Good morning 🇺🇸

The Fast Five → Harris, Trump clash on the economy in first debate, the billionaires backing Trump and Harris, Google and Apple face billions in penalties, Nippon Steel exec flies to Washington in last attempt to save deal, and AMD’s CEO says the AI supercycle is just beginning…

→ Complimentary Report: How to Survive Upcoming Stock Market Crisis *

Calendar: (all times ET) - Full calendar here

Today: Consumer price index (CPI), 8:30 AM

Tomorrow:

Initial jobless claims, 8:30 AM

Producer price index (PPI), 8:30 AM

Your 5-minute briefing for Wednesday, September 11:

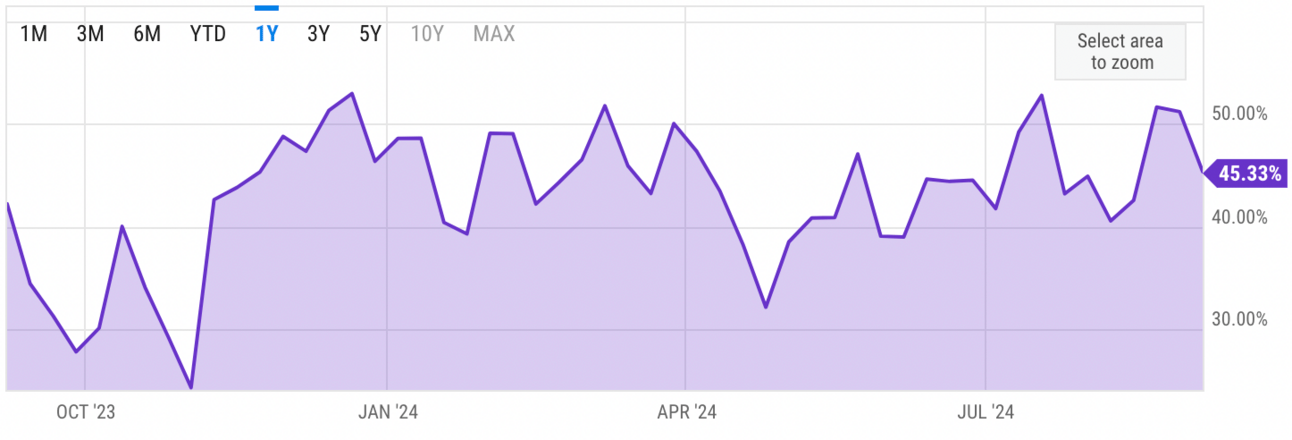

US Investor % Bullish Sentiment:

↓ 45.33% for Week of September 05 2024

Last week: 51.16%. Updates every Friday.

Market Wrap:

Stock futures flat ahead of August CPI report.

S&P up 0.5%, Nasdaq 0.8%, Nvidia higher; Dow -0.2% on JPMorgan dip.

GameStop shares dropped 10% after filing to sell 20M additional shares.

August CPI forecast: 0.2% monthly, 2.6% annual rise.

Fed rate cut odds: 69% for 25 bps, 31% for 50 bps.

EARNINGS

Here’s what we’re watching this week:

Thursday: Kroger (KR)

Adobe (ADBE) - earnings of $4.53 per share (+10.5% YoY) on revenue of $5.4B (+10.2% YoY)

Full earnings calendar here.

HEADLINES

US incomes rose last year but poverty rates changed little (more)

Fed to cut biggest banks’ capital hike by half in overhaul (more)

Wall St worries Harris tax plan would hurt corporate profits (more)

Oil prices fall 3% without real change in fundamentals (more)

JPMorgan leads banks in dimming outlooks, spoiling win on rules (more)

Nippon Steel exec flies to Washington in last attempt to save US Steel deal (more)

Google and Apple face billions in penalties after losing EU appeals (more)

AMD CEO: The AI supercycle is just beginning (more)

The iPhone 16 will ship as a work in progress (more)

Southwest Chair to step down next year as Elliott pushes for changes (more)

Starbucks new CEO to improve US stores as first task (more)

Bank of America ups minimum hourly pay to $24 (more)

Hedge fund pushes for end of Murdochs’ control at News Corp (more)

Is a stock market wipeout inevitable?

In fact, J.P. Morgan is calling this "The most predictable crisis in history."

Now I write this knowing full well the stock market is at all-time highs. And it's been one heck of a rally.

But this rally is about to end. And it won't be pretty when it does.

Because there are three warning signs flashing right now that NO ONE seems to be talking about.

In this free report I'm going tell you exactly why a market crash is about to happen -

And more importantly, how you could protect your money... And even prosper as it all comes crashing down.

Click here to learn more >>>

Dylan Jovine, CEO & Founder

Behind the Markets

- sponsored message -

DEALFLOW

M+A | Investments

UPS to buy Germany-based healthcare logistics firm Frigo-Trans (more)

AngloGold to buy gold miner Centamin in $2.5B deal (more)

Buyout firm GTCR in advanced talks to acquire German drugmaker Stada (more)

Finland’s Sampo secures deal for Danish insurer Topdanmark (more)

True, a tech and data-first global executive talent platform, acquired Paradigm Search, a company known for their ability to place elite engineering and product leaders (more)

OceanSound Partners, a PE firm that invests in tech-enabled services companies serving government and enterprise, acquires PAR Excellence Systems, supply chain solutions to the healthcare industry, from Northlane Capital Partners (more)

RoadSafe Traffic, a provider of infrastructure services, acquired All Star Striping, a pavement marking business (more)

Confluent, a data streaming provider, acquired WarpStream, a provider of an Apache Kafka®-compatible data streaming platform (more)

AMI, a dynamic firmware company, received a majority investment from THL Partners (more)

VC

Glean, a Work AI platform for enterprises, raised over $260M in Series E funding at a $4.6B valuation (more)

finally, an AI-powered, all-in-one finance and HR suite, raised $50M in Series B funding and $150M in Credit Facility (more)

Smartcat, an enterprise language AI platform, raised $43M in Series C funding (more)

Versana, a centralized, real-time digital syndicated loan market data platform provider, closed a $26M capital raise (more)

Piace Technologies, a clinical gen AI solution that supports inpatient care teams, raised $25M in Growth funding (more)

Darkhive, a defense tech startup focused on open architecture Uncrewed Aircraft Systems integrated with a secure software delivery system, raised $21M in Series A funding (more)

P0 Security, a unified IGA and PAM platform for the cloud designed to secure all enterprise cloud identities, raised $15M in Series A funding (more)

DRiP, a platform for creators to release and distribute NFT content, raised $8M in seed funding (more)

Korio, a randomization and trial supply management tech company, raised an undisclosed amount in Series A Funding (more)

Mother Games, an art and media company that creates transformative experiences, raised $5M in funding (more)

StackGen, a generative infrastructure from code company, raised $12.3M in Seed funding (more)

Track3D, an AI-first startup building a reality intelligence platform for the construction industry, raised $3.4M in Seed funding (more)

CRYPTO

BULLISH BITES

📉 Investor Alert: 4 Steps to Survive the Coming Market Crash *

🚀 TLC: Underfunded, aging NASA may be on unsustainable path.

🔥 Buzzing What is the FIRE movement?

🛻 Proposals: The US takes aim at truck bloat.

🧥 Next Level: Former Apple design head Jony Ive's new jacket.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.