Good morning.

The Fast Five → Main Street left as collateral damage in tariff war, Bessent emerges as Wall St man-of-the-hour trade negotiator, inflation rate eases to 2.4%, Senate confirms Trump’s pro-crypto SEC chair Paul Atkins, the wealthy are loading up on cash, gold and family trusts…

Calendar: (all times ET) - Full Calendar

Today:

Producer price index (PPI), 8:30A

Tomorrow:

none watched

Your 5-minute briefing for Friday, April 11:

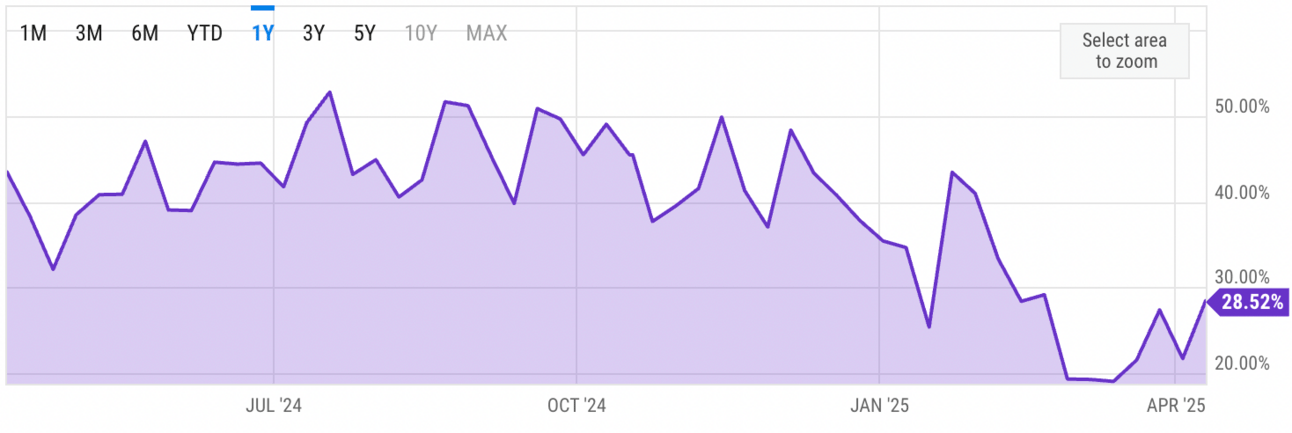

US Investor % Bullish Sentiment:

↑ 28.52% for Week of April 10 2025

Previous week: 21.76%. Updates every Friday.

Market Wrap:

Futures: S&P -0.8%, Nasdaq -0.9%, Dow -277 pts (-0.7%).

Major indexes slid Thursday, wiping much of Wednesday’s rally.

China tariff set at 145%; others at 10%, with 25% on Canada/Mexico exceptions.

Week-to-date: S&P +3.8%, Nasdaq +5.1%, Dow +3.3%.

Earnings from JPM, WFC, MS, BLK + PPI & sentiment data due Friday.

EARNINGS

Here’s what we’re watching today:

Today: BlackRock $BLK ( ▼ 7.33% ) , Morgan Stanley $MS ( ▼ 7.51% ) , Wells Fargo $WFC ( ▼ 7.14% )

JPMorgan Chase $JPM ( ▼ 7.48% ) - earnings of $4.61 per share on $43.8B revenue

Amazon Shocker

Love or hate Jeff Bezos...

I think we can all agree that Amazon has changed the world.

It delivers 20 million packages a day... powers some of the most popular websites... delivers medication to half of the U.S. population... and even produces award-winning films and TV shows.

But I believe "Amazon Helios" will be bigger than all of those... COMBINED.

That's why I recently took a deep dive into this little-known initiative...

And what I found is truly astonishing.

According to the World Economic Forum, this is "the most exciting human discovery since fire.

Whitney Tilson

Editor, Stansberry

HEADLINES

Wall St ends sharply lower as tariff risks send investors fleeing (more)

Stocks, bonds fall as Trump’s tariff reprieve proves fleeting (more)

Trump dodged a disaster from the bond market (more)

Retail investors run head first into this topsy-turvy market (more)

The wealthy are loading up on cash, gold, family trusts during turmoil (more)

US inflation slows in March, but tariffs likely to raise prices (more)

US weekly jobless claims rise marginally (more)

Senate confirms Trump’s pro-crypto SEC chair pick Paul Atkins (more)

Ray Dalio: Tariff turmoil hurt US reputation for reliability (more)

US dollar index suffers biggest drop since 2022, hits new low for the year (more)

Gold hits record high as US-China trade war intensifies (more)

Freight orders surge on Trump tariffs trade whipsaw: ‘The ships are filling up’ (more)

US Steel falls 10% after Trump says he doesn’t want Japan owner (more)

US bank regulator begins work with DOGE staff (more)

DEALFLOW

M+A | Investments

VC

Base Power, an energy company, raised $200M in Series B funding co-led by Addition, Andreessen Horowitz, Lightspeed Venture Partners, and Breakthrough Energy Ventures (more)

Tessell, a multi-cloud DBaaS provider, raised $60M in Series B funding (more)

Simplifyber, a bio-based materials company, raised $12M in Series A funding (more)

Remedy Scientific, an environmental remediation automation company, raised $11M in Seed funding round (more)

CRYPTO

BULLISH BITES

🔥 The most exciting human discovery since fire? *

⚔️ Trump and Xi are preparing for a war nobody wants.

📈 How the mother of all ‘short squeezes’ helped drive stocks to historic gains Wed.

🤫 Inside the secretive AI life sciences startup spun off from Google DeepMind.

✈️ The 50 best places to travel this year.

DAILY SHARES

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.