☕️ Good morning.

The Fast Five → Citi to lay off 20,000 employees in overhaul, IMF warns AI to hit almost 40% of jobs worldwide, US economy set for another cash boost if Congress backs tax deal, Microsoft expands AI Copilot to consumers, and Hertz selling 20,000 EV’s switching back to gas-powered cars…

Your 5-minute briefing for Tuesday, January 16:

BEFORE THE OPEN

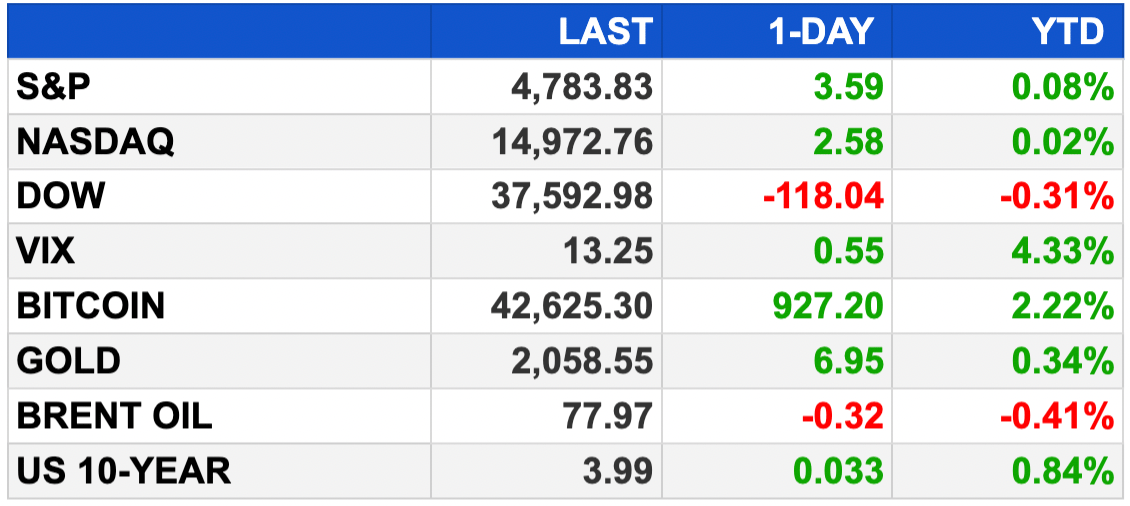

As of market close 1/12/2024. Bitcoin as of 1/15/2024.

PRE-MARKET:

MARKETS:

Dow slipped Friday 0.31% to 37,592.98 as Q4 earnings and inflation data weighed.

S&P 500 inches up 0.08% to 4,783.83, Nasdaq rises 0.02% to 14,972.76.

UnitedHealth and Delta stocks decline despite strong earnings.

Major banks report mixed results: Bank of America down 1.1%, Wells Fargo -3.3%, JPMorgan -0.7%, Citigroup up 1%.

Inflation report shows wholesale prices down 0.1% in December.

Weekly gains: Dow +0.34%, S&P 500 +1.84%, Nasdaq +3.09%.

EARNINGS

What we’re watching this week:

Today: Morgan Stanley (MS)

Goldman Sachs (GS) - expected: $3.11 per share (-6.3% YoY) on $9.8 billion revenue (-7.1% YoY)

Wednesday: Charles Schwab (SCHW)

Kinder Morgan (KMI) - expected: $.30 per share (-3.2% YoY) on $4.4 billion revenue (-3.7% YoY)

Friday:

Travelers (TRV) - expected: $5.00 per share (+47% YoY) on $10 billion revenue (+13.1% YoY)

Full earnings calendar here

HEADLINES

US economy set for another cash boost if Congress backs tax deal (more)

Interest rate cuts aren't good news for profit forecasts, history shows (more)

Bank valuations could rise by $7 trillion in five years, study finds (more)

Oil edges lower despite Middle East conflict (more)

China holds key rate as economy prepares for ‘difficult year’ (more)

Venezuela boosts minimum wage by 43% to quell protests (more)

Norway Wealth Fund CEO Tangen warns on low returns ahead (more)

Apple news:

Boeing adding additional quality inspections for 737 Max (more)

Google’s latest layoffs are just the beginning (more)

Hertz makes ‘agile’ decision to shift strategy and sell EVs, Teslas (more)

Microsoft expands Office AI Copilot to consumers, smaller companies (more)

De Beers cuts diamond prices to revive sales (more)

Larry Fink just kicked off the last chapter of his BlackRock reign (more)

TOGETHER WITH TRADINGVIEW

Where the world charts, chats and trades.

Come see what you’re missing! Try TradingView — the supercharged, super-charting platform and social network for traders and investors.

~ please suppor/t our sponsors ~

DEALFLOW

M & A | INVESTMENTS

EQT, KKR are among suitors for $5 Billion Broadcom asset (more)

Deutsche Bank analyzing deals with Commerzbank, ABN Amro, others (more)

PAI exploring options for $10 Billion Nestle Ice Cream JV (more)

Starwood Capital Group agreed to buy a portfolio of hotels in London's West End from Edwardian Hotels (more)

Bain Capital and Hellman & Friedman are in talks to acquire Nasdaq-listed contract life cycle software company DocuSign (more)

Hillhouse and Mitsui & Company are both in talks to buy Eu Yan Sang, a pharmaceutical company, for approx. $700M (more)

TPG made a strategic investment in asset manager The Visualize Group (more)

China's BYD in talks with Brazil's Sigma Lithium on supply deal (more)

Japan's Fuji Soft has received buyout proposals from multiple PE firms as the company explores a potential sale as part of a strategic review by its largest shareholder, 3D Investment Partners (more)

Commerzbank merger talk resurfaces as Germany mulls company sales (more)

Xos buys ElectraMeccanica (more)

Corsair acquires MJM (more)

Crest Rock Partners invests in Specialty Pipe & Tube (more)

TA-backed Riskonnect buys Ventiv Technology (more)

JMI Equity invests in Safe Software (more)

VC

Silver Rock Group today announced that it plans to invest $300 million in equity financing in Doc.com (more)

Rune Labs, a precision neurology software and data company, has announced a strategic round of $12M, increasing the total amount raised by the company to over $42M (more)

Neocis, a global leader in robot-assisted dental implant surgery, announced that the company has raised $20M in additional funding (more)

GolfForever has closed a $10M Series A funding round (more)

Shimmer, an innovative online coaching platform designed for adults with ADHD today announces it has raised $2.2M in seed funding (more)

KlariVis, a trailblazer in data analytics solutions for community banks and credit unions, closed its Series B capital round led by Blueprint Equity (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

Bitcoin’s ETF hangover saddles the token with its worst streak in a month (more)

Bitcoin's technicals suggests deeper pullback to $38K (more)

Coinbase at the center of Bitcoin ETF draws envy and risks (more)

JPMorgan sees significant capital from existing crypto products pouring into new spot Bitcoin ETFs (more)

BULLISH BITES

🌎 Davos insider: Heading to Davos, here’s what was overheard on connecting trains from Zurich to WEF // lnside the Davos cash machine.

🚘 Futuristic: All the future of transportation tech that stood out at CES 2024.

🚀 Trending: WhatsApp is finally catching on in the US growing 80% among daily business users in 2023.

😎 Buzzworthy: You may wonder why people pay over $150,000 for a Mercedes G-Wagon. Now, you know.

📈 See what the buzz is about! Try TradingView — the supercharged, super-charting platform and social network for traders and investors. Take TradingView for a test-drive here »

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.