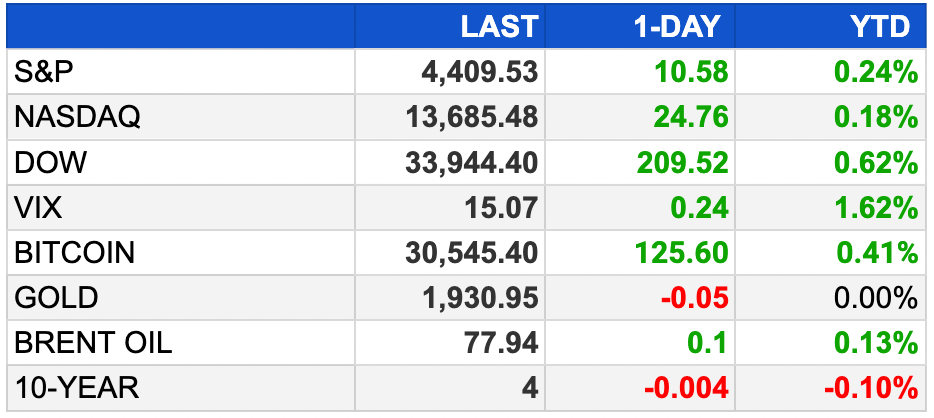

Here’s your market briefing for today:

BEFORE THE OPEN

As of market close 7/10/2023.

Markets:

Following a halt to a three-day downturn in major averages, U.S. stock futures remained largely unchanged Monday night.

S&P 500, Nasdaq-100, Dow Jones futures slightly down.

Monday recap: Dow gained 0.62%, S&P rose 0.24%, Nasdaq up 0.18%.

Key reports ahead: June consumer price index (Wed), June producer price index (Thu) - will provide clues on inflation trend and future interest rates.

Investors foresee quarter-point rate increase at Fed's July meeting; September decision uncertain due to robust jobs data.

Upcoming: NFIB Small Business Index for June (Tue); expected reading is 90.0, slightly above May's 89.4.

Q2 arnings season begins this week: Watch for reports from JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, PepsiCo, Delta Air, and UnitedHealth.

EARNINGS

What we’re watching this week:

Tomorrow: AngioDynamics (ANGO), MillerKnoll (MLKN)

Thursday:

Conagra (CAG)

Delta Airlines (DAL)

Fastenal (FAST)

PepsiCo (PEP)

Progressive (PGR)

Washington Federal (WAFD)

Friday:

BlackRock (BLK)

Citigroup (C)

JPMorgan Chase (JPM)

State Street (STT)

UnitedHealth Group (UNH)

Wells Fargo (WFC)

Full earnings calendar here

NEWS BRIEFING

Sarah Silverman

Apple supplier Foxconn pulls out of $19.5 billion India chip project (more)

Turkey agrees to back Sweden’s NATO bid in boost to alliance (more)

Toyota, Stellantis blast Biden’s plan to boost electric car sales (more)

China slides to brink of deflation, adding stimulus urgency (more)

Citi, TD, Wells Fargo among banks testing regulator-friendly blockchain (more)

Home prices are hitting new highs again, as high rates put the squeeze on supply (more)

Carl Icahn's fortune jumps by $1 billion as new loan agreement boosts his company's stock 22% (more)

Threads, Twitter Drama…

JThreads now fastest-growing app In history, including ChatGPT—with 100 Million users In just five days (more)

Elon Musk and Mark Zuckerberg's feud is so embarrassing (more)

Elon Musk jet tracking account moves to Meta's Threads amid Twitter ban (more)

Meta's new Threads app raises potential privacy concerns over data sharing (more)

Twitch is launching a discovery feed and other short-form video features (more)

Cava is the new Chipotle (more)

Airbnb bookings dip in Austin, San Francisco prompting ‘doom loop’ fears (more)

VanMoof, the e-bike darling, skids off track: Sales paused, execs depart (more)

Electric car inventory grows as sales struggles to keep up (more)

BP settles US natgas market manipulation case for $10.75 million (more)

China extends pressure on lenders to help beleaguered developers (more)

Countries repatriating gold in wake of sanctions against Russia (more)

Flexport’s Ryan Petersen joins Thiel-backed Founders Fund as partner (more)

DEALFLOW

Morgan Stanley hires JPMorgan North America M&A head Caggiano (more)

Siemens Taps BNP for potential €3B Innomotics sale (more)

China Merchants bids $3.4B for Chindata to challenge Bain (more)

Sourcetable raises $3M, claiming the future of spreadsheets is spreadsheets (more)

SpyGlass Pharma closes $90M Series C financing (more)

Pano AI raises $17M in growth funding (more)

Reseda Group acquires ChannelNet (more)

BlueAlly acquires B2B Technologies (more)

Honeywell to acquire SCADAfence (more)

Francisco Partners buys Macrobond from Nordic Capital (more)

GlobalLogic acquires Sidero (more)

Trash Butler receives investment from TZP Group (more)

Solenis completes acquisition of Diversey for $4.6 Billion (more)

DigitalOcean acquires Paperspace for $111M (more)

Gr4vy receives multi-million dollar investment from W23 (more)

Trax Technologies receives minority equity investment from TBK Bank (more)

CRYPTO

Standard Chartered bumps up bitcoin forecast to $120,000 (more)

Crypto funding drops for fifth straight quarter as investors continue to pull back (more)

Crypto losses halved in Q2 2023 to $204M (more)

Voyager platform sees over $250M In withdrawals as creditors swiftly pull out funds (more)

AI and crypto integration is going to happen whether you want it or not $33 million (more)

BULLISH BITES

🔥 Pay to work with your hero: Steve Jobs’ intern went on to sell his company to Google for $625 million—he now advises grads to pay to work for impressive people (read)

🔥 From Beatlemania to Taylor-mania: How the meteoric rise of The Beatles helps to explain Taylor Swift's "Eras" tour, on pace to be the first tour ever to gross $1B. (read)

Know someone who would enjoy this?

What did you think about today's briefing?

See you bright and early tomorrow… -mb